Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the Debt Ratio, Debt to Equity Ratio, Times Interest Earned Ratio, Fixed Assets Turnover Ratio for The Heart Hospital in 2019? Please look

What is the Debt Ratio, Debt to Equity Ratio, Times Interest Earned Ratio, Fixed Assets Turnover Ratio for The Heart Hospital in 2019?

Please look at the images and also the options that are available for answers

Debt Ratio

A: 52.2%

B: 63.4%

C: 28.0%

D: 45.6%

Debt to Equity Ratio

A: 2.05 times

B: 1.09 times

C: 5.1 times

D: 0.79 times

Times Interest Earned Ratio

A: 20.4%

B: 7.9 times

C: 11.77 times

D: 13.0 times

Fixed Assets Turnover Ratio

A: 2.6 times

B: 1.9 times

C: 4.5 times

D: 0.08 times

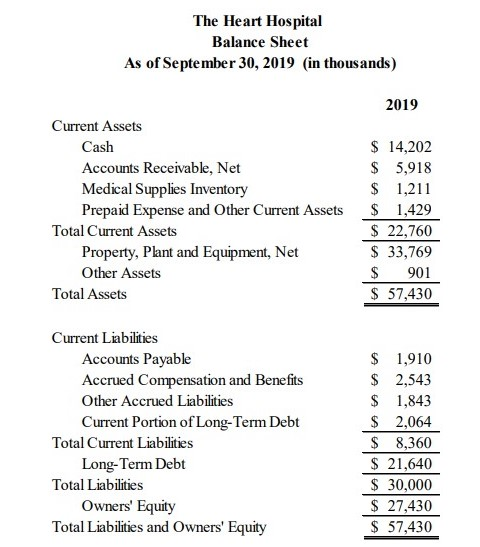

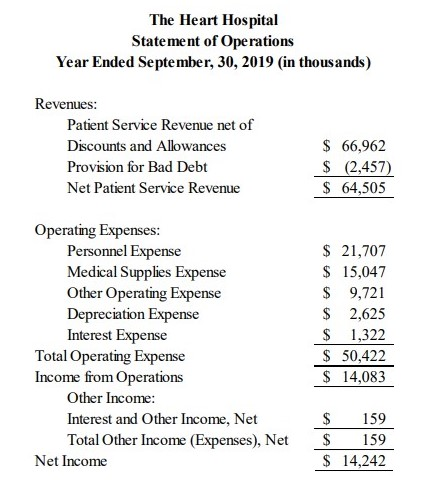

The Heart Hospital Balance Sheet As of September 30, 2019 (in thousands) 2019 Current Assets Cash Accounts Receivable, Net Medical Supplies Inventory Prepaid Expense and Other Current Assets Total Current Assets Property, Plant and Equipment, Net Other Assets Total Assets $ 14,202 $ 5,918 $ 1,211 $ 1,429 $ 22,760 $ 33,769 $ 901 $ 57,430 Current Liabilities Accounts Payable Accrued Compensation and Benefits Other Accrued Liabilities Current Portion of Long-Term Debt Total Current Liabilities Long-Term Debt Total Liabilities Owners' Equity Total Liabilities and Owners' Equity $ 1,910 $ 2,543 $ 1,843 $ 2,064 $ 8,360 $ 21,640 $ 30,000 $ 27,430 $ 57,430 The Heart Hospital Statement of Operations Year Ended September, 30, 2019 (in thousands) Revenues: Patient Service Revenue net of Discounts and Allowances Provision for Bad Debt Net Patient Service Revenue $ 66,962 $ (2,457) $ 64,505 Operating Expenses: Personnel Expense Medical Supplies Expense Other Operating Expense Depreciation Expense Interest Expense Total Operating Expense Income from Operations Other Income: Interest and Other Income, Net Total Other Income (Expenses), Net Net Income $ 21,707 $ 15,047 $ 9,721 $ 2,625 $ 1,322 $ 50,422 $ 14,083 159 $ $ $ 14,242Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started