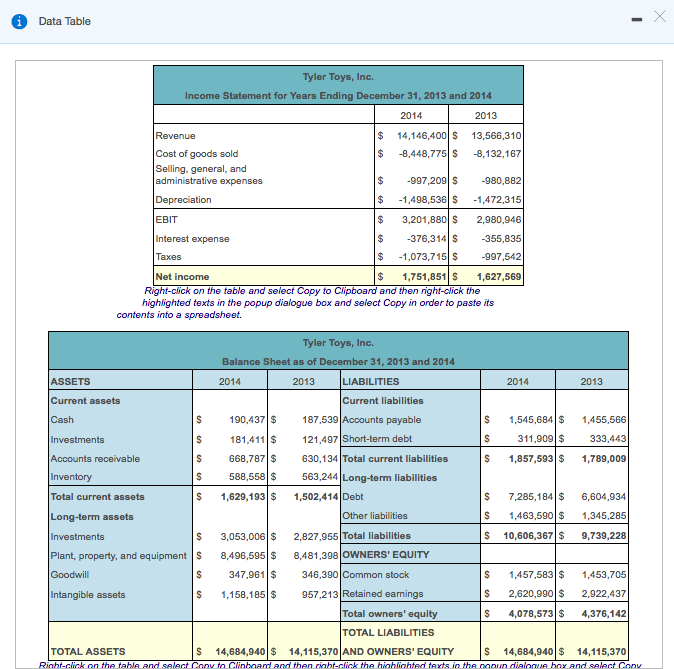

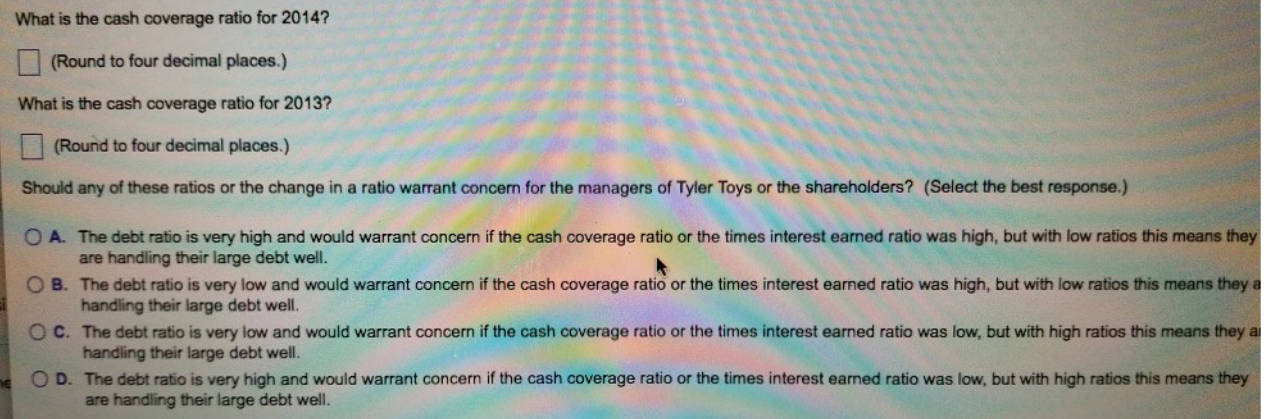

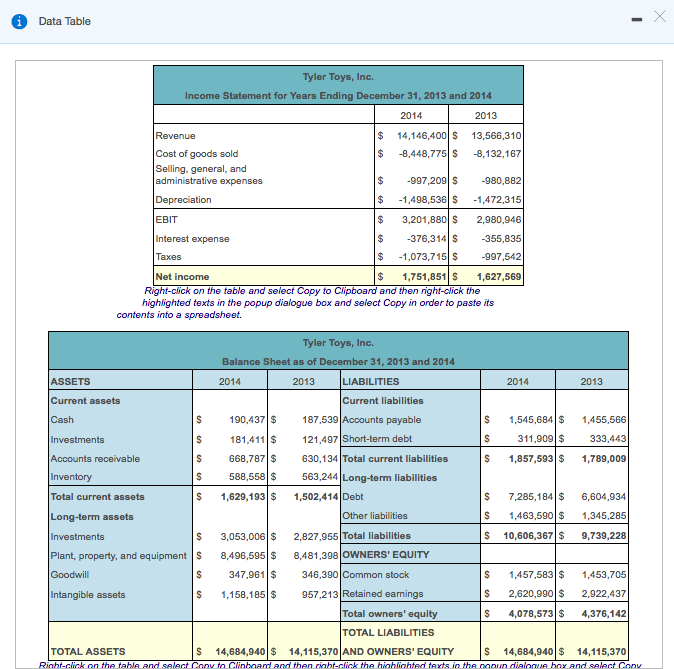

What is the debt ratio for 2014? (Round to four decimal places.) What is the debt ratio for 2013? (Round to four decimal places.) What is the times interest earned ratio for 2014? (Round to four decimal places.) What is the times interest earned ratio for 2013? - (Round to four decimal places.) What is the cash coverage ratio for 2014? she (Round to four decimal places.) What is the cash coverage ratio for 2014? (Round to four decimal places.) What is the cash coverage ratio for 2013? (Round to four decimal places.) Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? (Select the best response.) O A. The debt ratio is very high and would warrant concern if the cash coverage ratio or the times interest earned ratio was high, but with low ratios this means they are handling their large debt well. OB. The debt ratio is very low and would warrant concern if the cash coverage ratio or the times interest earned ratio was high, but with low ratios this means they a handling their large debt well. OC. The debt ratio is very low and would warrant concern if the cash coverage ratio or the times interest earned ratio was low, but with high ratios this means they a handling their large debt well. ne OD. The debt ratio is very high and would warrant concern if the cash coverage ratio or the times interest earned ratio was low, but with high ratios this means they are handling their large debt well. i Data Table -X Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue 14,146,400 $ 13,566,310 Cost of goods sold -8,448,775 -8,132,167 Selling, general, and administrative expenses -997,209 S -980,882 Depreciation -1,498,536 S -1,472,315 EBIT 3,201,880 $ 2,980,946 Interest expense $ -376,314 S -355,835 Taxes -1,073,715 $ -997,542 Net income $ 1,751,851 $ 1,627,569 Right click on the table and select Copy to clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet. Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 ASSETS 2014 2013 LIABILITIES 2014 2013 Current assets Current liabilities Cash 190,437 $ 187,539 Accounts payable $ 1,545,684 $ 1,455,566 Investments 181,411 $ 121,497 Short-term debt 311,909 $ 333,443 Accounts receivable 668,787 $ 630,134 Total current liabilities $ 1,857,593 $ 1,789,009 Inventory 588,558 $ 563,244 Long-term liabilities Total current assets 1,629,193 $ 1,502,414 Debt $ 7,285,184 $ 6,604,934 Long-term assets Other liabilities $ 1,463,590 $ 1,345,285 Investments 3,053,006 $ 2,827,955 Total liabilities $ 10,606,367 $ 9,739,228 Plant, property, and equipments 8,496,595 $ 8,481,398 OWNERS' EQUITY Goodwill 347,961 $ 346,390 Common stock $ 1,457,583 $ 1,453,705 Intangible assets 1,158,185 $ 957,213 Retained earnings $ 2,620,990 $ 2,922,437 Total owners' equity $ 4,078,573 $ 4,376,142 TOTAL LIABILITIES TOTAL ASSETS $ 14,684,940 $ 14,115,370 AND OWNERS' EQUITY $ 14,684,940 $ 14,115,370 Right click on the table and select Conv to Clinboard and then rinht-click the highlighted texts in the nanun dialogue boy and select Conv