Answered step by step

Verified Expert Solution

Question

1 Approved Answer

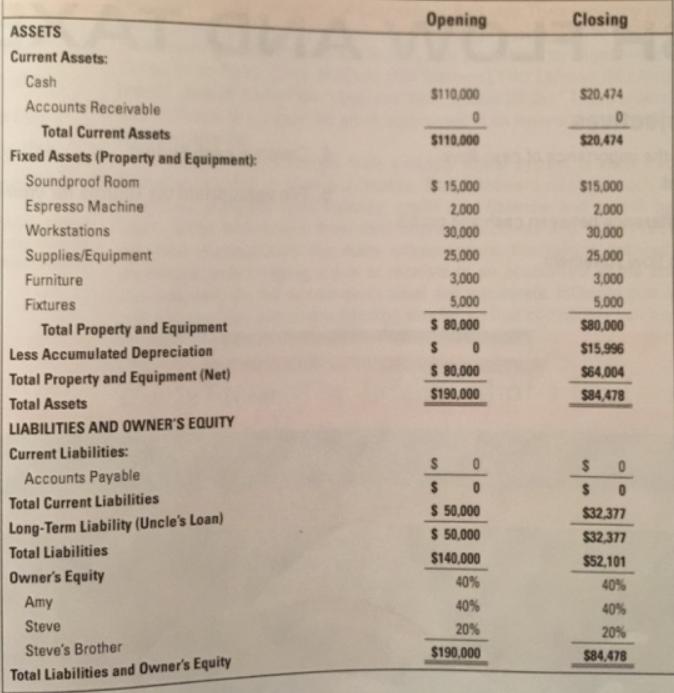

What is the debt-to-equity ratio of the Portland Freelancers' Caf? Look at each section of the caf's cash flow statement. Write a memo highlight-

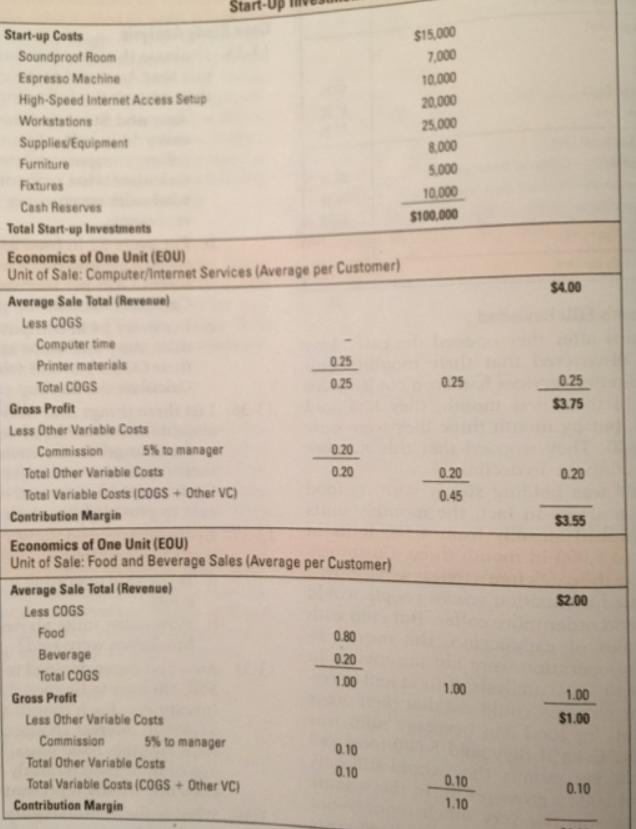

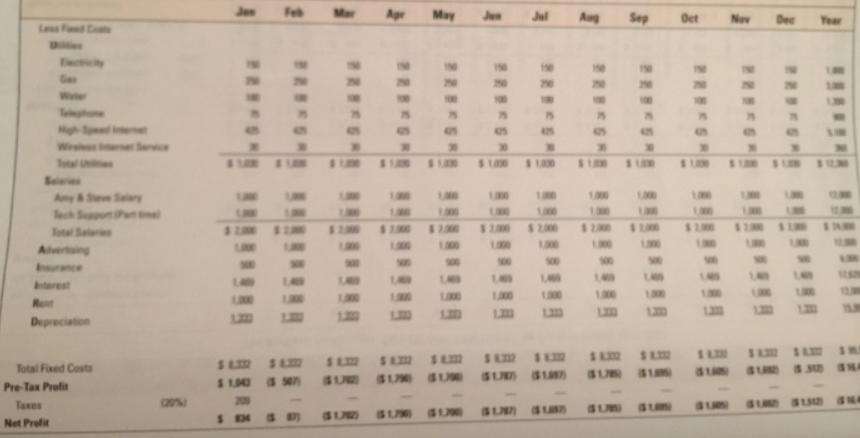

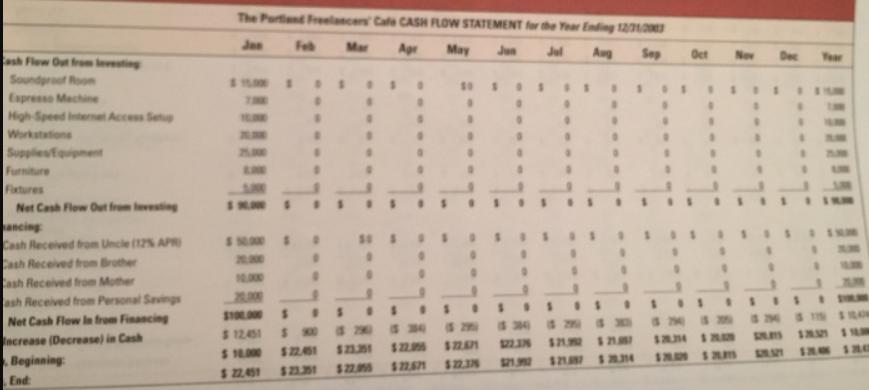

What is the debt-to-equity ratio of the Portland Freelancers' Caf? Look at each section of the caf's cash flow statement. Write a memo highlight- ing three insights you have about why this business is not succeeding, based on what you see in its cash flow statement. Review the caf's balance sheet. Explain why the net value of the caf's property and equipment has decreased from $80,000 in month one to $64,000 at year's end. Start-Up Start-up Costs Soundproot Room $15,000 7,000 Espresso Machine 10.000 High-Speed Internet Access Setup 20,000 Workstations 25,000 Supplies/Equipment 8,000 Furniture 5.000 Faxtures 10.000 Cash Reserves $100.000 Total Start-up Investments Economics of One Unit (EOU) Unit of Sale: Computer/Internet Services (Average per Customer) $4.00 Average Sale Total (Revenue) Less COGS Computer time Printer materials 0.25 Total COGS 0.25 0.25 025 Gross Profit $3.75 Less Other Variable Costs Commission 5% to manager 0.20 Total Other Variable Costs 0.20 0.20 0.20 Total Variable Costs (COGS + Other VC) 0.45 Contribution Margin $3.55 Economics of One Unit (EOU) Unit of Sale: Food and Beverage Sales (Average per Customer) Average Sale Total (Revenue) $2.00 Less COGS Food 0.80 Beverage 0.20 Total COGS 1.00 1.00 Gross Profit 1.00 Less Other Variable Costs $1.00 Commission 5% to manager 0.10 Tatal Other Variable Costs 0.10 0.10 Total Variable Costs (COGS + Other VC) Contribution Margin 0.10 1.10 Jen Feb Apr May Je Jul Aug Sep Oet Nev Dec Year Less 190 110 Ge 20 250 750 20 Wter 00 100 00 76 75 .3B 415 425 W Service S100 8100 51.00 S1.00 $1.00 S00 S100 S1030 Seie 1300 300 1.00 1.00 U90 LU0 LIM Any&S Sy ech S P Sotal Sa 1300 130 1:00 U90 L00 100 U90 $2.0 82.00 $2.000 $1.00 $200 200 21.000 $1.00 1300 00 1300 1,00 1300 L00 UM0 Alvering 00 100 AU0 00 100 Iurance L40 140 140 1,40 trest 1300 UNE L30 120 00 Ret 1:00 LD 100 1300 120 Depreciation S SL S S sm $.32 Total Fixed Costa SUR S3D NA SUN SU SUB S1n SUB Pre-Tax Profit SL0 S Taxes (20%) 200 SUBE SU SM4 SUB SURE SUR SUS SUB] Net Prefit SEM PRBKGR PREKGR The Partiend Freelancers Cafe CASH FLOW STATEMENT for the Year Ending 1212 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year sh Flew Out frem levesting Soundproof Expresso Machine High-Speed internet Access Set Workstations Suppliestorpment Furniture Fixtures .. UM ... Net Cash Flow Out from levesting ancing Cash Received from Uncle (12 APR Cash Received from Bruther Cash Received from Mother ash Received from Personal Sevings 2000 10.000 .3. S1O00 $ 1241 S .000 Net Cash Flow Ie from Financing ncrease (Decrease) in Cash Beginning $2241 $21.1 $22.5P1 $22.3 21 $21 $22.451 $21.1 $22 End Opening Closing ASSETS Current Assets: Cash $110,000 $20,474 Accounts Receivable Total Current Assets $110.000 $20,474 Fixed Assets (Property and Equipment): Soundproof Room $ 15,000 $15.000 Espresso Machine 2,000 2,000 Workstations 30,000 30,000 Supplies/Equipment 25,000 25,000 Furniture 3,000 3,000 Fixtures 5,000 5,000 $ 80,000 $80.000 Total Property and Equipment Less Accumulated Depreciation $15.996 $ 80,000 $64,004 Total Property and Equipment (Net) $190.000 $84,478 Total Assets LIABILITIES AND OWNER'S EQUITY Current Liabilities: $ 0 %24 Accounts Payable Total Current Liabilities $ 50,000 $ 50,000 $32.377 Long-Term Liability (Uncle's Loan) Total Liabilities $32,377 $140,000 $52,101 Owner's Equity 40% 40% Amy 40% 40% Steve 20% 20% Steve's Brother $190,000 $84,478 Total Liabilities and Owner's Equity What is the debt-to-equity ratio of the Portland Freelancers' Caf? Look at each section of the caf's cash flow statement. Write a memo highlight- ing three insights you have about why this business is not succeeding, based on what you see in its cash flow statement. Review the caf's balance sheet. Explain why the net value of the caf's property and equipment has decreased from $80,000 in month one to $64,000 at year's end. Start-Up Start-up Costs Soundproot Room $15,000 7,000 Espresso Machine 10.000 High-Speed Internet Access Setup 20,000 Workstations 25,000 Supplies/Equipment 8,000 Furniture 5.000 Faxtures 10.000 Cash Reserves $100.000 Total Start-up Investments Economics of One Unit (EOU) Unit of Sale: Computer/Internet Services (Average per Customer) $4.00 Average Sale Total (Revenue) Less COGS Computer time Printer materials 0.25 Total COGS 0.25 0.25 025 Gross Profit $3.75 Less Other Variable Costs Commission 5% to manager 0.20 Total Other Variable Costs 0.20 0.20 0.20 Total Variable Costs (COGS + Other VC) 0.45 Contribution Margin $3.55 Economics of One Unit (EOU) Unit of Sale: Food and Beverage Sales (Average per Customer) Average Sale Total (Revenue) $2.00 Less COGS Food 0.80 Beverage 0.20 Total COGS 1.00 1.00 Gross Profit 1.00 Less Other Variable Costs $1.00 Commission 5% to manager 0.10 Tatal Other Variable Costs 0.10 0.10 Total Variable Costs (COGS + Other VC) Contribution Margin 0.10 1.10 Jen Feb Apr May Je Jul Aug Sep Oet Nev Dec Year Less 190 110 Ge 20 250 750 20 Wter 00 100 00 76 75 .3B 415 425 W Service S100 8100 51.00 S1.00 $1.00 S00 S100 S1030 Seie 1300 300 1.00 1.00 U90 LU0 LIM Any&S Sy ech S P Sotal Sa 1300 130 1:00 U90 L00 100 U90 $2.0 82.00 $2.000 $1.00 $200 200 21.000 $1.00 1300 00 1300 1,00 1300 L00 UM0 Alvering 00 100 AU0 00 100 Iurance L40 140 140 1,40 trest 1300 UNE L30 120 00 Ret 1:00 LD 100 1300 120 Depreciation S SL S S sm $.32 Total Fixed Costa SUR S3D NA SUN SU SUB S1n SUB Pre-Tax Profit SL0 S Taxes (20%) 200 SUBE SU SM4 SUB SURE SUR SUS SUB] Net Prefit SEM PRBKGR PREKGR The Partiend Freelancers Cafe CASH FLOW STATEMENT for the Year Ending 1212 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year sh Flew Out frem levesting Soundproof Expresso Machine High-Speed internet Access Set Workstations Suppliestorpment Furniture Fixtures .. UM ... Net Cash Flow Out from levesting ancing Cash Received from Uncle (12 APR Cash Received from Bruther Cash Received from Mother ash Received from Personal Sevings 2000 10.000 .3. S1O00 $ 1241 S .000 Net Cash Flow Ie from Financing ncrease (Decrease) in Cash Beginning $2241 $21.1 $22.5P1 $22.3 21 $21 $22.451 $21.1 $22 End Opening Closing ASSETS Current Assets: Cash $110,000 $20,474 Accounts Receivable Total Current Assets $110.000 $20,474 Fixed Assets (Property and Equipment): Soundproof Room $ 15,000 $15.000 Espresso Machine 2,000 2,000 Workstations 30,000 30,000 Supplies/Equipment 25,000 25,000 Furniture 3,000 3,000 Fixtures 5,000 5,000 $ 80,000 $80.000 Total Property and Equipment Less Accumulated Depreciation $15.996 $ 80,000 $64,004 Total Property and Equipment (Net) $190.000 $84,478 Total Assets LIABILITIES AND OWNER'S EQUITY Current Liabilities: $ 0 %24 Accounts Payable Total Current Liabilities $ 50,000 $ 50,000 $32.377 Long-Term Liability (Uncle's Loan) Total Liabilities $32,377 $140,000 $52,101 Owner's Equity 40% 40% Amy 40% 40% Steve 20% 20% Steve's Brother $190,000 $84,478 Total Liabilities and Owner's Equity What is the debt-to-equity ratio of the Portland Freelancers' Caf? Look at each section of the caf's cash flow statement. Write a memo highlight- ing three insights you have about why this business is not succeeding, based on what you see in its cash flow statement. Review the caf's balance sheet. Explain why the net value of the caf's property and equipment has decreased from $80,000 in month one to $64,000 at year's end. Start-Up Start-up Costs Soundproot Room $15,000 7,000 Espresso Machine 10.000 High-Speed Internet Access Setup 20,000 Workstations 25,000 Supplies/Equipment 8,000 Furniture 5.000 Faxtures 10.000 Cash Reserves $100.000 Total Start-up Investments Economics of One Unit (EOU) Unit of Sale: Computer/Internet Services (Average per Customer) $4.00 Average Sale Total (Revenue) Less COGS Computer time Printer materials 0.25 Total COGS 0.25 0.25 025 Gross Profit $3.75 Less Other Variable Costs Commission 5% to manager 0.20 Total Other Variable Costs 0.20 0.20 0.20 Total Variable Costs (COGS + Other VC) 0.45 Contribution Margin $3.55 Economics of One Unit (EOU) Unit of Sale: Food and Beverage Sales (Average per Customer) Average Sale Total (Revenue) $2.00 Less COGS Food 0.80 Beverage 0.20 Total COGS 1.00 1.00 Gross Profit 1.00 Less Other Variable Costs $1.00 Commission 5% to manager 0.10 Tatal Other Variable Costs 0.10 0.10 Total Variable Costs (COGS + Other VC) Contribution Margin 0.10 1.10 Jen Feb Apr May Je Jul Aug Sep Oet Nev Dec Year Less 190 110 Ge 20 250 750 20 Wter 00 100 00 76 75 .3B 415 425 W Service S100 8100 51.00 S1.00 $1.00 S00 S100 S1030 Seie 1300 300 1.00 1.00 U90 LU0 LIM Any&S Sy ech S P Sotal Sa 1300 130 1:00 U90 L00 100 U90 $2.0 82.00 $2.000 $1.00 $200 200 21.000 $1.00 1300 00 1300 1,00 1300 L00 UM0 Alvering 00 100 AU0 00 100 Iurance L40 140 140 1,40 trest 1300 UNE L30 120 00 Ret 1:00 LD 100 1300 120 Depreciation S SL S S sm $.32 Total Fixed Costa SUR S3D NA SUN SU SUB S1n SUB Pre-Tax Profit SL0 S Taxes (20%) 200 SUBE SU SM4 SUB SURE SUR SUS SUB] Net Prefit SEM PRBKGR PREKGR The Partiend Freelancers Cafe CASH FLOW STATEMENT for the Year Ending 1212 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year sh Flew Out frem levesting Soundproof Expresso Machine High-Speed internet Access Set Workstations Suppliestorpment Furniture Fixtures .. UM ... Net Cash Flow Out from levesting ancing Cash Received from Uncle (12 APR Cash Received from Bruther Cash Received from Mother ash Received from Personal Sevings 2000 10.000 .3. S1O00 $ 1241 S .000 Net Cash Flow Ie from Financing ncrease (Decrease) in Cash Beginning $2241 $21.1 $22.5P1 $22.3 21 $21 $22.451 $21.1 $22 End Opening Closing ASSETS Current Assets: Cash $110,000 $20,474 Accounts Receivable Total Current Assets $110.000 $20,474 Fixed Assets (Property and Equipment): Soundproof Room $ 15,000 $15.000 Espresso Machine 2,000 2,000 Workstations 30,000 30,000 Supplies/Equipment 25,000 25,000 Furniture 3,000 3,000 Fixtures 5,000 5,000 $ 80,000 $80.000 Total Property and Equipment Less Accumulated Depreciation $15.996 $ 80,000 $64,004 Total Property and Equipment (Net) $190.000 $84,478 Total Assets LIABILITIES AND OWNER'S EQUITY Current Liabilities: $ 0 %24 Accounts Payable Total Current Liabilities $ 50,000 $ 50,000 $32.377 Long-Term Liability (Uncle's Loan) Total Liabilities $32,377 $140,000 $52,101 Owner's Equity 40% 40% Amy 40% 40% Steve 20% 20% Steve's Brother $190,000 $84,478 Total Liabilities and Owner's Equity What is the debt-to-equity ratio of the Portland Freelancers' Caf? Look at each section of the caf's cash flow statement. Write a memo highlight- ing three insights you have about why this business is not succeeding, based on what you see in its cash flow statement. Review the caf's balance sheet. Explain why the net value of the caf's property and equipment has decreased from $80,000 in month one to $64,000 at year's end. Start-Up Start-up Costs Soundproot Room $15,000 7,000 Espresso Machine 10.000 High-Speed Internet Access Setup 20,000 Workstations 25,000 Supplies/Equipment 8,000 Furniture 5.000 Faxtures 10.000 Cash Reserves $100.000 Total Start-up Investments Economics of One Unit (EOU) Unit of Sale: Computer/Internet Services (Average per Customer) $4.00 Average Sale Total (Revenue) Less COGS Computer time Printer materials 0.25 Total COGS 0.25 0.25 025 Gross Profit $3.75 Less Other Variable Costs Commission 5% to manager 0.20 Total Other Variable Costs 0.20 0.20 0.20 Total Variable Costs (COGS + Other VC) 0.45 Contribution Margin $3.55 Economics of One Unit (EOU) Unit of Sale: Food and Beverage Sales (Average per Customer) Average Sale Total (Revenue) $2.00 Less COGS Food 0.80 Beverage 0.20 Total COGS 1.00 1.00 Gross Profit 1.00 Less Other Variable Costs $1.00 Commission 5% to manager 0.10 Tatal Other Variable Costs 0.10 0.10 Total Variable Costs (COGS + Other VC) Contribution Margin 0.10 1.10 Jen Feb Apr May Je Jul Aug Sep Oet Nev Dec Year Less 190 110 Ge 20 250 750 20 Wter 00 100 00 76 75 .3B 415 425 W Service S100 8100 51.00 S1.00 $1.00 S00 S100 S1030 Seie 1300 300 1.00 1.00 U90 LU0 LIM Any&S Sy ech S P Sotal Sa 1300 130 1:00 U90 L00 100 U90 $2.0 82.00 $2.000 $1.00 $200 200 21.000 $1.00 1300 00 1300 1,00 1300 L00 UM0 Alvering 00 100 AU0 00 100 Iurance L40 140 140 1,40 trest 1300 UNE L30 120 00 Ret 1:00 LD 100 1300 120 Depreciation S SL S S sm $.32 Total Fixed Costa SUR S3D NA SUN SU SUB S1n SUB Pre-Tax Profit SL0 S Taxes (20%) 200 SUBE SU SM4 SUB SURE SUR SUS SUB] Net Prefit SEM PRBKGR PREKGR The Partiend Freelancers Cafe CASH FLOW STATEMENT for the Year Ending 1212 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year sh Flew Out frem levesting Soundproof Expresso Machine High-Speed internet Access Set Workstations Suppliestorpment Furniture Fixtures .. UM ... Net Cash Flow Out from levesting ancing Cash Received from Uncle (12 APR Cash Received from Bruther Cash Received from Mother ash Received from Personal Sevings 2000 10.000 .3. S1O00 $ 1241 S .000 Net Cash Flow Ie from Financing ncrease (Decrease) in Cash Beginning $2241 $21.1 $22.5P1 $22.3 21 $21 $22.451 $21.1 $22 End Opening Closing ASSETS Current Assets: Cash $110,000 $20,474 Accounts Receivable Total Current Assets $110.000 $20,474 Fixed Assets (Property and Equipment): Soundproof Room $ 15,000 $15.000 Espresso Machine 2,000 2,000 Workstations 30,000 30,000 Supplies/Equipment 25,000 25,000 Furniture 3,000 3,000 Fixtures 5,000 5,000 $ 80,000 $80.000 Total Property and Equipment Less Accumulated Depreciation $15.996 $ 80,000 $64,004 Total Property and Equipment (Net) $190.000 $84,478 Total Assets LIABILITIES AND OWNER'S EQUITY Current Liabilities: $ 0 %24 Accounts Payable Total Current Liabilities $ 50,000 $ 50,000 $32.377 Long-Term Liability (Uncle's Loan) Total Liabilities $32,377 $140,000 $52,101 Owner's Equity 40% 40% Amy 40% 40% Steve 20% 20% Steve's Brother $190,000 $84,478 Total Liabilities and Owner's Equity What is the debt-to-equity ratio of the Portland Freelancers' Caf? Look at each section of the caf's cash flow statement. Write a memo highlight- ing three insights you have about why this business is not succeeding, based on what you see in its cash flow statement. Review the caf's balance sheet. Explain why the net value of the caf's property and equipment has decreased from $80,000 in month one to $64,000 at year's end. Start-Up Start-up Costs Soundproot Room $15,000 7,000 Espresso Machine 10.000 High-Speed Internet Access Setup 20,000 Workstations 25,000 Supplies/Equipment 8,000 Furniture 5.000 Faxtures 10.000 Cash Reserves $100.000 Total Start-up Investments Economics of One Unit (EOU) Unit of Sale: Computer/Internet Services (Average per Customer) $4.00 Average Sale Total (Revenue) Less COGS Computer time Printer materials 0.25 Total COGS 0.25 0.25 025 Gross Profit $3.75 Less Other Variable Costs Commission 5% to manager 0.20 Total Other Variable Costs 0.20 0.20 0.20 Total Variable Costs (COGS + Other VC) 0.45 Contribution Margin $3.55 Economics of One Unit (EOU) Unit of Sale: Food and Beverage Sales (Average per Customer) Average Sale Total (Revenue) $2.00 Less COGS Food 0.80 Beverage 0.20 Total COGS 1.00 1.00 Gross Profit 1.00 Less Other Variable Costs $1.00 Commission 5% to manager 0.10 Tatal Other Variable Costs 0.10 0.10 Total Variable Costs (COGS + Other VC) Contribution Margin 0.10 1.10 Jen Feb Apr May Je Jul Aug Sep Oet Nev Dec Year Less 190 110 Ge 20 250 750 20 Wter 00 100 00 76 75 .3B 415 425 W Service S100 8100 51.00 S1.00 $1.00 S00 S100 S1030 Seie 1300 300 1.00 1.00 U90 LU0 LIM Any&S Sy ech S P Sotal Sa 1300 130 1:00 U90 L00 100 U90 $2.0 82.00 $2.000 $1.00 $200 200 21.000 $1.00 1300 00 1300 1,00 1300 L00 UM0 Alvering 00 100 AU0 00 100 Iurance L40 140 140 1,40 trest 1300 UNE L30 120 00 Ret 1:00 LD 100 1300 120 Depreciation S SL S S sm $.32 Total Fixed Costa SUR S3D NA SUN SU SUB S1n SUB Pre-Tax Profit SL0 S Taxes (20%) 200 SUBE SU SM4 SUB SURE SUR SUS SUB] Net Prefit SEM PRBKGR PREKGR The Partiend Freelancers Cafe CASH FLOW STATEMENT for the Year Ending 1212 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year sh Flew Out frem levesting Soundproof Expresso Machine High-Speed internet Access Set Workstations Suppliestorpment Furniture Fixtures .. UM ... Net Cash Flow Out from levesting ancing Cash Received from Uncle (12 APR Cash Received from Bruther Cash Received from Mother ash Received from Personal Sevings 2000 10.000 .3. S1O00 $ 1241 S .000 Net Cash Flow Ie from Financing ncrease (Decrease) in Cash Beginning $2241 $21.1 $22.5P1 $22.3 21 $21 $22.451 $21.1 $22 End Opening Closing ASSETS Current Assets: Cash $110,000 $20,474 Accounts Receivable Total Current Assets $110.000 $20,474 Fixed Assets (Property and Equipment): Soundproof Room $ 15,000 $15.000 Espresso Machine 2,000 2,000 Workstations 30,000 30,000 Supplies/Equipment 25,000 25,000 Furniture 3,000 3,000 Fixtures 5,000 5,000 $ 80,000 $80.000 Total Property and Equipment Less Accumulated Depreciation $15.996 $ 80,000 $64,004 Total Property and Equipment (Net) $190.000 $84,478 Total Assets LIABILITIES AND OWNER'S EQUITY Current Liabilities: $ 0 %24 Accounts Payable Total Current Liabilities $ 50,000 $ 50,000 $32.377 Long-Term Liability (Uncle's Loan) Total Liabilities $32,377 $140,000 $52,101 Owner's Equity 40% 40% Amy 40% 40% Steve 20% 20% Steve's Brother $190,000 $84,478 Total Liabilities and Owner's Equity What is the debt-to-equity ratio of the Portland Freelancers' Caf? Look at each section of the caf's cash flow statement. Write a memo highlight- ing three insights you have about why this business is not succeeding, based on what you see in its cash flow statement. Review the caf's balance sheet. Explain why the net value of the caf's property and equipment has decreased from $80,000 in month one to $64,000 at year's end. Start-Up Start-up Costs Soundproot Room $15,000 7,000 Espresso Machine 10.000 High-Speed Internet Access Setup 20,000 Workstations 25,000 Supplies/Equipment 8,000 Furniture 5.000 Faxtures 10.000 Cash Reserves $100.000 Total Start-up Investments Economics of One Unit (EOU) Unit of Sale: Computer/Internet Services (Average per Customer) $4.00 Average Sale Total (Revenue) Less COGS Computer time Printer materials 0.25 Total COGS 0.25 0.25 025 Gross Profit $3.75 Less Other Variable Costs Commission 5% to manager 0.20 Total Other Variable Costs 0.20 0.20 0.20 Total Variable Costs (COGS + Other VC) 0.45 Contribution Margin $3.55 Economics of One Unit (EOU) Unit of Sale: Food and Beverage Sales (Average per Customer) Average Sale Total (Revenue) $2.00 Less COGS Food 0.80 Beverage 0.20 Total COGS 1.00 1.00 Gross Profit 1.00 Less Other Variable Costs $1.00 Commission 5% to manager 0.10 Tatal Other Variable Costs 0.10 0.10 Total Variable Costs (COGS + Other VC) Contribution Margin 0.10 1.10 Jen Feb Apr May Je Jul Aug Sep Oet Nev Dec Year Less 190 110 Ge 20 250 750 20 Wter 00 100 00 76 75 .3B 415 425 W Service S100 8100 51.00 S1.00 $1.00 S00 S100 S1030 Seie 1300 300 1.00 1.00 U90 LU0 LIM Any&S Sy ech S P Sotal Sa 1300 130 1:00 U90 L00 100 U90 $2.0 82.00 $2.000 $1.00 $200 200 21.000 $1.00 1300 00 1300 1,00 1300 L00 UM0 Alvering 00 100 AU0 00 100 Iurance L40 140 140 1,40 trest 1300 UNE L30 120 00 Ret 1:00 LD 100 1300 120 Depreciation S SL S S sm $.32 Total Fixed Costa SUR S3D NA SUN SU SUB S1n SUB Pre-Tax Profit SL0 S Taxes (20%) 200 SUBE SU SM4 SUB SURE SUR SUS SUB] Net Prefit SEM PRBKGR PREKGR The Partiend Freelancers Cafe CASH FLOW STATEMENT for the Year Ending 1212 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year sh Flew Out frem levesting Soundproof Expresso Machine High-Speed internet Access Set Workstations Suppliestorpment Furniture Fixtures .. UM ... Net Cash Flow Out from levesting ancing Cash Received from Uncle (12 APR Cash Received from Bruther Cash Received from Mother ash Received from Personal Sevings 2000 10.000 .3. S1O00 $ 1241 S .000 Net Cash Flow Ie from Financing ncrease (Decrease) in Cash Beginning $2241 $21.1 $22.5P1 $22.3 21 $21 $22.451 $21.1 $22 End Opening Closing ASSETS Current Assets: Cash $110,000 $20,474 Accounts Receivable Total Current Assets $110.000 $20,474 Fixed Assets (Property and Equipment): Soundproof Room $ 15,000 $15.000 Espresso Machine 2,000 2,000 Workstations 30,000 30,000 Supplies/Equipment 25,000 25,000 Furniture 3,000 3,000 Fixtures 5,000 5,000 $ 80,000 $80.000 Total Property and Equipment Less Accumulated Depreciation $15.996 $ 80,000 $64,004 Total Property and Equipment (Net) $190.000 $84,478 Total Assets LIABILITIES AND OWNER'S EQUITY Current Liabilities: $ 0 %24 Accounts Payable Total Current Liabilities $ 50,000 $ 50,000 $32.377 Long-Term Liability (Uncle's Loan) Total Liabilities $32,377 $140,000 $52,101 Owner's Equity 40% 40% Amy 40% 40% Steve 20% 20% Steve's Brother $190,000 $84,478 Total Liabilities and Owner's Equity

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Debt to Equity Ratio Total Liabilities Shareholders Equity 32377 52101 062 The companys debt to equi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started