Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Nintendo Co., Ltd. has spent $300,000 on research and development of a new video game console. The new console is now ready for

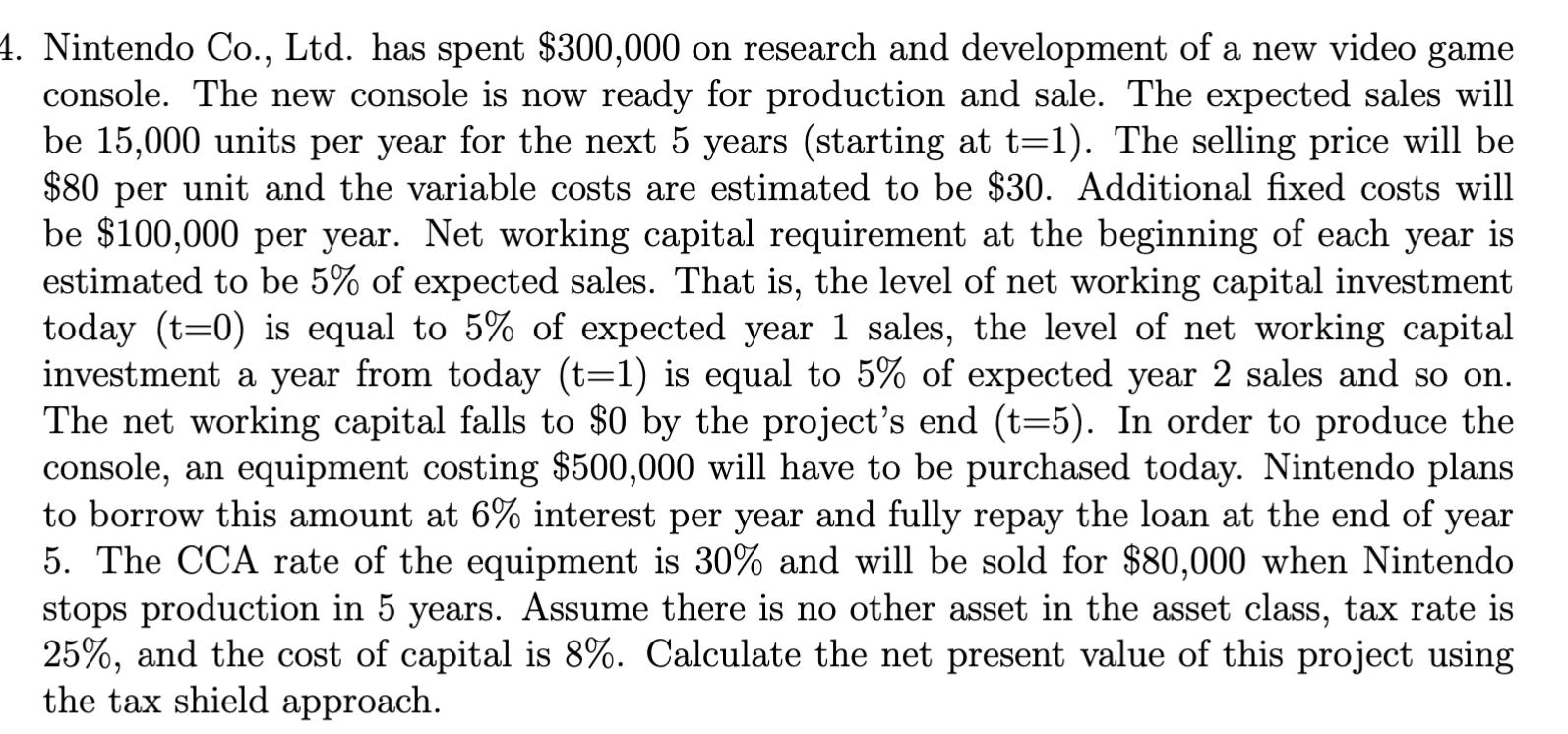

4. Nintendo Co., Ltd. has spent $300,000 on research and development of a new video game console. The new console is now ready for production and sale. The expected sales will be 15,000 units per year for the next 5 years (starting at t=1). The selling price will be $80 per unit and the variable costs are estimated to be $30. Additional fixed costs will be $100,000 per year. Net working capital requirement at the beginning of each year is estimated to be 5% of expected sales. That is, the level of net working capital investment today (t=0) is equal to 5% of expected year 1 sales, the level of net working capital investment a year from today (t=1) is equal to 5% of expected year 2 sales and so on. The net working capital falls to $0 by the project's end (t=5). In order to produce the console, an equipment costing $500,000 will have to be purchased today. Nintendo plans to borrow this amount at 6% interest per year and fully repay the loan at the end of year 5. The CCA rate of the equipment is 30% and will be sold for $80,000 when Nintendo stops production in 5 years. Assume there is no other asset in the asset class, tax rate is 25%, and the cost of capital is 8%. Calculate the net present value of this project using the tax shield approach.

Step by Step Solution

★★★★★

3.29 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Net Present Value tax shield approach 500000 800...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started