Question

What is the equity risk premium calculated by the Capital Asset Pricing Model? a. 5 percent b. 10 percent c. 3 percent d. 13 percent

What is the equity risk premium calculated by the Capital Asset Pricing Model? a. 5 percent b. 10 percent c. 3 percent d. 13 percent

The weight of preferred equity in the companys capital structure is: a. 20 percent b. $20 million c. 5.48 percent d. 5.80 percent

What is the common stock proportion in the companys total capital? a. 36.23 percent b. 125 percent c. 36.55 percent d. 34.25 percent

Which type of capital would cause the second break point in the companys Weighted Average Cost of Capital when more capital is raised? a. Common Equity b. Preferred Equity c. Stock Class A d. Debt

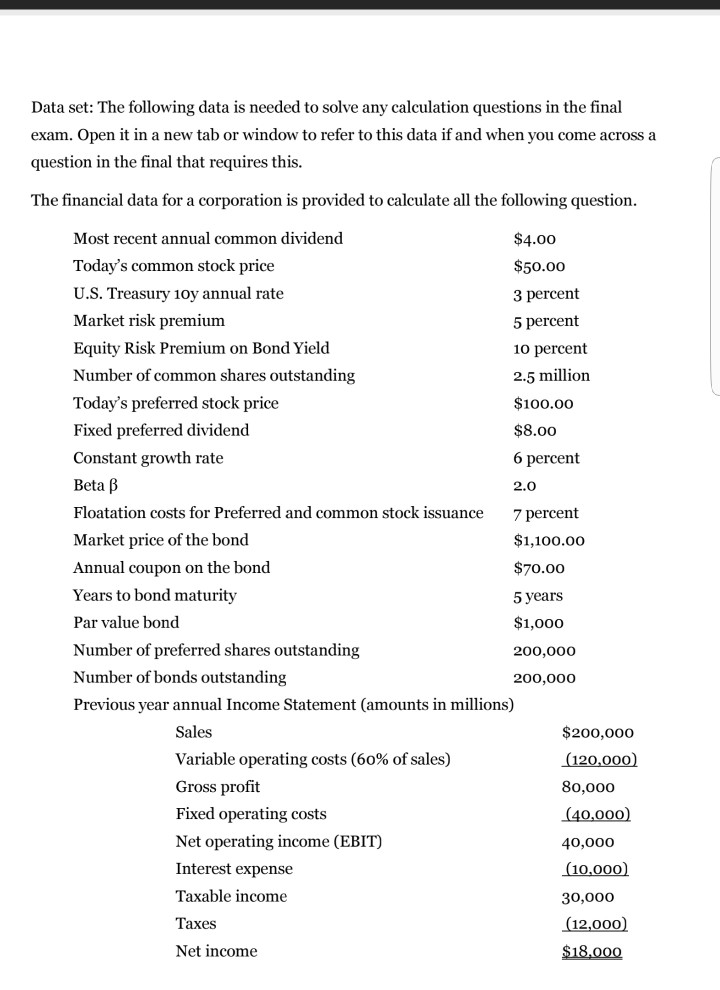

Data set: The following data is needed to solve any calculation questions in the final exam. Open it in a new tab or window to refer to this data if and when you come across a question in the final that requires this. The financial data for a corporation is provided to calculate all the following question. 2.0 Most recent annual common dividend $4.00 Today's common stock price $50.00 U.S. Treasury 1oy annual rate 3 percent Market risk premium 5 percent Equity Risk Premium on Bond Yield 10 percent Number of common shares outstanding 2.5 million Today's preferred stock price $100.00 Fixed preferred dividend $8.00 Constant growth rate 6 percent Beta B Floatation costs for Preferred and common stock issuance 7 percent Market price of the bond $1,100.00 Annual coupon on the bond $70.00 Years to bond maturity 5 years Par value bond $1,000 Number of preferred shares outstanding 200,000 Number of bonds outstanding 200,000 Previous year annual Income Statement (amounts in millions) Sales $200,000 Variable operating costs (60% of sales) (120,000) Gross profit 80,000 Fixed operating costs (40,000) Net operating income (EBIT) 40,000 Interest expense (10,000) Taxable income 30,000 Taxes (12,000) Net income $18.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started