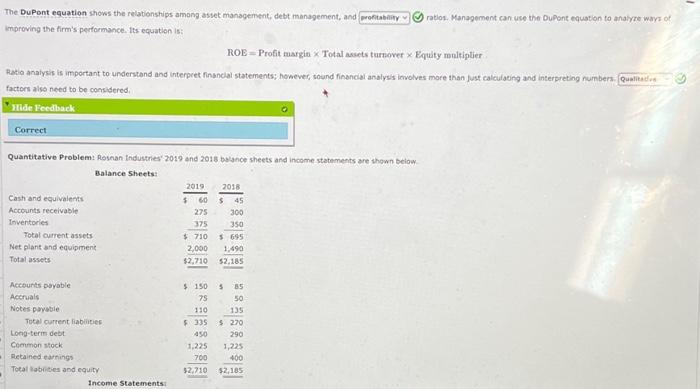

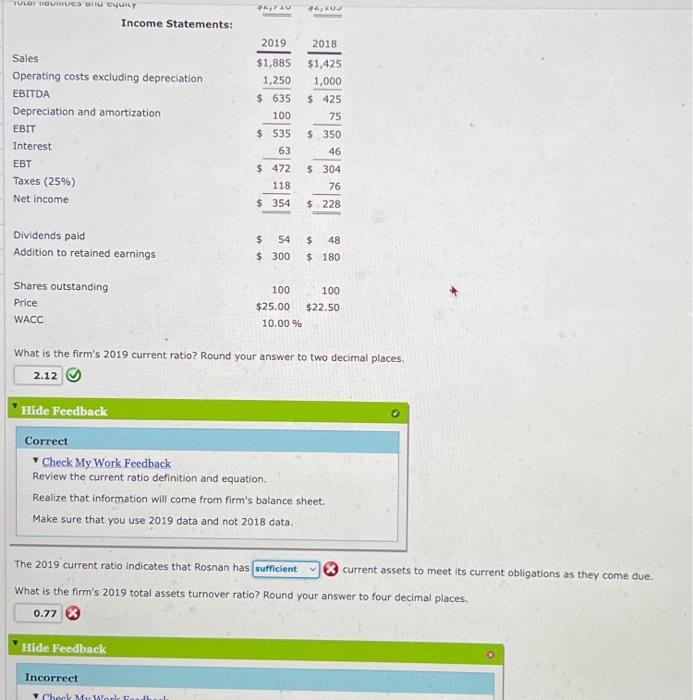

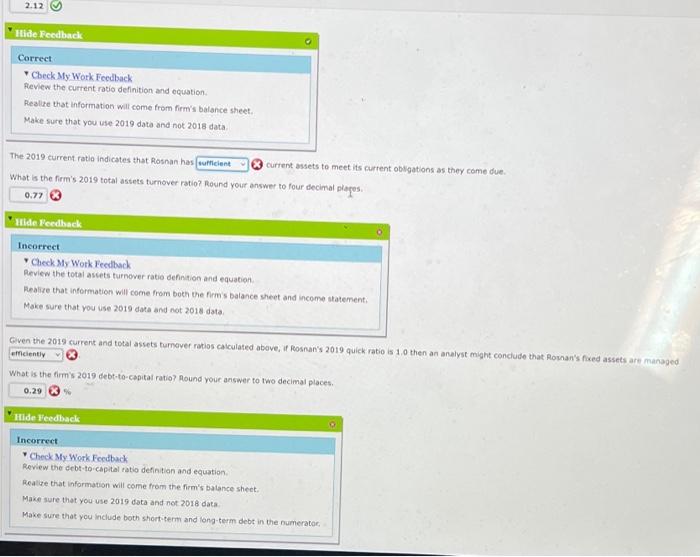

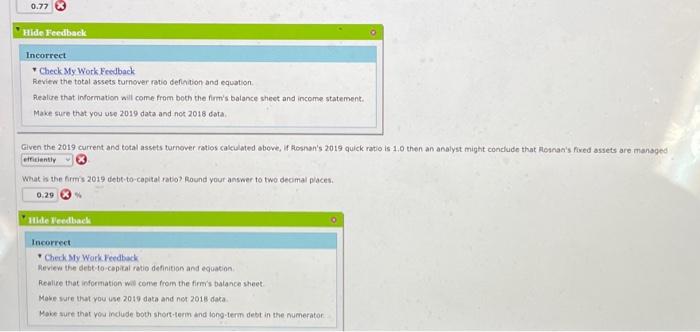

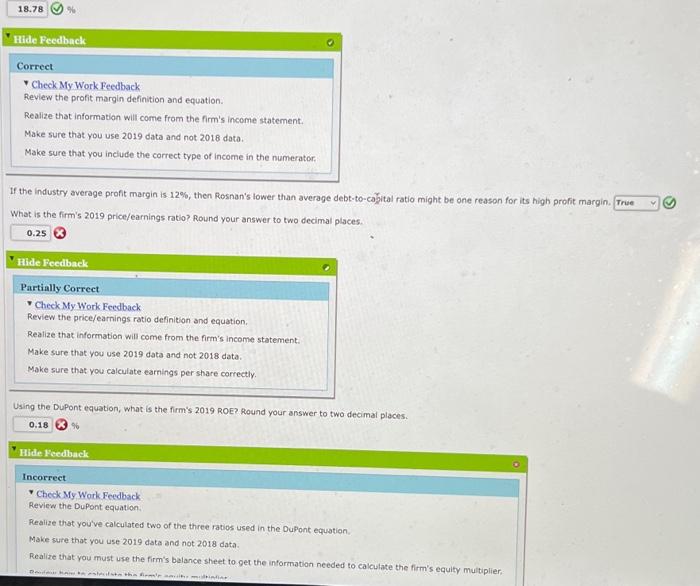

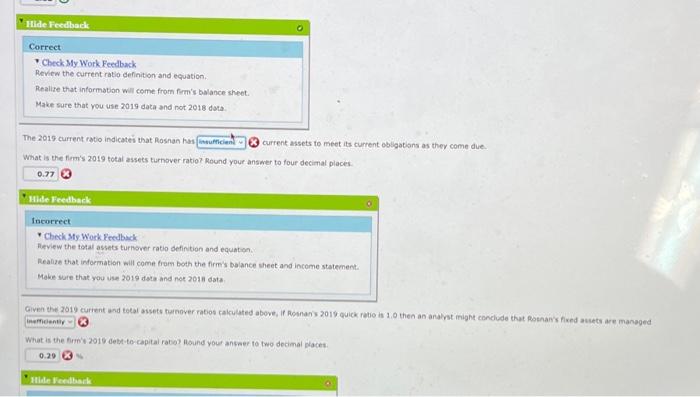

What is the firm's 2019 current ratio? Round your answer to two decimal places. The 2019 current ratio indicates that Rosnan has current assets to meet its current obligations as they come due. What is the firm's 2019 total assets turnover ratio? Round your answer to four decimal places. - Check My Work Feedback Reviea the total assets tumover ratio defincion and equation. Realue that information will come from boch the firm's batance sheet and income statement. Make sure that you use 2019 data and not 2018 data. Given the 2019 current and total assets turnover ratios calculated obove, if Roshan's 2019 quick ratio is 1.0 then an analyst might conclude that Mosnan's fixed assets are managed 6 What is the firmis 2019 debe-to-copital rato? Round your answer to two decimal places. Correct Check My Work Feedback Review the profit margin definition and equation. Realize that information will come from the firm's income statement. Make sure that you use 2019 data and not 2018 data. Make sure that you include the correct type of income in the numerator. If the industry average proft margin is 12%, then Rosnan's lower than average debt-to-cagital ratio might be one reason for its high profit margin. What is the firm's 2019 price/earnings ratio? Round your answer to two decimal places. Using the DuPont equation, what is the firm's 2019 ROE? Round your answer to two decimal places. 6% Correct - Check Sly Work Feedback Review the current ratio definition and equation. Realise that information will come from firmis balance sheet. Make sure that you use 2019 data and not 2018 data. The 2019 current ratio indicatei that Rosnan has 6 current assets to meot its current oblgotions as ther come due. What is the firm's 2019 total assets turnover ratio? Round your answer to four decimal places. 9 What is the firmit 2010 debt to capital rabe? llound your anseer to two decimal places. 6= The Dupont equation shows the relationships among asset management, debt manapement, and (5) ratios. Manapement can use the Dupant equation to analyre warr of improving the firm's performance. fts equation is: ROE = Profit margin Total assets turnover Equity mnitiplier Ratio analysis is important to understond and interpret finsnclal statements; however, sound finoncial anolysis iovolves more than fust calculacing and interpreting numbers. factors also need to be comsidered; Quantitative Problem: Rosnan fndustries' 2019 and 2018 bulance sheets and income statements are vhown below. Balance sheets: Correct - Cbeck My Work Feedback Review the current ratio definition and equation. Realize that information will come from firm's balance sheet. Make sure that you use 2019 data and not 2018 data The 2019 current ratia indicates that Rosnan has 6 current assets to meet its current oblgations as they come due. What is the firm's 2019 total astets turnover ratio? Round your answer to four decimal plapos. 6 Titie Dealhoek Qven the 2019 current and total assets turneiver ratios calculated above, if Rosnan's 2019 quick ratio is 1.0 then an analyst might conclude that Royan's ficed assets are managed .3 What is the firm's 2019 debt-to-capital ratio? Round your answer to two decimal places. What is the firm's 2019 current ratio? Round your answer to two decimal places. The 2019 current ratio indicates that Rosnan has current assets to meet its current obligations as they come due. What is the firm's 2019 total assets turnover ratio? Round your answer to four decimal places. - Check My Work Feedback Reviea the total assets tumover ratio defincion and equation. Realue that information will come from boch the firm's batance sheet and income statement. Make sure that you use 2019 data and not 2018 data. Given the 2019 current and total assets turnover ratios calculated obove, if Roshan's 2019 quick ratio is 1.0 then an analyst might conclude that Mosnan's fixed assets are managed 6 What is the firmis 2019 debe-to-copital rato? Round your answer to two decimal places. Correct Check My Work Feedback Review the profit margin definition and equation. Realize that information will come from the firm's income statement. Make sure that you use 2019 data and not 2018 data. Make sure that you include the correct type of income in the numerator. If the industry average proft margin is 12%, then Rosnan's lower than average debt-to-cagital ratio might be one reason for its high profit margin. What is the firm's 2019 price/earnings ratio? Round your answer to two decimal places. Using the DuPont equation, what is the firm's 2019 ROE? Round your answer to two decimal places. 6% Correct - Check Sly Work Feedback Review the current ratio definition and equation. Realise that information will come from firmis balance sheet. Make sure that you use 2019 data and not 2018 data. The 2019 current ratio indicatei that Rosnan has 6 current assets to meot its current oblgotions as ther come due. What is the firm's 2019 total assets turnover ratio? Round your answer to four decimal places. 9 What is the firmit 2010 debt to capital rabe? llound your anseer to two decimal places. 6= The Dupont equation shows the relationships among asset management, debt manapement, and (5) ratios. Manapement can use the Dupant equation to analyre warr of improving the firm's performance. fts equation is: ROE = Profit margin Total assets turnover Equity mnitiplier Ratio analysis is important to understond and interpret finsnclal statements; however, sound finoncial anolysis iovolves more than fust calculacing and interpreting numbers. factors also need to be comsidered; Quantitative Problem: Rosnan fndustries' 2019 and 2018 bulance sheets and income statements are vhown below. Balance sheets: Correct - Cbeck My Work Feedback Review the current ratio definition and equation. Realize that information will come from firm's balance sheet. Make sure that you use 2019 data and not 2018 data The 2019 current ratia indicates that Rosnan has 6 current assets to meet its current oblgations as they come due. What is the firm's 2019 total astets turnover ratio? Round your answer to four decimal plapos. 6 Titie Dealhoek Qven the 2019 current and total assets turneiver ratios calculated above, if Rosnan's 2019 quick ratio is 1.0 then an analyst might conclude that Royan's ficed assets are managed .3 What is the firm's 2019 debt-to-capital ratio? Round your answer to two decimal places