Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is the formula for the question signs i do not understand Download the applying Excel' worksheet below and save it to your computer. View

what is the formula for the question signs i do not understand

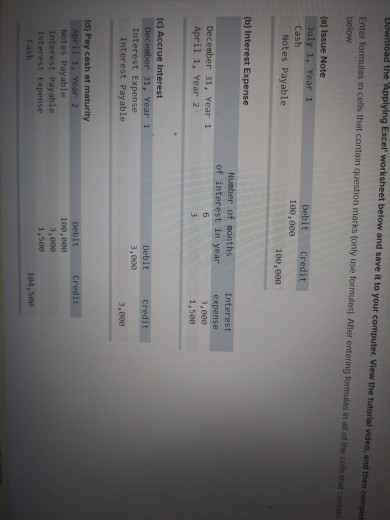

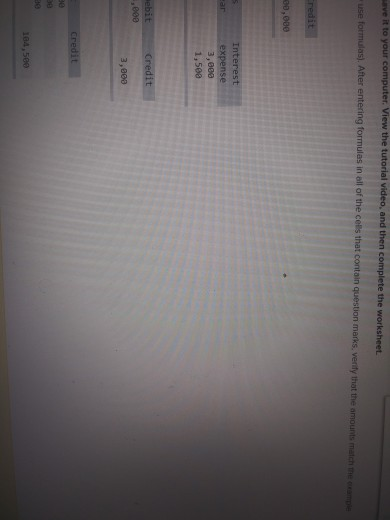

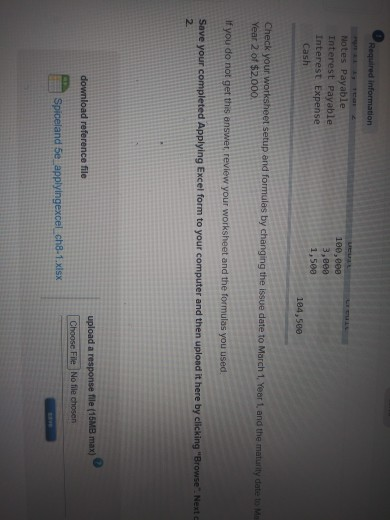

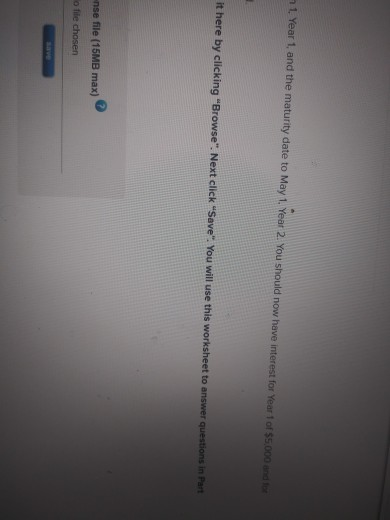

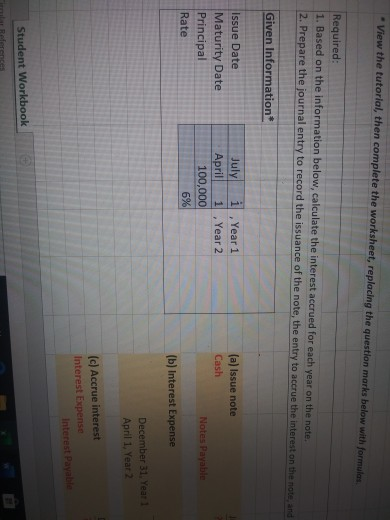

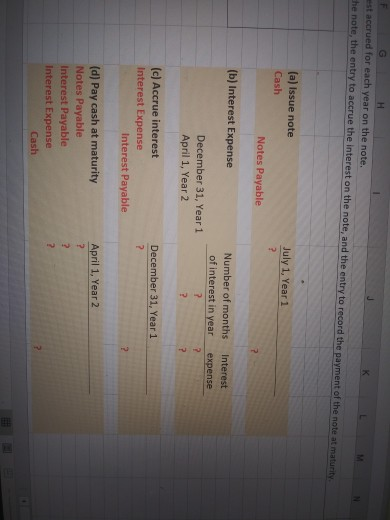

Download the applying Excel' worksheet below and save it to your computer. View the tutorial video, and then complet Enter formulas in colls that contain question marks (only use formulas). After entering formules in all of me cells that com below (a) Issue Note July 1, Year 1 Cash Notes Payable Debit 100,000 Credit 100,000 (b) Interest Expense Number of months of interest in year fi December 31, Year 1 April 1, Year 2 Interest expense 3,000 1,500 3 (c) Accrue Interest December 31, Year 1 Interest Expense Interest Payable Credit Debit 3,000 3,000 Credit (d) Pay cash at maturity April 1. Year 2 Notes Payable Interest Payable Interest Expense Cash Debit 100,000 3,000 104,500 ve it to your computer. View the tutorial video, and then complete the worksheet use formulas). After entering formulas in all of the cells that contain question marks, verify that the amounts match them credit 00,000 ar Interest expense 3,000 1,500 ebit Credit ..000 3,000 Credit se 30 184,500 Required information Notes Payable Interest Payable Interest Expense Cash 100,000 3,000 1,500 104,500 Check your worksheet setup and formulas by changing the issue date to March 1, Year 1, and the maturity date to Me Year 2 of $2,000. If you do not get this answer review your worksheet and the formulas you used. Save your completed Applying Excel form to your computer and then upload it here by clicking "Browse". Next 2. download reference file upload a response file (16MB max) Choose File No file chosen Spiceland 5e_applyingexcel_ch8-1.xlsx 1 Year 1, and the maturity date to May 1 Year 2. You should now have interest for Year 1 of $5.000 and it here by clicking "Browse". Next click "Save". You will use this worksheet to answer questions in Pan -nse file (15MB max) o file chosen View the tutorial, then complete the worksheet, replacing the question marks below with formulas Required: 1. Based on the information below, calculate the interest accrued for each year on the note. 2. Prepare the journal entry to record the issuance of the note, the entry to accrue the interest on the note, and Given Information Issue Date Maturity Date Principal Rate July i , Year 1 April 1 , Year 2 100,000 6% (a) Issue note Cash Notes Payable (b) Interest Expense December 31 Year 1 April 1. Year 2 (c) Accrue interest Interest Expense Interest Payable Student Workbook F G H est accrued for each year on the note. M the note, the entry to accrue the interest on the note, and the entry to record the payment of the note at maturity July 1, Year 1 (a) Issue note Cash Notes Payable 2 (b) Interest Expense Number of months of interest in year 2 ? Interest expense ? December 31, Year 1 April 1, Year 2 December 31, Year 1 (c) Accrue interest Interest Expense Interest Payable ? April 1, Year 2 (d) Pay cash at maturity Notes Payable Interest Payable Interest Expense CashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started