what is the formula used for interest expense?

what is the formula used for interest expense?

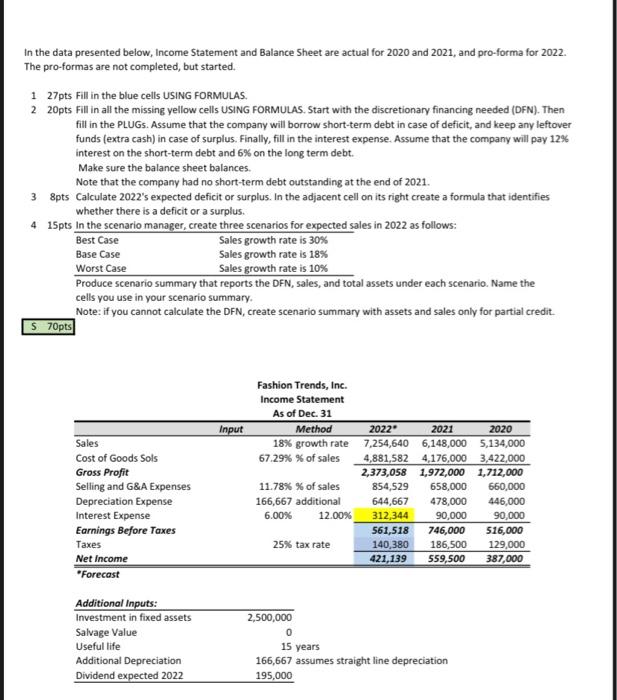

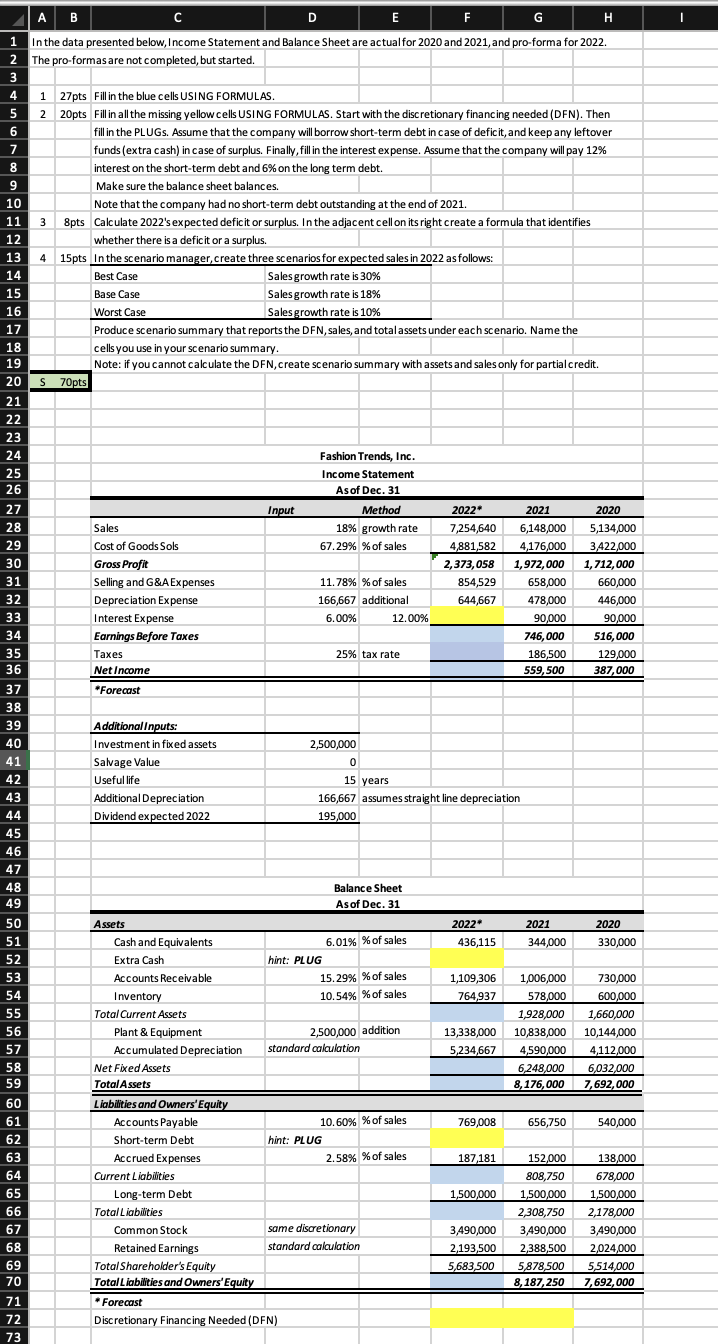

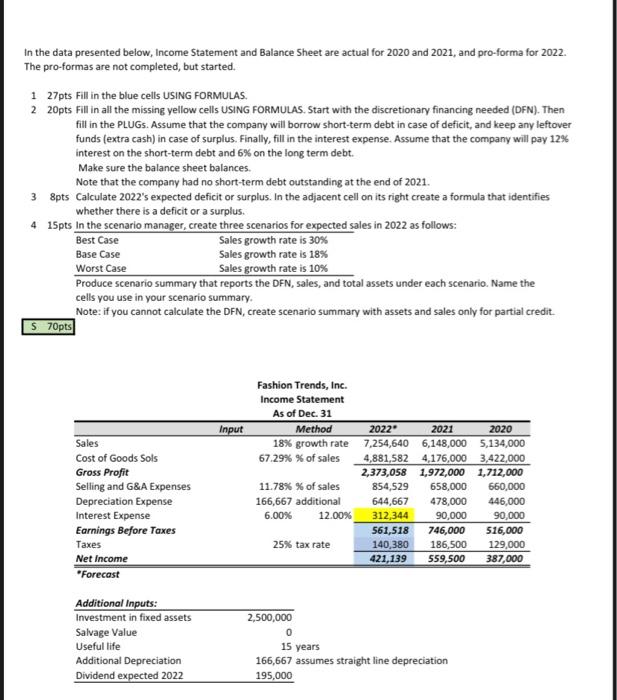

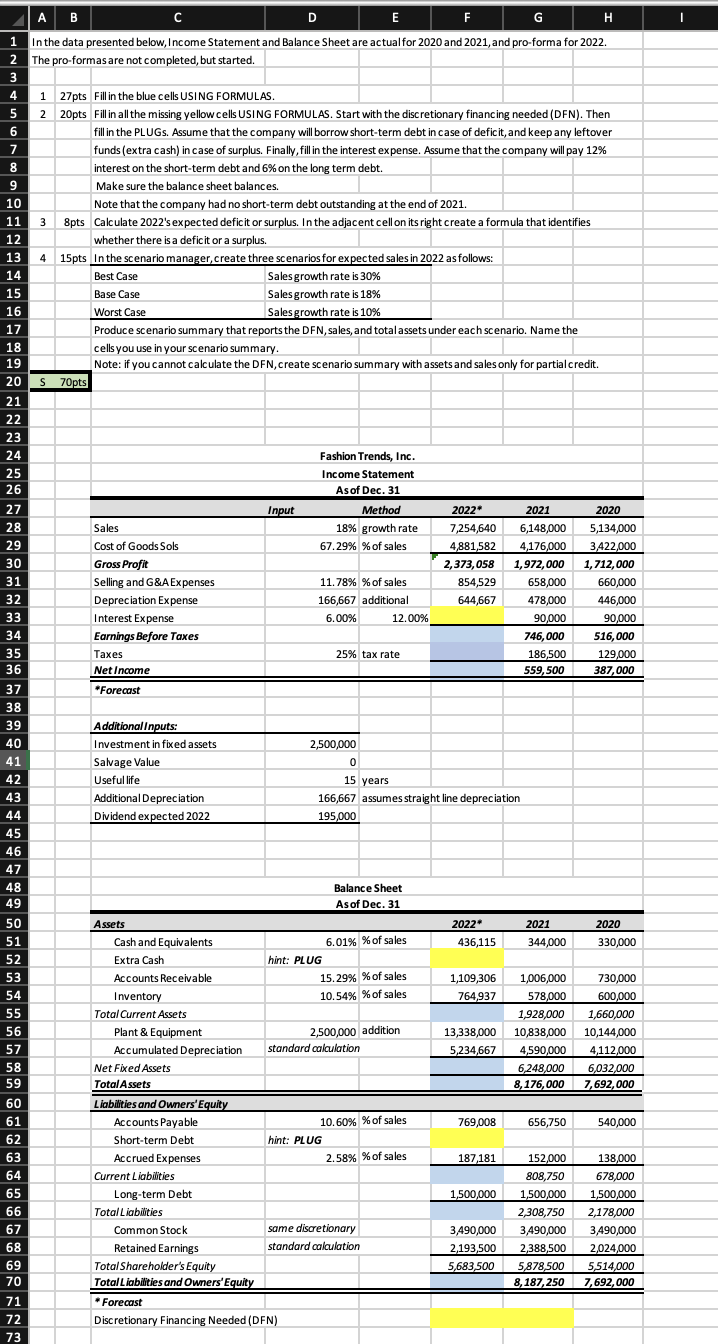

In the data presented below, Income Statement and Balance Sheet are actual for 2020 and 2021 , and pro-forma for 2022. The pro-formas are not completed, but started. 127pts Fill in the blue cells USING FORMULAS. 2 20pts Fill in all the missing yellow cells USING FORMULAS. Start with the discretionary financing needed (DFN). Then fill in the PLUGs. Assume that the company will borrow short-term debt in case of deficit, and keep any leftover funds (extra cash) in case of surplus. Finally, fill in the interest expense. Assume that the company will pay 12% interest on the short-term debt and 6% on the long term debt. Make sure the balance sheet balances. Note that the company had no short-term debt outstanding at the end of 2021. 3 8pts Calculate 2022's expected deficit or surplus. In the adjacent cell on its right create a formula that identifies whether there is a deficit or a surplus. 4 15pts In the scenario manager. create three scenarios for expected sales in 2022 as follows: Produce scenario summary that reports the DFN, sales, and total assets under each scenario. Name the cells you use in your scenario summary. Note: if you cannot calculate the DFN, create scenario summary with assets and sales only for partial credit. In the data presented below, Income Statement and Balance Sheet are actual for 2020 and 2021 , and pro-forma for 2022. The pro-formas are not completed, but started. 127pts Fill in the blue cells USING FORMULAS. 2 20pts Fill in all the missing yellow cells USING FORMULAS. Start with the discretionary financing needed (DFN). Then fill in the PLUGs. Assume that the company will borrow short-term debt in case of deficit, and keep any leftover funds (extra cash) in case of surplus. Finally, fill in the interest expense. Assume that the company will pay 12% interest on the short-term debt and 6% on the long term debt. Make sure the balance sheet balances. Note that the company had no short-term debt outstanding at the end of 2021. 3 8pts Calculate 2022's expected deficit or surplus. In the adjacent cell on its right create a formula that identifies whether there is a deficit or a surplus. 4 15pts In the scenario manager. create three scenarios for expected sales in 2022 as follows: Produce scenario summary that reports the DFN, sales, and total assets under each scenario. Name the cells you use in your scenario summary. Note: if you cannot calculate the DFN, create scenario summary with assets and sales only for partial credit

what is the formula used for interest expense?

what is the formula used for interest expense?