Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the fourth step of the capital budgeting process? a) Generating ideas Ob) Collection of data c) Evaluation and decision making d) Reevaluation

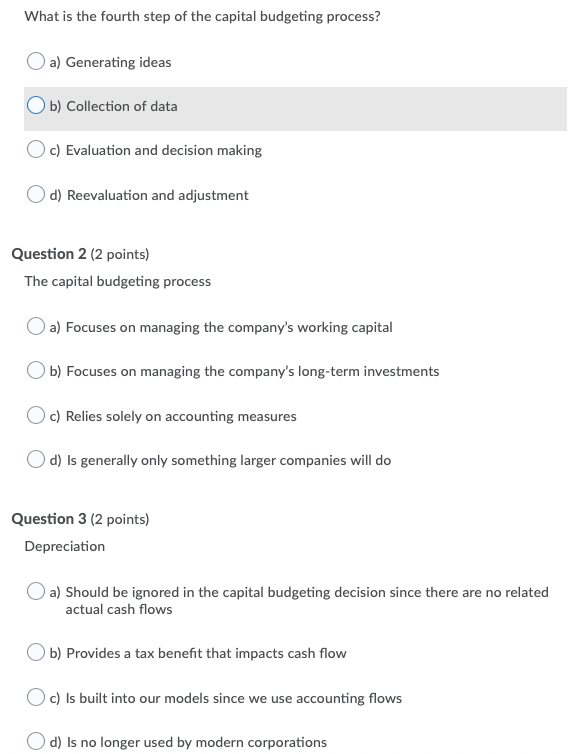

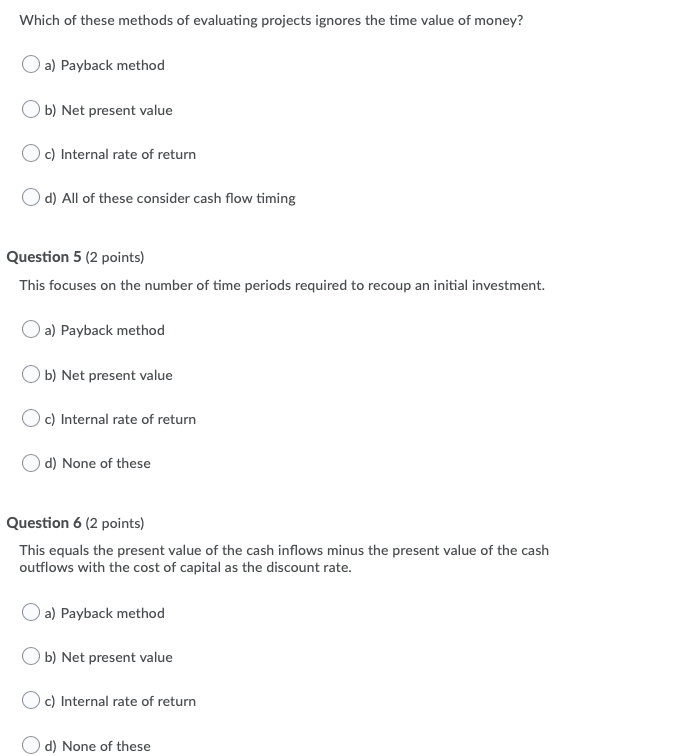

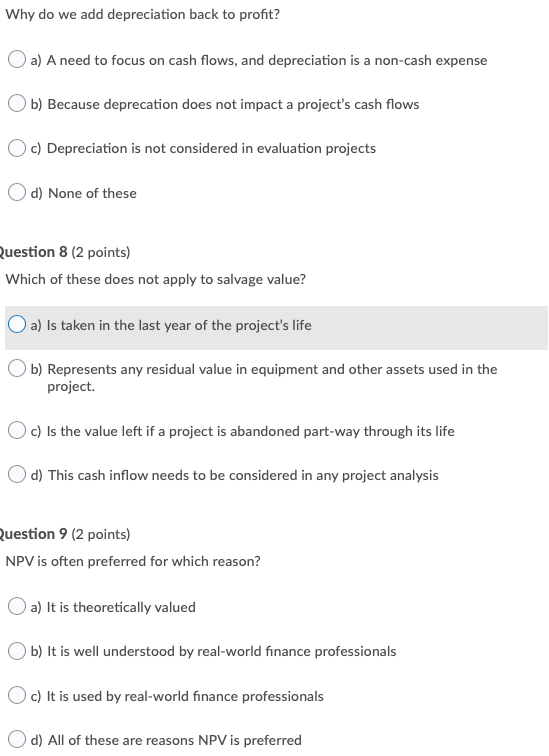

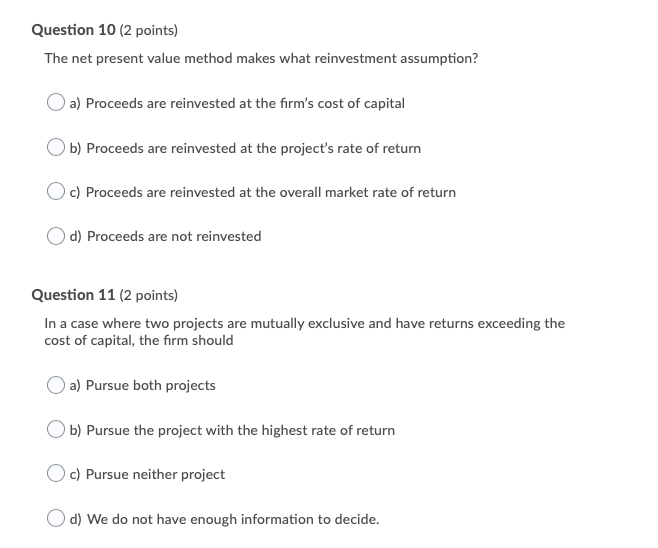

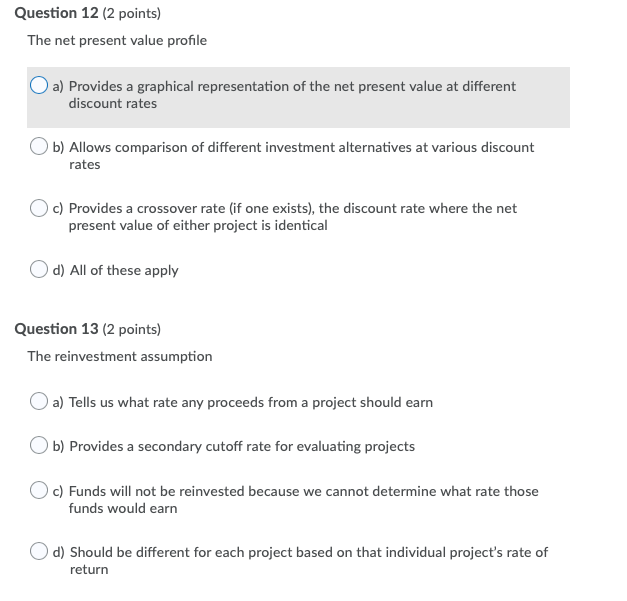

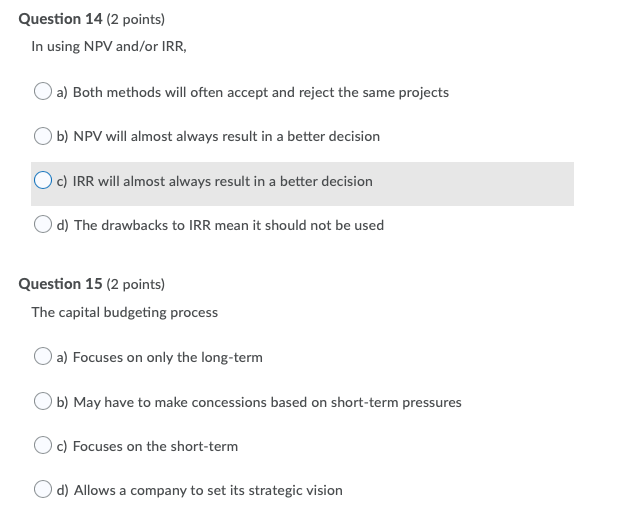

What is the fourth step of the capital budgeting process? a) Generating ideas Ob) Collection of data c) Evaluation and decision making d) Reevaluation and adjustment Question 2 (2 points) The capital budgeting process a) Focuses on managing the company's working capital b) Focuses on managing the company's long-term investments c) Relies solely on accounting measures d) Is generally only something larger companies will do Question 3 (2 points) Depreciation a) Should be ignored in the capital budgeting decision since there are no related actual cash flows Ob) Provides a tax benefit that impacts cash flow c) Is built into our models since we use accounting flows d) Is no longer used by modern corporations Which of these methods of evaluating projects ignores the time value of money? a) Payback method b) Net present value c) Internal rate of return d) All of these consider cash flow timing Question 5 (2 points) This focuses on the number of time periods required to recoup an initial investment. a) Payback method b) Net present value c) Internal rate of return d) None of these Question 6 (2 points) This equals the present value of the cash inflows minus the present value of the cash outflows with the cost of capital as the discount rate. a) Payback method Ob) Net present value c) Internal rate of return d) None of these Why do we add depreciation back to profit? O a) A need to focus on cash flows, and depreciation is a non-cash expense b) Because deprecation does not impact a project's cash flows c) Depreciation is not considered in evaluation projects d) None of these Question 8 (2 points) Which of these does not apply to salvage value? O a) Is taken in the last year of the project's life b) Represents any residual value in equipment and other assets used in the project. c) Is the value left if a project is abandoned part-way through its life d) This cash inflow needs to be considered in any project analysis Question 9 (2 points) NPV is often preferred for which reason? a) It is theoretically valued b) It is well understood by real-world finance professionals c) It is used by real-world finance professionals d) All of these are reasons NPV is preferred Question 10 (2 points) The net present value method makes what reinvestment assumption? a) Proceeds are reinvested at the firm's cost of capital b) Proceeds are reinvested at the project's rate of return Oc) Proceeds are reinvested at the overall market rate of return d) Proceeds are not reinvested Question 11 (2 points) In a case where two projects are mutually exclusive and have returns exceeding the cost of capital, the firm should a) Pursue both projects O b) Pursue the project with the highest rate of return c) Pursue neither project Od) We do not have enough information to decide. Question 12 (2 points) The net present value profile a) Provides a graphical representation of the net present value at different discount rates b) Allows comparison of different investment alternatives at various discount rates c) Provides a crossover rate (if one exists), the discount rate where the net present value of either project is identical d) All of these apply Question 13 (2 points) The reinvestment assumption a) Tells us what rate any proceeds from a project should earn Ob) Provides a secondary cutoff rate for evaluating projects Oc) Funds will not be reinvested because we cannot determine what rate those funds would earn d) Should be different for each project based on that individual project's rate of return Question 14 (2 points) In using NPV and/or IRR, a) Both methods will often accept and reject the same projects b) NPV will almost always result in a better decision c) IRR will almost always result in a better decision d) The drawbacks to IRR mean it should not be used Question 15 (2 points) The capital budgeting process a) Focuses on only the long-term b) May have to make concessions based on short-term pressures c) Focuses on the short-term d) Allows a company to set its strategic vision

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Capital Budgeting Process Answers 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started