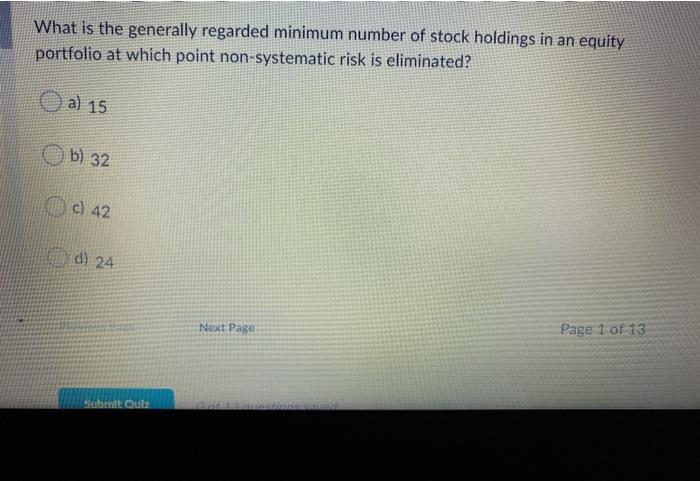

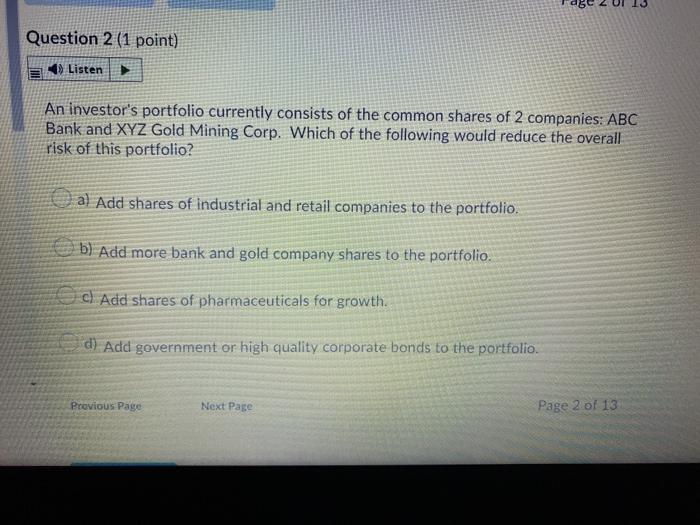

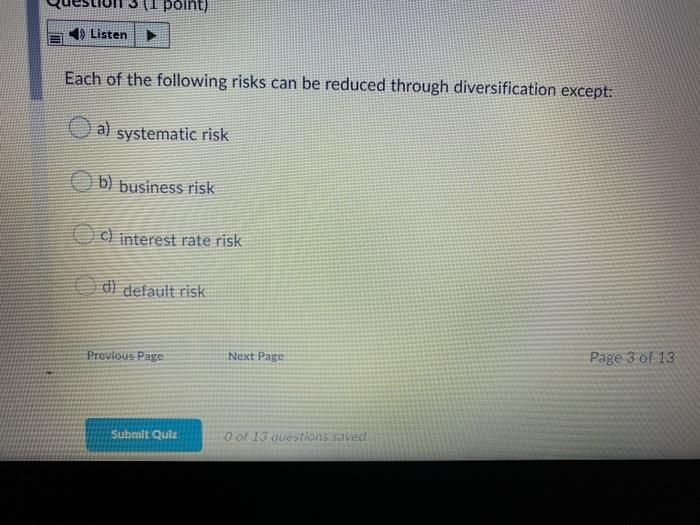

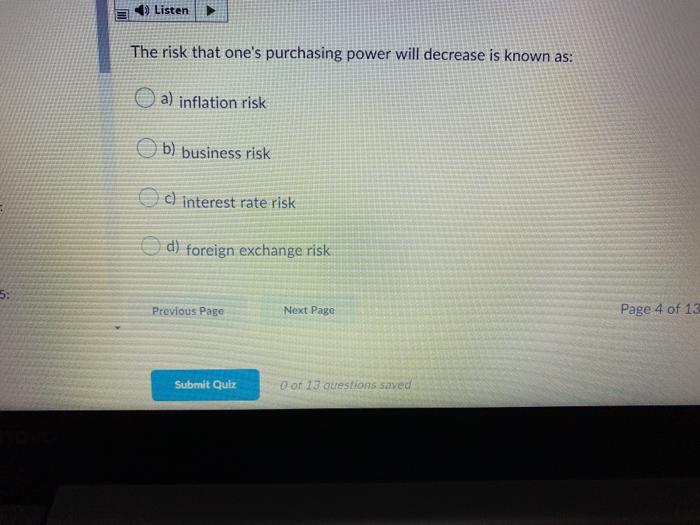

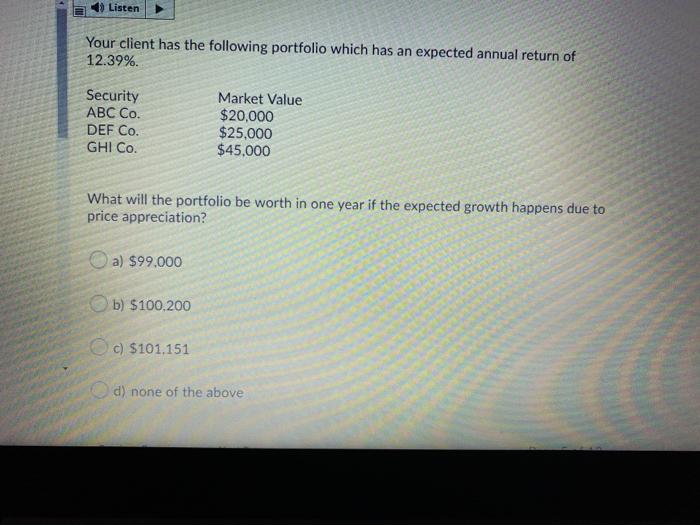

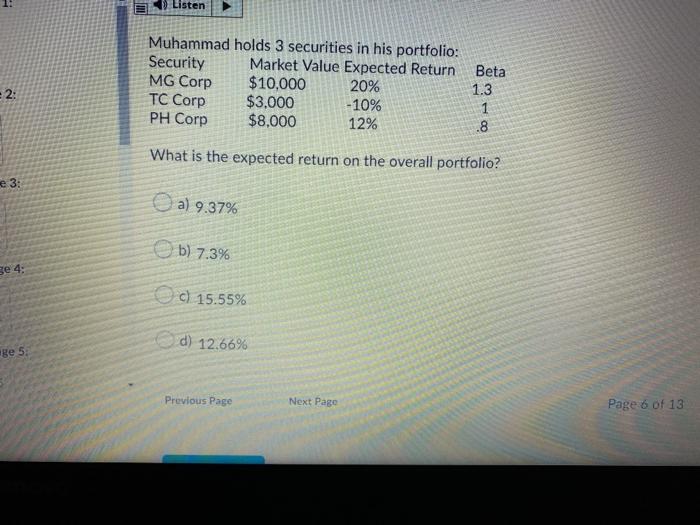

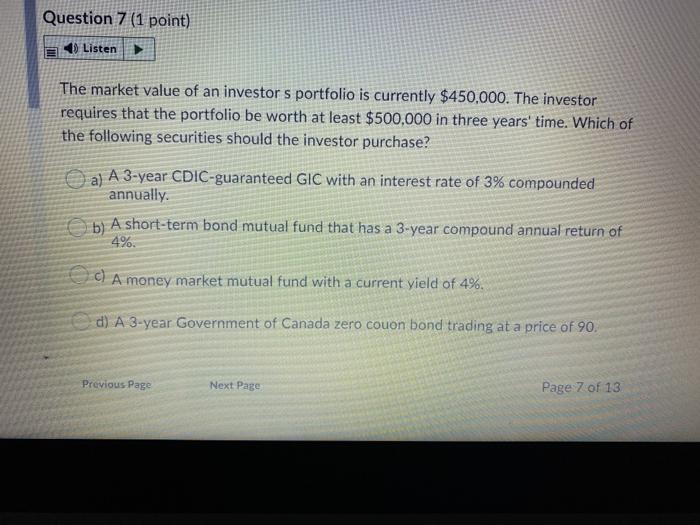

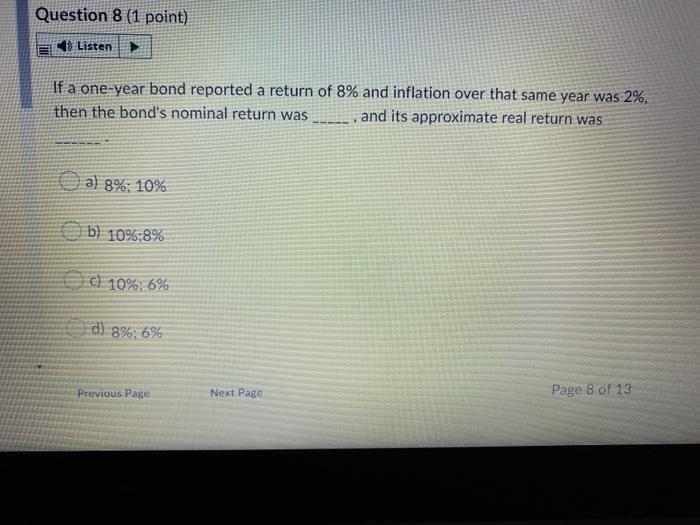

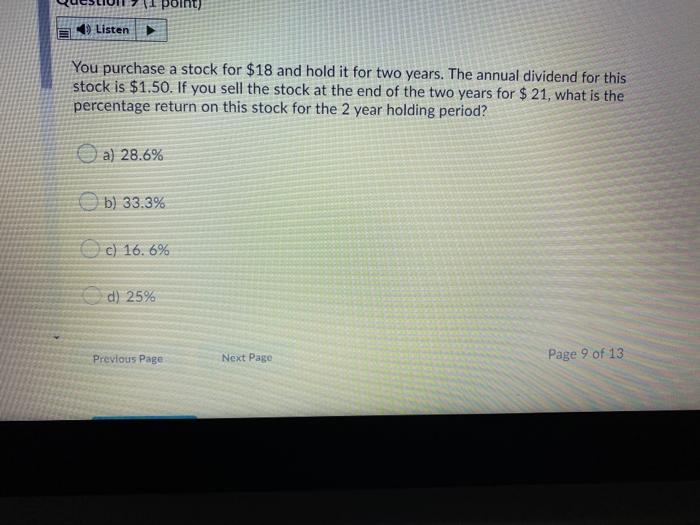

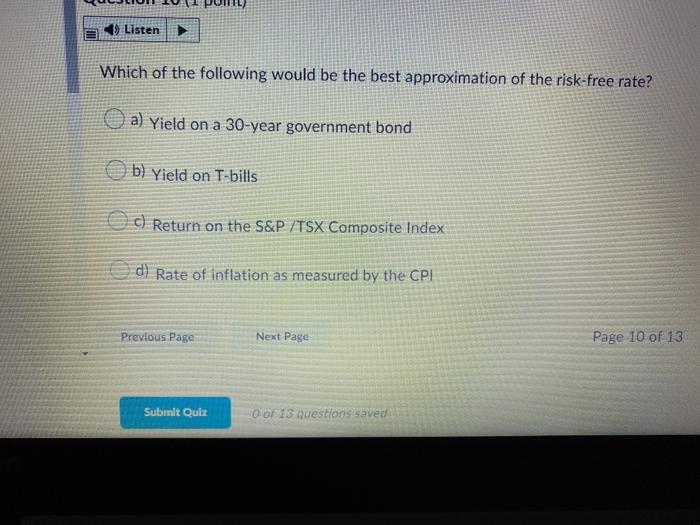

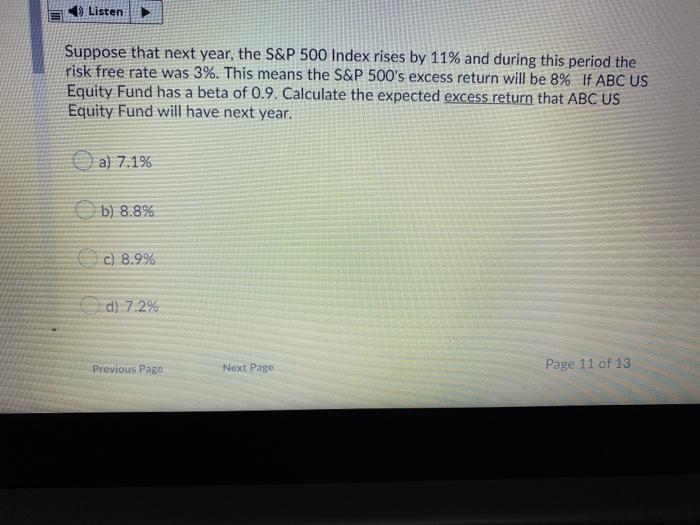

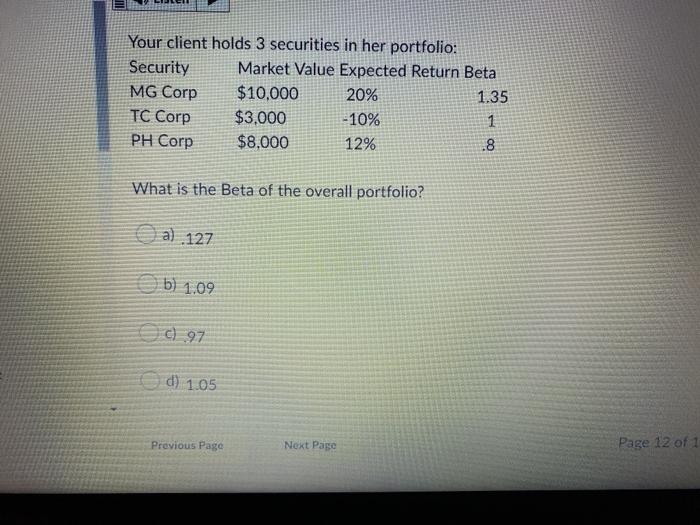

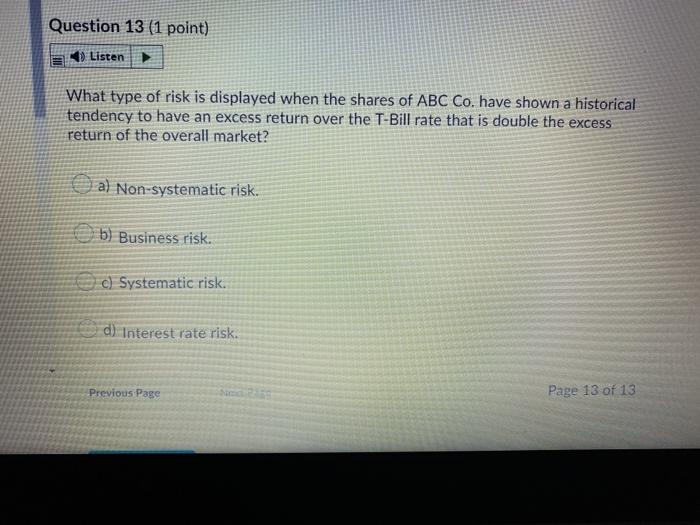

What is the generally regarded minimum number of stock holdings in an equity portfolio at which point non-systematic risk is eliminated? a) 15 b) 32 ) c) 42 od 24 Next Page Page 1 of 13 Submit Outz Question 2 (1 point) Listen An investor's portfolio currently consists of the common shares of 2 companies: ABC Bank and XYZ Gold Mining Corp. Which of the following would reduce the overall risk of this portfolio? a) Add shares of industrial and retail companies to the portfolio. b) Add more bank and gold company shares to the portfolio. c) Add shares of pharmaceuticals for growth. d) Add government or high quality corporate bonds to the portfolio Previous Page Next Page Page 2 of 13 point) Listen Each of the following risks can be reduced through diversification except: systematic risk b) business risk c) interest rate risk d) default risk Previous Page Next Page Page 3 of 13 Submit Quiz 0 0 13 questions saved Listen The risk that one's purchasing power will decrease is known as: a) inflation risk b) business risk c) interest rate risk d) foreign exchange risk 5: Previous Page Next Page Page 4 of 13 Submit Quiz Oon 13 questions saved Listen Your client has the following portfolio which has an expected annual return of 12.39% Security ABC Co. DEF Co. GHI Co. Market Value $20,000 $25,000 $45.000 What will the portfolio be worth in one year if the expected growth happens due to price appreciation? a) $99.000 b) $100,200 c) $101.151 d) none of the above Listen Muhammad holds 3 securities in his portfolio: Security Market Value Expected Return MG Corp $10.000 20% TC Corp $3,000 - 10% PH Corp $8.000 12% 2: Beta 1.3 1 .8 What is the expected return on the overall portfolio? e 3: a) 9.37% b) 7.3% Se 4: ) 15.55% d) 12.66% ge 5 Previous Page Next Page Page 6 of 13 Question 7 (1 point) Listen The market value of an investor s portfolio is currently $450,000. The investor requires that the portfolio be worth at least $500,000 in three years' time. Which of the following securities should the investor purchase? a) A 3-year CDIC-guaranteed GIC with an interest rate of 3% compounded annually. A short-term bond mutual fund that has a 3-year compound annual return of 4%. c) A money market mutual fund with a current yield of 4%. d) A 3-year Government of Canada zero couon bond trading at a price of 90. Previous Page Next Page Page 7 of 13 Question 8 (1 point) Listen If a one-year bond reported a return of 8% and inflation over that same year was 2%. then the bond's nominal return was and its approximate real return was a) 8%: 10% b) 10%;8% ) 10%: 6% d) 8%; 6% Previous Page Next Page Page 8 of 13 point) Listen You purchase a stock for $18 and hold it for two years. The annual dividend for this stock is $1.50. If you sell the stock at the end of the two years for $ 21, what is the percentage return on this stock for the 2 year holding period? a) 28.6% b) 33.3% c) 16.6% d) 25% Previous Page Next Page Page 9 of 13 Listen Which of the following would be the best approximation of the risk-free rate? a) Yield on a 30-year government bond b) Yield on T-bills c) Return on the S&P /TSX Composite Index d) Rate of inflation as measured by the CPI Previous Page Next Page Page 10 of 13 Submit Quiz O of 15 questions saved Listen Suppose that next year, the S&P 500 Index rises by 11% and during this period the risk free rate was 3%. This means the S&P 500's excess return will be 8% If ABC US Equity Fund has a beta of 0.9. Calculate the expected excess return that ABC US Equity Fund will have next year. a) 7.1% b) 8.8% c) 8.9% d) 7.2% Previous Page Next Page Page 11 of 13 Your client holds 3 securities in her portfolio: Security Market Value Expected Return Beta MG Corp $10,000 20% 1.35 TC Corp $3,000 - 10% 1 PH Corp $8,000 12% 8 What is the Beta of the overall portfolio? ca) 127 b) 1.09 C) 97 Hed) 1.05 Previous Page Next Page Page 12 of 1 Question 13 (1 point) Listen What type of risk is displayed when the shares of ABC Co. have shown a historical tendency to have an excess return over the T-Bill rate that is double the excess return of the overall market? a) Non-systematic risk. b) Business risk. c) Systematic risk. d) Interest rate risk. Previous Page Page 13 of 13