Answered step by step

Verified Expert Solution

Question

1 Approved Answer

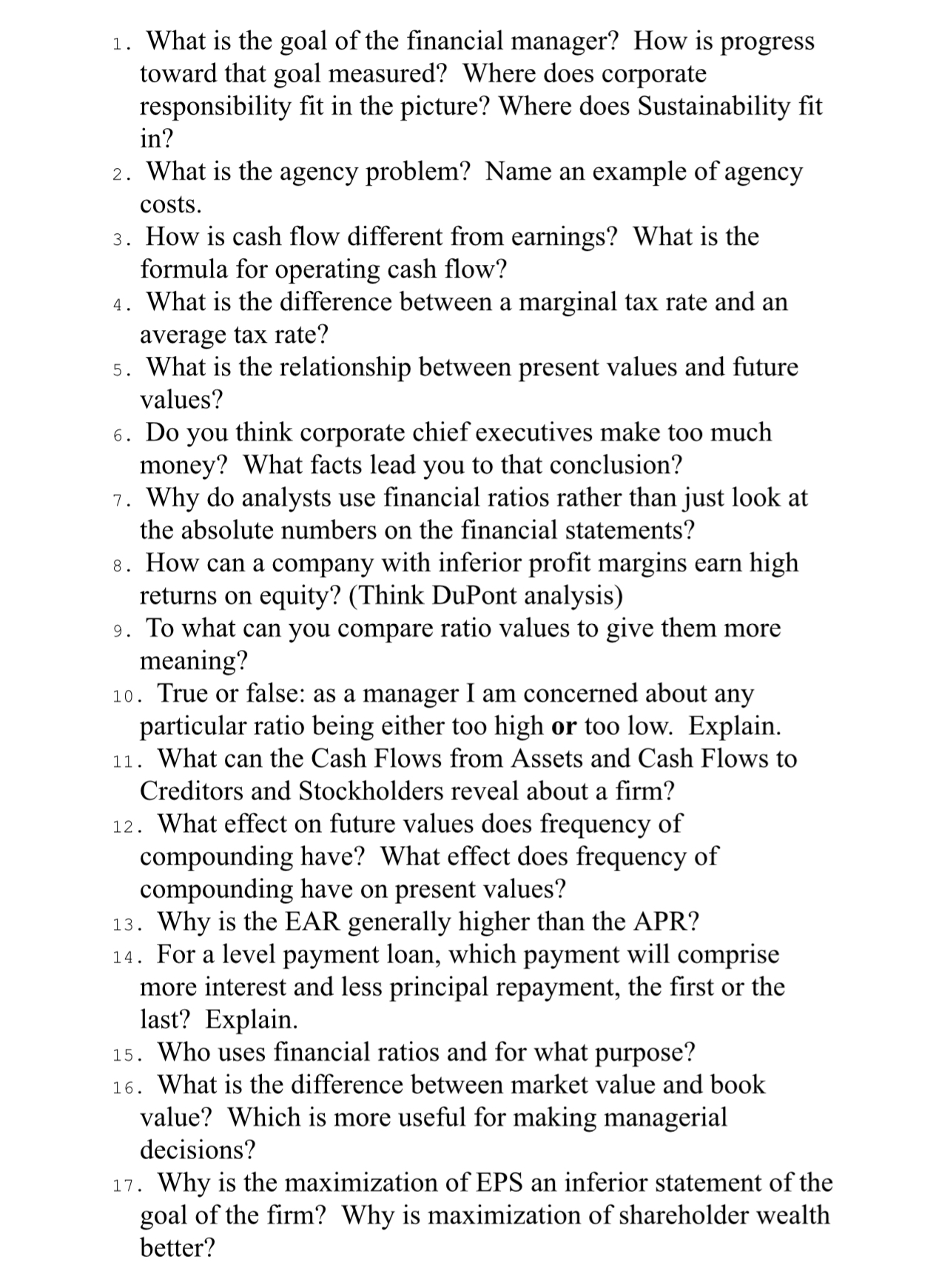

What is the goal of the financial manager? How is progress toward that goal measured? Where does corporate responsibility fit in the picture? Where does

What is the goal of the financial manager? How is progress

toward that goal measured? Where does corporate

responsibility fit in the picture? Where does Sustainability fit

in

What is the agency problem? Name an example of agency

costs.

How is cash flow different from earnings? What is the

formula for operating cash flow?

What is the difference between a marginal tax rate and an

average tax rate?

What is the relationship between present values and future

values?

Do you think corporate chief executives make too much

money? What facts lead you to that conclusion?

Why do analysts use financial ratios rather than just look at

the absolute numbers on the financial statements?

How can a company with inferior profit margins earn high

returns on equity? Think DuPont analysis

To what can you compare ratio values to give them more

meaning?

True or false: as a manager I am concerned about any

particular ratio being either too high or too low. Explain.

What can the Cash Flows from Assets and Cash Flows to

Creditors and Stockholders reveal about a firm?

What effect on future values does frequency of

compounding have? What effect does frequency of

compounding have on present values?

Why is the EAR generally higher than the APR?

For a level payment loan, which payment will comprise

more interest and less principal repayment, the first or the

last? Explain.

Who uses financial ratios and for what purpose?

What is the difference between market value and book

value? Which is more useful for making managerial

decisions?

Why is the maximization of EPS an inferior statement of the

goal of the firm? Why is maximization of shareholder wealth

better?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started