Answered step by step

Verified Expert Solution

Question

1 Approved Answer

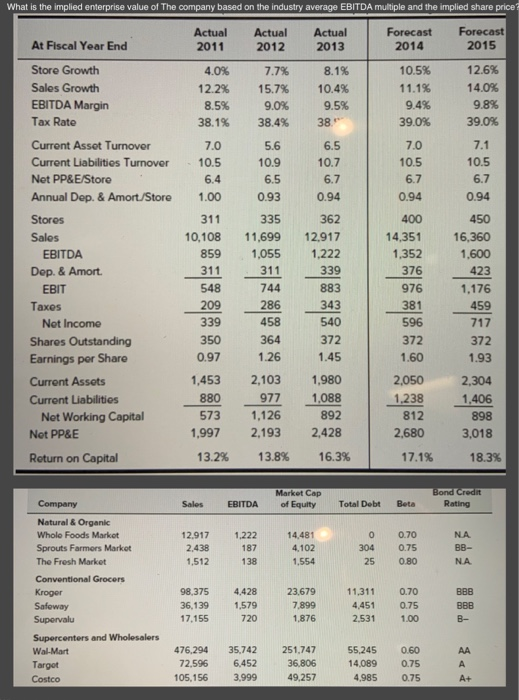

What is the implied enterprise value of The company based on the industry average EBITDA multiple and the implied share price? What is the implied

What is the implied enterprise value of The company based on the industry average EBITDA multiple and the implied share price?

What is the implied enterprise value of whole food based on the industry average EBITDA multiple and the implied share price?

1. what is the enterprise value of whole food?

What is the implied enterprise value of The company based on the industry average EBITDA multiple and the implied share price? Actual 2011 At Fiscal Year End Actual 2012 Actual 2013 Forecast 2014 Forecast 2015 40% 12.2% 8.5% 38.1% 7.7% 15.7% 9.0% 38.4% 8.1% 10.4% 9.5% 38. 10.5% 11.1% 9.4% 39.0% 12.6% 14.0% 9.8% 39.0% Store Growth Sales Growth EBITDA Margin Tax Rate Current Asset Turnover Current Liabilities Turnover Net PP&E/Store Annual Dep. & Amort/Store Stores 7.0 10.5 6.4 1.00 5.6 10.9 6.5 0.93 6.5 10.7 6.7 0.94 7.0 10.5 6.7 0.94 7.1 10.5 6.7 0.94 Sales EBITDA Dop. & Amort. EBIT Taxes Net Income Shares Outstanding Earnings per Share Current Assets Current Liabilities Net Working Capital Net PP&E Return on Capital 311 10,108 859 311 548 209 339 350 0.97 335 11,699 1,055 311 744 286 458 364 1.26 362 12.917 1,222 339 883 343 540 372 1.45 400 14,351 1,352 376 976 381 596 372 1.60 450 16,360 1,600 423 1,176 459 717 372 1.93 1,453 880 573 1.997 2,103 977 1,126 2,193 1,980 1.088 892 2,428 2,050 1,238 812 2.680 2,304 1,406 898 3.018 13.2% 13.8% 16.3% 17.1% 18.3% Sales Market Cap of Equity EBITDA Bond Credit Rating Total Debt Beta 12.917 2.438 1,512 1.222 187 138 14,481 4,102 1,554 0 304 25 0.70 0.75 0.80 NA BB- NA Company Natural & Organic Whole Foods Market Sprouts Farmers Market The Fresh Market Conventional Grocers Kroger Safeway Supervalu Supercenters and Wholesalers Wal-Mart Targot Costco 98,375 36,139 17.155 4,428 1,579 720 23,679 7,899 1.876 11,311 4,451 2.531 0.70 0.75 1.00 BBB BBB B- 476.294 72.596 105,156 35,742 6.452 3,999 251,747 36.806 49,257 55.245 14,089 0.60 0.75 0.75 AA A+ 4.985 What is the implied enterprise value of The company based on the industry average EBITDA multiple and the implied share price? Actual 2011 At Fiscal Year End Actual 2012 Actual 2013 Forecast 2014 Forecast 2015 40% 12.2% 8.5% 38.1% 7.7% 15.7% 9.0% 38.4% 8.1% 10.4% 9.5% 38. 10.5% 11.1% 9.4% 39.0% 12.6% 14.0% 9.8% 39.0% Store Growth Sales Growth EBITDA Margin Tax Rate Current Asset Turnover Current Liabilities Turnover Net PP&E/Store Annual Dep. & Amort/Store Stores 7.0 10.5 6.4 1.00 5.6 10.9 6.5 0.93 6.5 10.7 6.7 0.94 7.0 10.5 6.7 0.94 7.1 10.5 6.7 0.94 Sales EBITDA Dop. & Amort. EBIT Taxes Net Income Shares Outstanding Earnings per Share Current Assets Current Liabilities Net Working Capital Net PP&E Return on Capital 311 10,108 859 311 548 209 339 350 0.97 335 11,699 1,055 311 744 286 458 364 1.26 362 12.917 1,222 339 883 343 540 372 1.45 400 14,351 1,352 376 976 381 596 372 1.60 450 16,360 1,600 423 1,176 459 717 372 1.93 1,453 880 573 1.997 2,103 977 1,126 2,193 1,980 1.088 892 2,428 2,050 1,238 812 2.680 2,304 1,406 898 3.018 13.2% 13.8% 16.3% 17.1% 18.3% Sales Market Cap of Equity EBITDA Bond Credit Rating Total Debt Beta 12.917 2.438 1,512 1.222 187 138 14,481 4,102 1,554 0 304 25 0.70 0.75 0.80 NA BB- NA Company Natural & Organic Whole Foods Market Sprouts Farmers Market The Fresh Market Conventional Grocers Kroger Safeway Supervalu Supercenters and Wholesalers Wal-Mart Targot Costco 98,375 36,139 17.155 4,428 1,579 720 23,679 7,899 1.876 11,311 4,451 2.531 0.70 0.75 1.00 BBB BBB B- 476.294 72.596 105,156 35,742 6.452 3,999 251,747 36.806 49,257 55.245 14,089 0.60 0.75 0.75 AA A+ 4.985 2. what is the enterprise value EBITDA nultiple of whole food?

3. Estimate the share price of whole food?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started