Question

What is the information ratio of TOM using the Barclay Index as the benchmark? Annualized Return Annualized Volatility Max Drawdown Max Drawdown (Volatility- Annual Sharpe

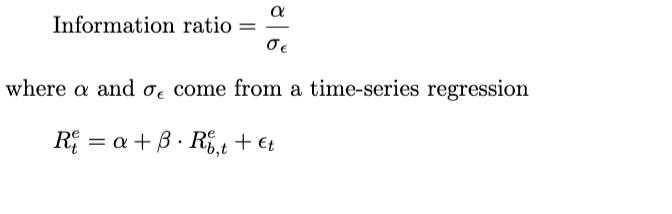

What is the information ratio of TOM using the Barclay Index as the benchmark?

![begin{tabular}{lrrr} & Al (Net of Fees) & Parker Index (Excess Returns) ( ^{[1]} ) & Barclay Index (Excess Returns) ( [1](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/12/6391c9f1c78b0_1670498801739.png)

Annualized Return Annualized Volatility Max Drawdown Max Drawdown (Volatility- Annual Sharpe Ratio Regression statistics[]; Alpha t-stat Beta t-stat R-Square Al (Net of Fees) 1.23% 4.83% -5.44% -5.44% 0.25 Parker Index (Excess Returns)[] -1.58% 6.09% -12.24% -9.75% -0.26 0.0017 1.14 0.5186 5.99 0.4279 Barclay Index (Excess Returns) [1] -1.29% 3.62% -10.90% -14.34% -0.36 0.0021 1.54 0.9697 7.32 0.5273

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The information ratio IR is a measurement of portfolio returns beyond the returns of a benchmark usu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown, Sanford J. Leeds

11th Edition

1305262999, 1305262997, 035726164X, 978-1305262997

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App