What is the IRR for debt option 1?

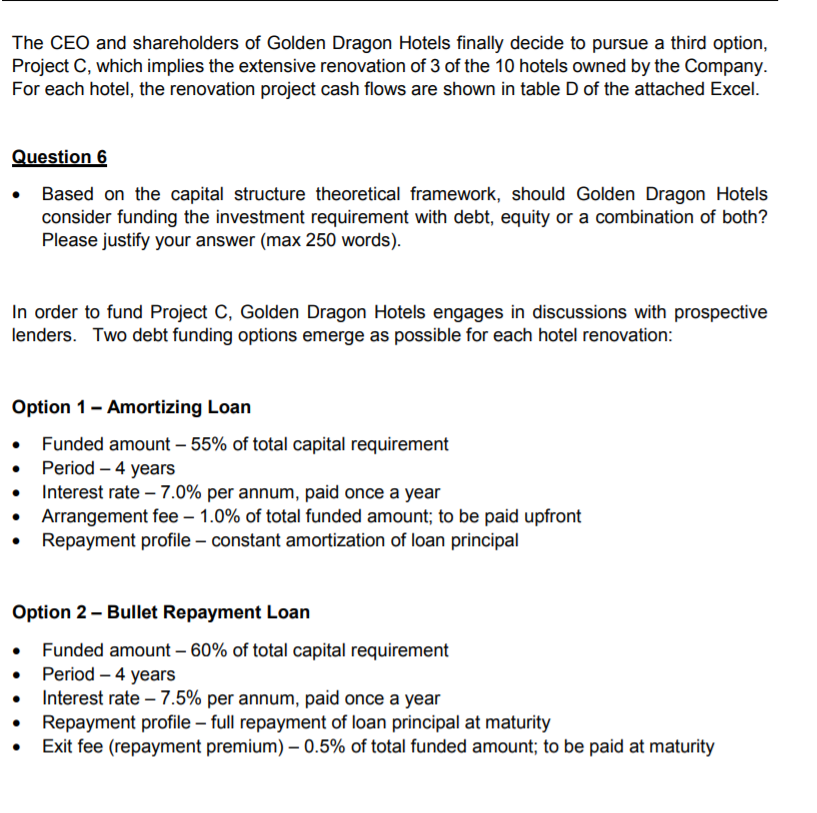

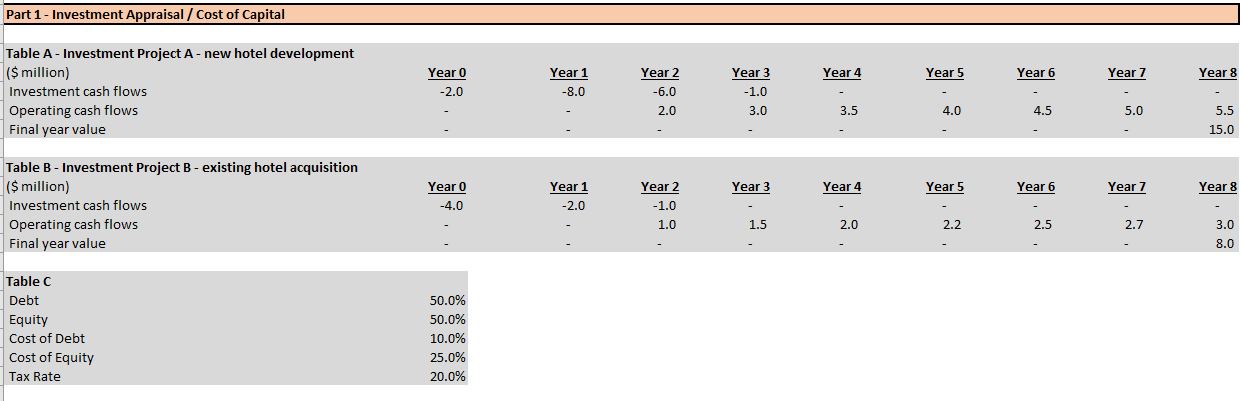

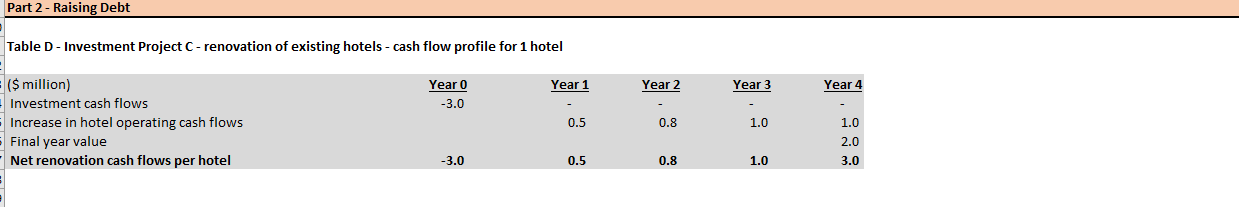

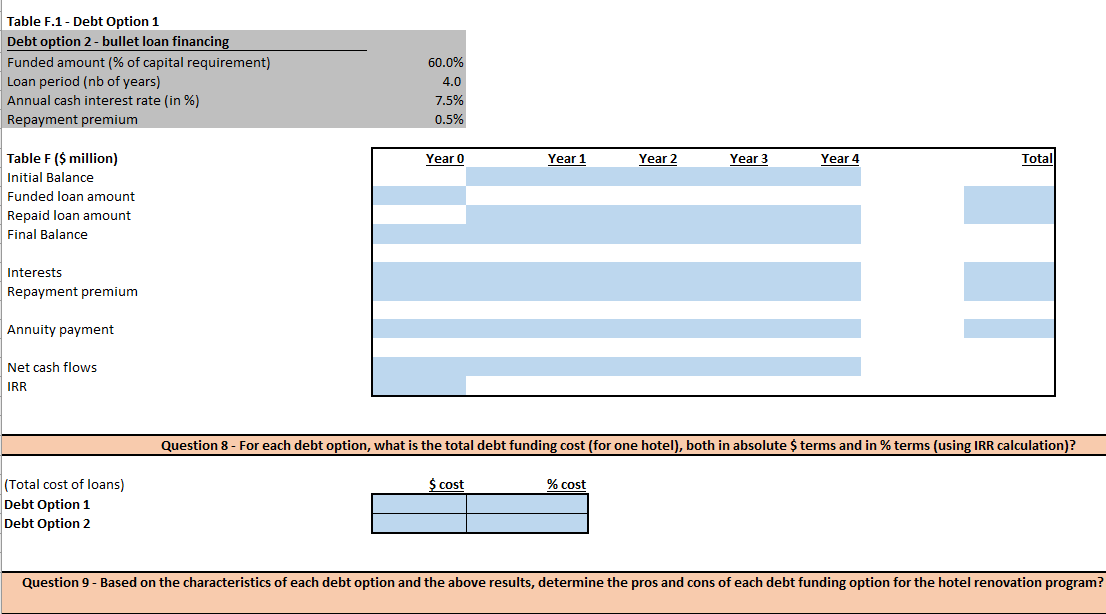

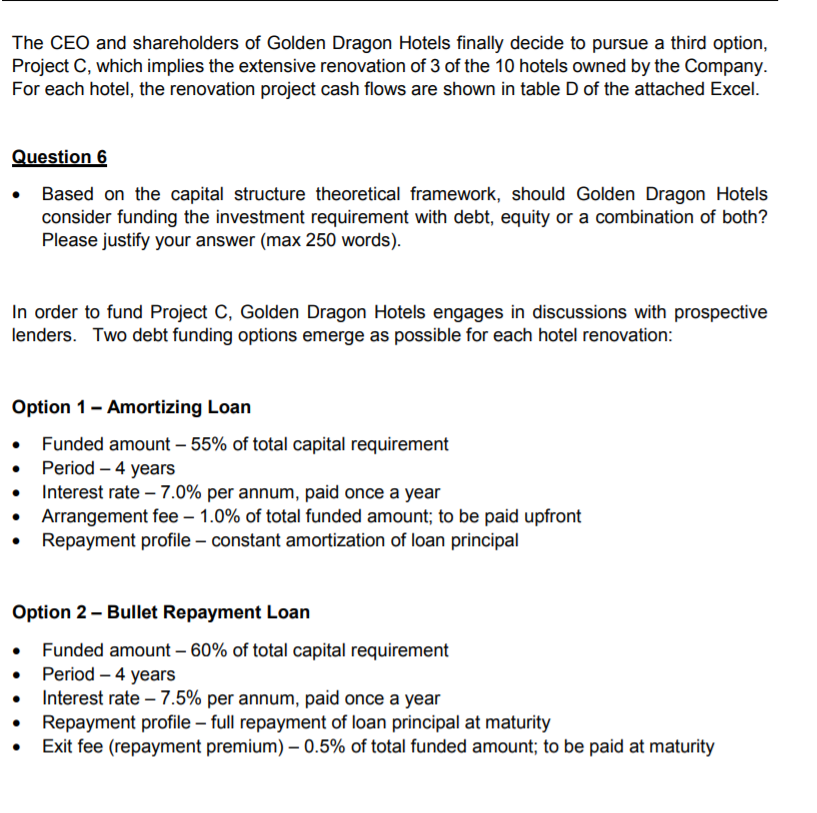

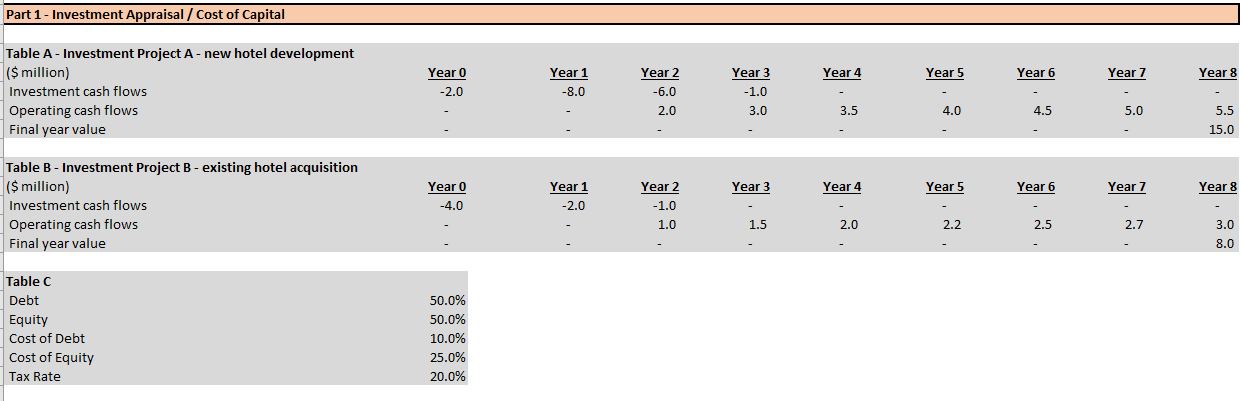

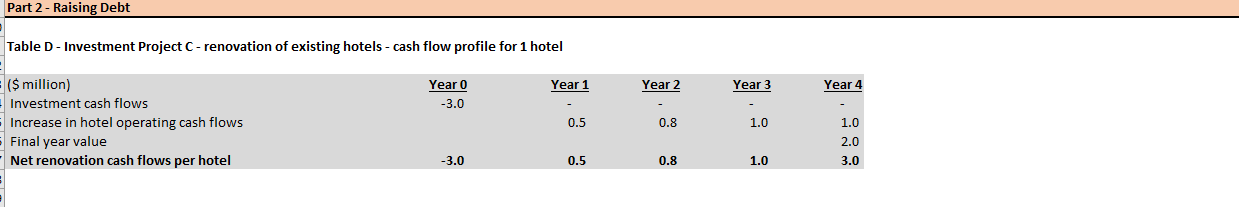

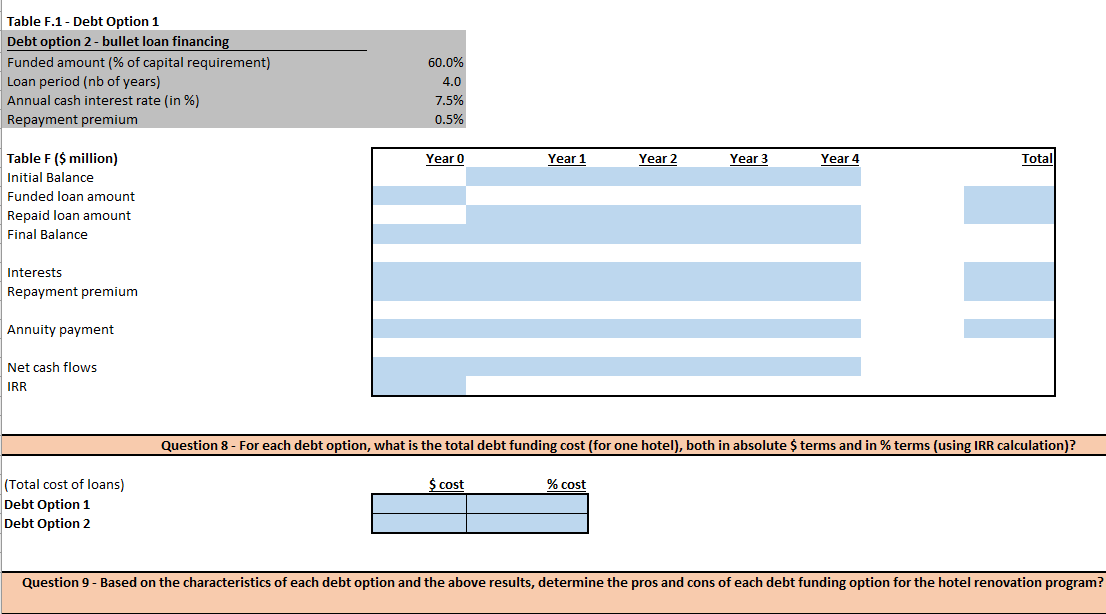

The CEO and shareholders of Golden Dragon Hotels finally decide to pursue a third option, Project C, which implies the extensive renovation of 3 of the 10 hotels owned by the Company. For each hotel, the renovation project cash flows are shown in table D of the attached Excel. Question 6 Based on the capital structure theoretical framework, should Golden Dragon Hotels consider funding the investment requirement with debt, equity or a combination of both? Please justify your answer (max 250 words). In order to fund Project C, Golden Dragon Hotels engages in discussions with prospective lenders. Two debt funding options emerge as possible for each hotel renovation: Option 1 - Amortizing Loan Funded amount -55% of total capital requirement Period -4 years Interest rate - 7.0% per annum, paid once a year Arrangement fee - 1.0% of total funded amount; to be paid upfront Repayment profile - constant amortization of loan principal Option 2 - Bullet Repayment Loan Funded amount -60% of total capital requirement Period - 4 years Interest rate - 7.5% per annum, paid once a year Repayment profile - full repayment of loan principal at maturity Exit fee (repayment premium) - 0.5% of total funded amount; to be paid at maturity Part 1 - Investment Appraisal / Cost of Capital Year 4 Year 5 Year 6 Year 7 Year 8 Table A - Investment Project A-new hotel development ($ million) Investment cash flows Operating cash flows Final year value Year 1 -8.0 Year 2 -6.0 2.0 Year 3 -1.0 3.0 3.5 4.0 4.5 5.0 5.5 15.0 Year 3 Year 4 Year 5 Year 6 Year 0 -4.0 Table B - Investment Project B-existing hotel acquisition ($ million) Investment cash flows Operating cash flows Final year value Year 3 Yearo Year 7 Year 1 -2.0 Yeara Years Year 8 Year? Years Year 2 -1.0 1.0 Year6 Year? Year 8 - 1.5 2.0 2.2 2.5 27 3.0 8.0 Table C Debt Equity Cost of Debt Cost of Equity Tax Rate 50.0% 50.0% 10.0% 25.0% 20.0% Part 2 - Raising Debt Table D - Investment Project C-renovation of existing hotels - cash flow profile for 1 hotel Year o Year 1 Year 2 Year 3 Year 0 -3.0 Year 4 = ($ million) - Investment cash flows - Increase in hotel operating cash flows Final year value -Net renovation cash flows per hotel Year 1 0.5 0.5 Year 2 0.8 0.8 0.8 Year 3 1.0 1.0 1.0 Year 4 1.0 3:0 -3.0 -3.0 0.5 0.8 Table F.1 - Debt Option 1 Debt option 2 - bullet loan financing Funded amount (% of capital requirement) Loan period (nb of years) Annual cash interest rate (in %) Repayment premium 60.0% 4.0 7.5% 0.5% Year o Year 1 Year 2 Year 3 Year 4 Total Table F($ million) Initial Balance Funded loan amount Repaid loan amount Final Balance Interests Repayment premium Annuity payment Net cash flows IRR Question 8 - For each debt option, what is the total debt funding cost (for one hotel), both in absolute $ terms and in % terms (using IRR calculation)? $ cost % cost (Total cost of loans) Debt Option 1 Debt Option 2 Question 9 - Based on the characteristics of each debt option and the above results, determine the pros and cons of each debt funding option for the hotel renovation program? The CEO and shareholders of Golden Dragon Hotels finally decide to pursue a third option, Project C, which implies the extensive renovation of 3 of the 10 hotels owned by the Company. For each hotel, the renovation project cash flows are shown in table D of the attached Excel. Question 6 Based on the capital structure theoretical framework, should Golden Dragon Hotels consider funding the investment requirement with debt, equity or a combination of both? Please justify your answer (max 250 words). In order to fund Project C, Golden Dragon Hotels engages in discussions with prospective lenders. Two debt funding options emerge as possible for each hotel renovation: Option 1 - Amortizing Loan Funded amount -55% of total capital requirement Period -4 years Interest rate - 7.0% per annum, paid once a year Arrangement fee - 1.0% of total funded amount; to be paid upfront Repayment profile - constant amortization of loan principal Option 2 - Bullet Repayment Loan Funded amount -60% of total capital requirement Period - 4 years Interest rate - 7.5% per annum, paid once a year Repayment profile - full repayment of loan principal at maturity Exit fee (repayment premium) - 0.5% of total funded amount; to be paid at maturity Part 1 - Investment Appraisal / Cost of Capital Year 4 Year 5 Year 6 Year 7 Year 8 Table A - Investment Project A-new hotel development ($ million) Investment cash flows Operating cash flows Final year value Year 1 -8.0 Year 2 -6.0 2.0 Year 3 -1.0 3.0 3.5 4.0 4.5 5.0 5.5 15.0 Year 3 Year 4 Year 5 Year 6 Year 0 -4.0 Table B - Investment Project B-existing hotel acquisition ($ million) Investment cash flows Operating cash flows Final year value Year 3 Yearo Year 7 Year 1 -2.0 Yeara Years Year 8 Year? Years Year 2 -1.0 1.0 Year6 Year? Year 8 - 1.5 2.0 2.2 2.5 27 3.0 8.0 Table C Debt Equity Cost of Debt Cost of Equity Tax Rate 50.0% 50.0% 10.0% 25.0% 20.0% Part 2 - Raising Debt Table D - Investment Project C-renovation of existing hotels - cash flow profile for 1 hotel Year o Year 1 Year 2 Year 3 Year 0 -3.0 Year 4 = ($ million) - Investment cash flows - Increase in hotel operating cash flows Final year value -Net renovation cash flows per hotel Year 1 0.5 0.5 Year 2 0.8 0.8 0.8 Year 3 1.0 1.0 1.0 Year 4 1.0 3:0 -3.0 -3.0 0.5 0.8 Table F.1 - Debt Option 1 Debt option 2 - bullet loan financing Funded amount (% of capital requirement) Loan period (nb of years) Annual cash interest rate (in %) Repayment premium 60.0% 4.0 7.5% 0.5% Year o Year 1 Year 2 Year 3 Year 4 Total Table F($ million) Initial Balance Funded loan amount Repaid loan amount Final Balance Interests Repayment premium Annuity payment Net cash flows IRR Question 8 - For each debt option, what is the total debt funding cost (for one hotel), both in absolute $ terms and in % terms (using IRR calculation)? $ cost % cost (Total cost of loans) Debt Option 1 Debt Option 2 Question 9 - Based on the characteristics of each debt option and the above results, determine the pros and cons of each debt funding option for the hotel renovation program