Answered step by step

Verified Expert Solution

Question

1 Approved Answer

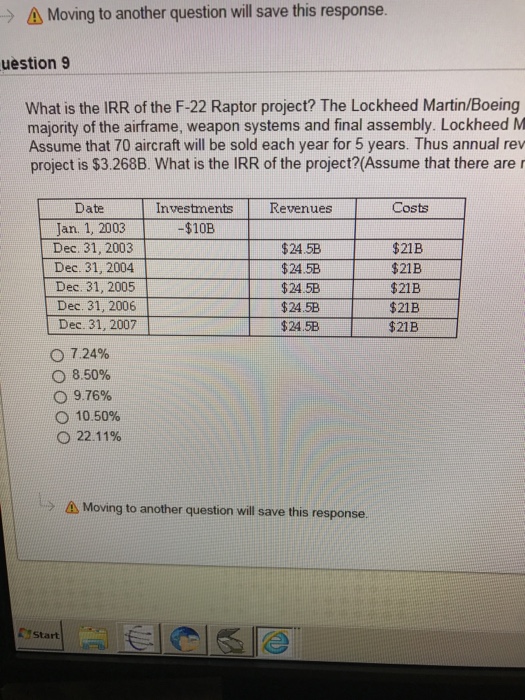

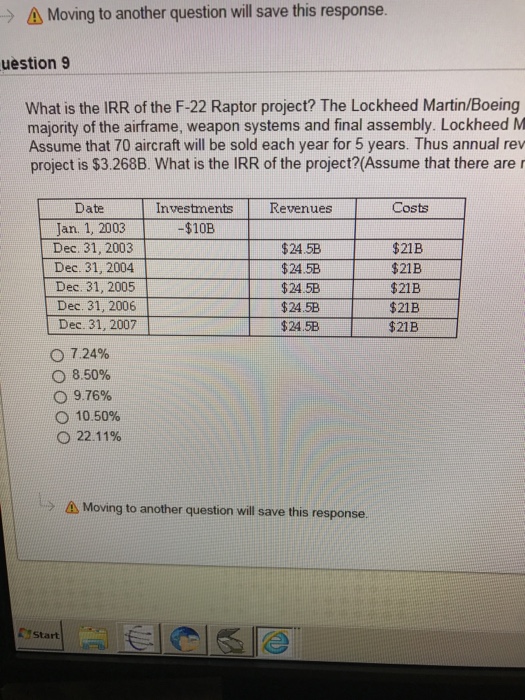

What is the IRR of the F-22 Raptor project? The Lockheed Martin/Boeing F-22 Raptor is a stealth fighter aircraft. It was designed primarily as an

What is the IRR of the F-22 Raptor project? The Lockheed Martin/Boeing F-22 Raptor is a stealth fighter aircraft. It was designed primarily as an air superiority fighter, but it is also capable of ground attacks and other roles. Lockheed Martin Aeronautics is the prime contractor and is responsive for the majority of the airframe, weapon systems and final assembly. Lockheed Martin invested over $10B on design and manufacturing for the aircraft. Assume that those investments were paid for on Jan. 1, 2003. Each aircraft will be sold for $350M and the variable code of building each airplane is $300M. Assume that 70 aircraft will be sold each year for 5 years. Thus annual revenues are $24.5B and annual costs are $21B. Assume that revenues and costs occur at year-end with the first year of operating cash flows occurring on Dec 31, 2003. Lockheed-Martin's cost of capital is 10% and the NPV of the project is $3.286B. What is the IRR of the project? (Assume that there are no taxes.)

-) Moving to another question will save this response. uestion 9 What is the IRR of the F-22 Raptor project? The Lockheed Martin/Boeing majority of the airframe, weapon systems and final assembly. Lockheed MM Assume that 70 aircraft will be sold each year for 5 years. Thus annual rev project is $3.268B. What is the IRR of the project?(Assume that there are r Investments Costs Date Jan. 1, 2003 Dec. 31, 2003 Dec. 31, 2004 Dec. 31, 2005 Dec. 31, 2006 Dec. 31, 2007 Revenues -$10B $24.5B $24.5B $24.5B $24.5B $24.5B $21B $21B $21B $21B $21B O 7.24% O 8.50% 9.76% O 10.50% O 22.1196 > Moving to another question will save this response. 1 start

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started