Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the journal entry to record the Depreciation for the year 2020? What is the journal entry to record the payment of Dividends for

What is the journal entry to record the Depreciation for the year 2020?

What is the journal entry to record the payment of Dividends for the year 2020?

What is the journal entry to record the payment on Notes Payable?

What are the journal entries to record the sale of Inventory to customers during 2020?

What is the journal entry to record the wages paid during 2020?

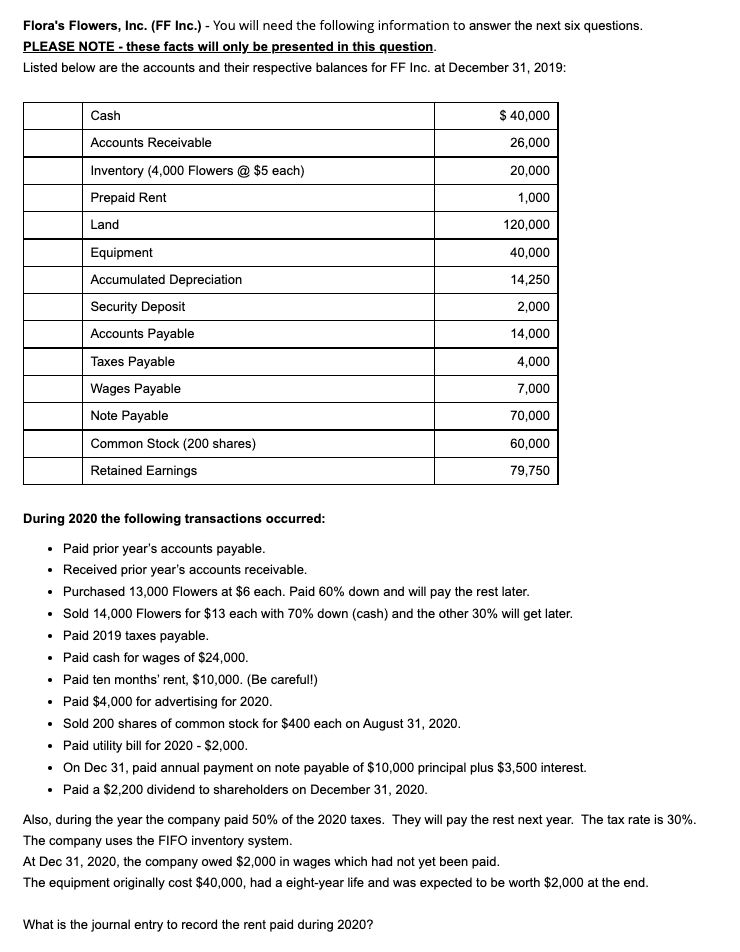

Flora's Flowers, Inc. (FF Inc.) - You will need the following information to answer the next six questions. PLEASE NOTE - these facts will only be presented in this question. Listed below are the accounts and their respective balances for FF Inc. at December 31, 2019: Cash Accounts Receivable Inventory (4,000 Flowers @ $5 each) Prepaid Rent Land Equipment Accumulated Depreciation Security Deposit Accounts Payable Taxes Payable Wages Payable Note Payable Common Stock (200 shares) Retained Earnings Paid cash for wages of $24,000. Paid ten months' rent, $10,000. (Be careful!) $ 40,000 26,000 20,000 1,000 120,000 40,000 14,250 2,000 14,000 4,000 7,000 70,000 During 2020 the following transactions occurred: Paid prior year's accounts payable. Received prior year's accounts receivable. Purchased 13,000 Flowers at $6 each. Paid 60% down and will pay the rest later. Sold 14,000 Flowers for $13 each with 70% down (cash) and the other 30% will get later. Paid 2019 taxes payable. 60,000 79,750 Paid $4,000 for advertising for 2020. Sold 200 shares of common stock for $400 each on August 31, 2020. Paid utility bill for 2020 - $2,000. On Dec 31, paid annual payment on note payable of $10,000 principal plus $3,500 interest. Paid a $2,200 dividend to shareholders on December 31, 2020. What is the journal entry to record the rent paid during 2020? Also, during the year the company paid 50% of the 2020 taxes. They will pay the rest next year. The tax rate is 30%. The company uses the FIFO inventory system. At Dec 31, 2020, the company owed $2,000 in wages which had not yet been paid. The equipment originally cost $40,000, had a eight-year life and was expected to be worth $2,000 at the end

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started