Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the loss on factoring should AAA report for 2019? What is the mount proceeds from discounting the note on June 30,2019? What amount

What is the loss on factoring should AAA report for 2019?

What is the mount proceeds from discounting the note on June 30,2019?

What amount should be recognized as interest expense related to the note discounting?

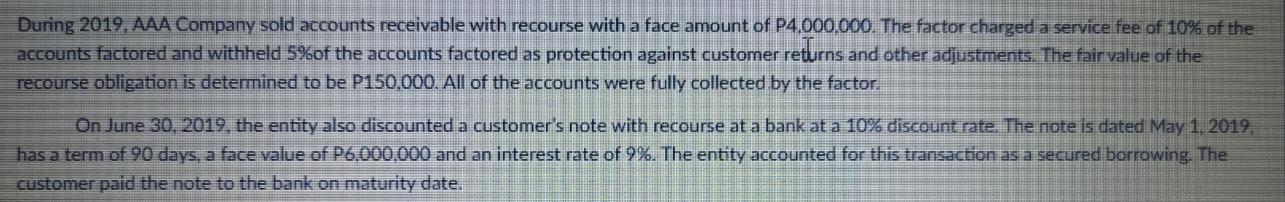

During 2019, AAA Company sold accounts receivable with recourse with a face amount of P4,000,000. The factor charged a service fee of 10% of the accounts factored and withheld 5% of the accounts factored as protection against customer returns and other adjustments. The fair value of the recourse obligation is determined to be P150,000. All of the accounts were fully collected by the factor. On June 30, 2019, the entity also discounted a customer's note with recourse at a bank at a 10% discount rate. The note is dated May 1, 2019. has a term of 90 days, a face value of P6,000,000 and an interest rate of 9%. The entity accounted for this transaction as a secured borrowing. The customer paid the note to the bank on maturity date.

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

i To compute the loss on factoring we need to calculate the total cost of factoring which is the sum ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started