Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the maximum return a perfect trader would get if they took long and short positions? (enter the amount without %) that is the

What is the maximum return a perfect trader would get if they took long and short positions? (enter the amount without %)

What is the maximum return a perfect trader would get if they took long and short positions? (enter the amount without %)

that is the full problem, what additinal information do you need?

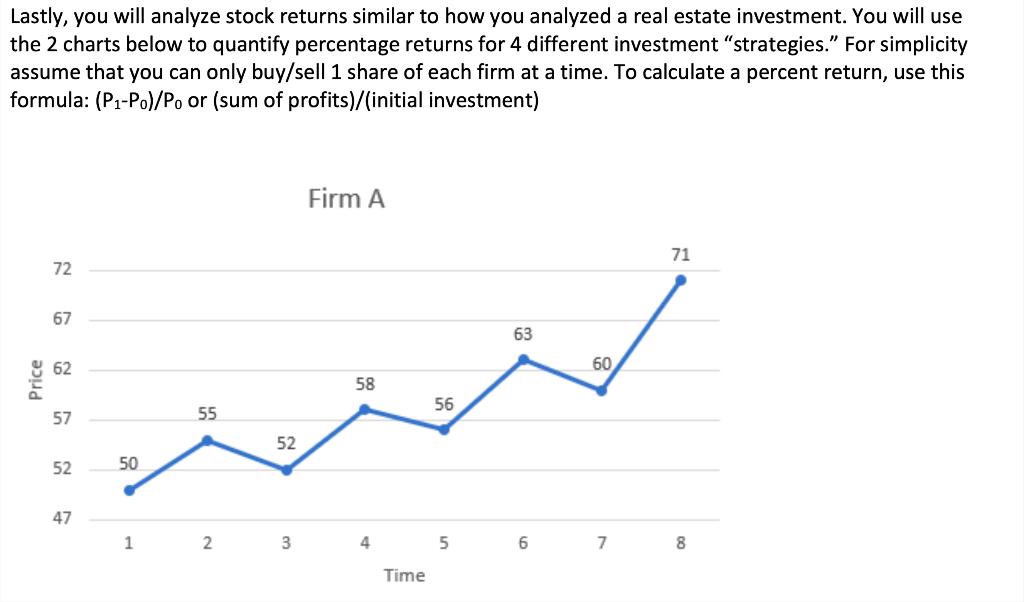

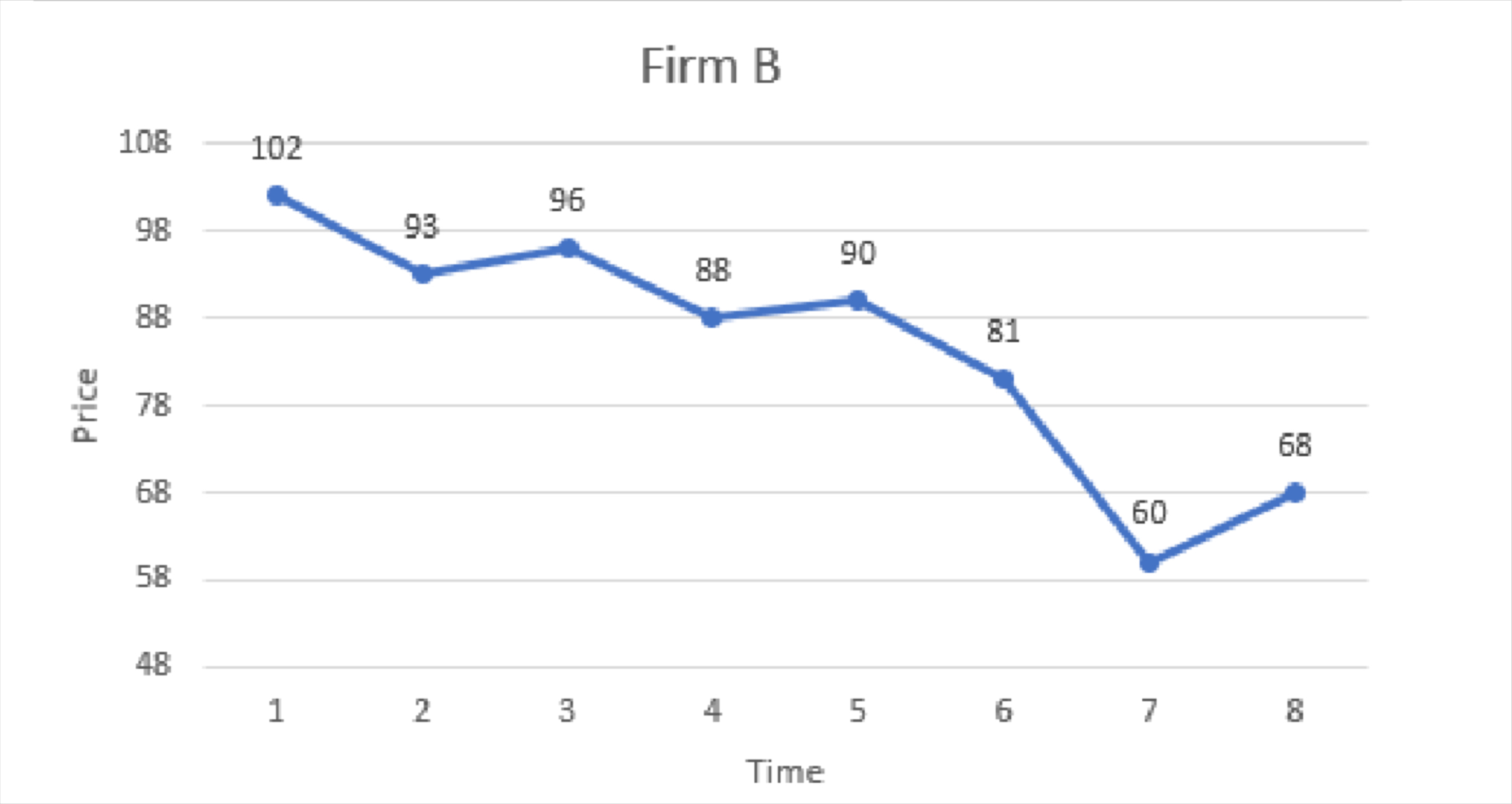

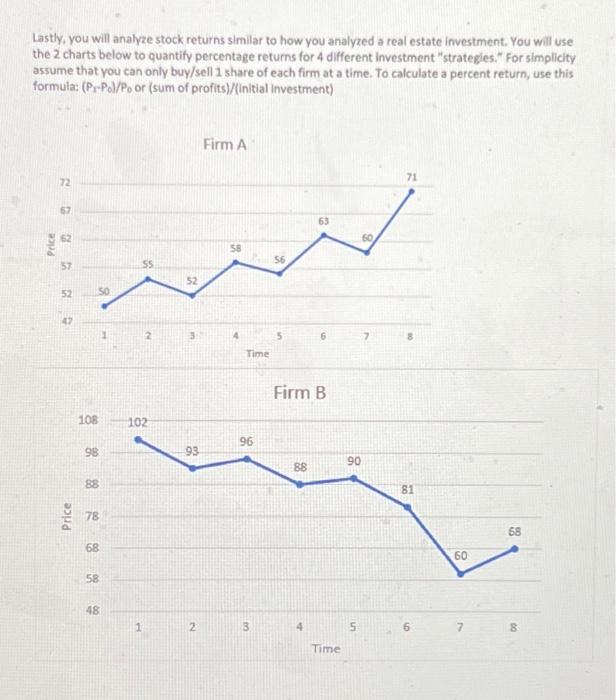

Lastly, you will analyze stock returns similar to how you analyzed a real estate investment. You will use the 2 charts below to quantify percentage returns for 4 different investment "strategies." For simplicity assume that you can only buy/sell 1 share of each firm at a time. To calculate a percent return, use this formula: (P1P0)/P0 or (sum of profits)/(initial investment) Firm B 48 1 2 3 4 6 7 8 Time Lastly, you will analyze stock returns similar to how you analyzed a real estate investment. You will use the 2 charts below to quantify percentage returns for 4 different investment "strategies." For simplicity assume that you can only buy/sell 1 share of each firm at a time. To calculate a percent return, use this formula: ( PrP0)/P0 or (sum of profits)/(initial investment) Firm B Lastly, you will analyze stock returns similar to how you analyzed a real estate investment. You will use the 2 charts below to quantify percentage returns for 4 different investment "strategies." For simplicity assume that you can only buy/sell 1 share of each firm at a time. To calculate a percent return, use this formula: (P1P0)/P0 or (sum of profits)/(initial investment) Firm B 48 1 2 3 4 6 7 8 Time Lastly, you will analyze stock returns similar to how you analyzed a real estate investment. You will use the 2 charts below to quantify percentage returns for 4 different investment "strategies." For simplicity assume that you can only buy/sell 1 share of each firm at a time. To calculate a percent return, use this formula: ( PrP0)/P0 or (sum of profits)/(initial investment) Firm B Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started