Answered step by step

Verified Expert Solution

Question

1 Approved Answer

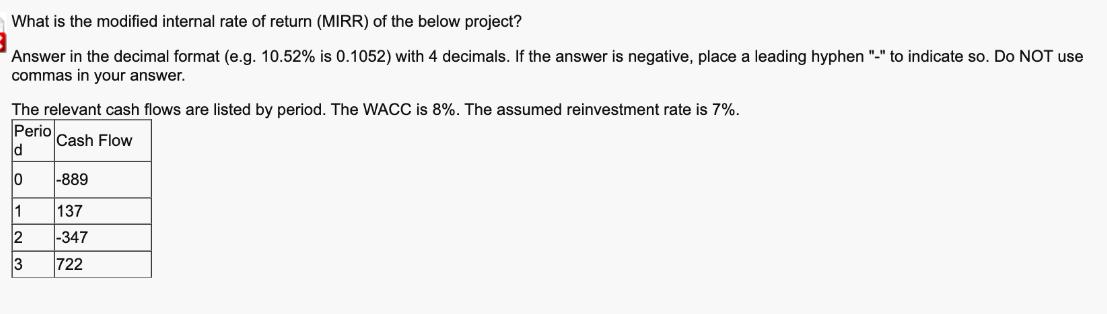

What is the modified internal rate of return (MIRR) of the below project? Answer in the decimal format (e.g. 10.52% is 0.1052) with 4

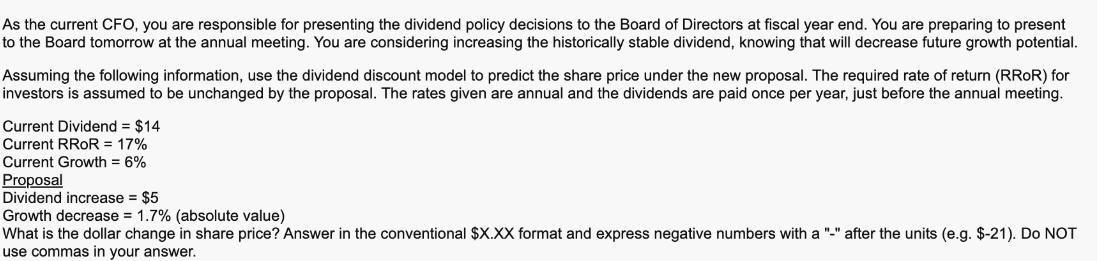

What is the modified internal rate of return (MIRR) of the below project? Answer in the decimal format (e.g. 10.52% is 0.1052) with 4 decimals. If the answer is negative, place a leading hyphen "-" to indicate so. Do NOT use commas in your answer. The relevant cash flows are listed by period. The WACC is 8%. The assumed reinvestment rate is 7%. Perio Cash Flow d 0 1 2 3 -889 137 -347 722 As the current CFO, you are responsible for presenting the dividend policy decisions to the Board of Directors at fiscal year end. You are preparing to present to the Board tomorrow at the annual meeting. You are considering increasing the historically stable dividend, knowing that will decrease future growth potential. Assuming the following information, use the dividend discount model to predict the share price under the new proposal. The required rate of return (RROR) for investors is assumed to be unchanged by the proposal. The rates given are annual and the dividends are paid once per year, just before the annual meeting. Current Dividend = $14 Current RROR = 17% Current Growth = 6% Proposal Dividend increase = $5 Growth decrease = 1.7% (absolute value) What is the dollar change in share price? Answer in the conventional $X.XX format and express negative numbers with a "-" after the units (e.g. $-21). Do NOT use commas in your answer.

Step by Step Solution

★★★★★

3.30 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer Therefore the Modified Interna...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started