Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the Net Income? You own a small consulting firm. In 2006 you purchased a small office for $700,000 for your own use in

What is the Net Income?

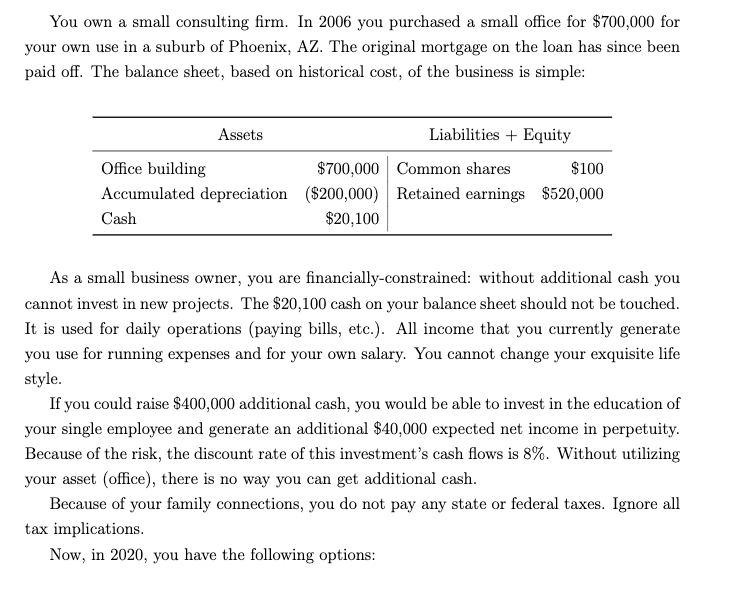

You own a small consulting firm. In 2006 you purchased a small office for $700,000 for your own use in a suburb of Phoenix, AZ. The original mortgage on the loan has since been paid off. The balance sheet, based on historical cost, of the business is simple: Assets Liabilities + Equity Office building $700,000 Common shares $100 Accumulated depreciation ($200,000) Retained earnings $520,000 Cash $20,100 As a small business owner, you are financially-constrained: without additional cash you cannot invest in new projects. The $20,100 cash on your balance sheet should not be touched. It is used for daily operations (paying bills, etc.). All income that you currently generate you use for running expenses and for your own salary. You cannot change your exquisite life style. If you could raise $400,000 additional cash, you would be able to invest in the education of your single employee and generate an additional $40,000 expected net income in perpetuity. Because of the risk, the discount rate of this investment's cash flows is 8%. Without utilizing your asset (office), there is no way you can get additional cash. Because of your family connections, you do not pay any state or federal taxes. Ignore all tax implications. Now, in 2020, you have the following options: You own a small consulting firm. In 2006 you purchased a small office for $700,000 for your own use in a suburb of Phoenix, AZ. The original mortgage on the loan has since been paid off. The balance sheet, based on historical cost, of the business is simple: Assets Liabilities + Equity Office building $700,000 Common shares $100 Accumulated depreciation ($200,000) Retained earnings $520,000 Cash $20,100 As a small business owner, you are financially-constrained: without additional cash you cannot invest in new projects. The $20,100 cash on your balance sheet should not be touched. It is used for daily operations (paying bills, etc.). All income that you currently generate you use for running expenses and for your own salary. You cannot change your exquisite life style. If you could raise $400,000 additional cash, you would be able to invest in the education of your single employee and generate an additional $40,000 expected net income in perpetuity. Because of the risk, the discount rate of this investment's cash flows is 8%. Without utilizing your asset (office), there is no way you can get additional cash. Because of your family connections, you do not pay any state or federal taxes. Ignore all tax implications. Now, in 2020, you have the following optionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started