Answered step by step

Verified Expert Solution

Question

1 Approved Answer

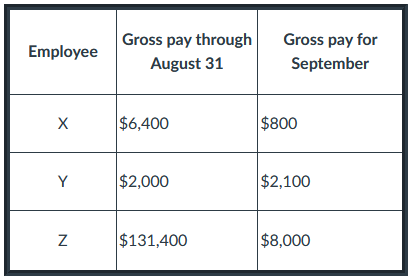

What is the net payroll tax expenses the company will record in September for the wages of employee Y ? (rounded to nearest dollar) Gross

What is the net payroll tax expenses the company will record in September for the wages of employee Y? (rounded to nearest dollar)

Gross pay through Gross pay for Employee August 31 September X $6,400 $800 Y $2,000 $2,100 N $131,400 $8,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations to determine the net payroll tax expenses for Employee Ys September wages Information provided Employee Ys gross pay through August 31 2000 Employee Ys gross pay for September 2100 Calculations 1 Determine total yeartodate gross pay for Employee Y ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d7ba0ec8b3_966423.pdf

180 KBs PDF File

663d7ba0ec8b3_966423.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started