Answered step by step

Verified Expert Solution

Question

1 Approved Answer

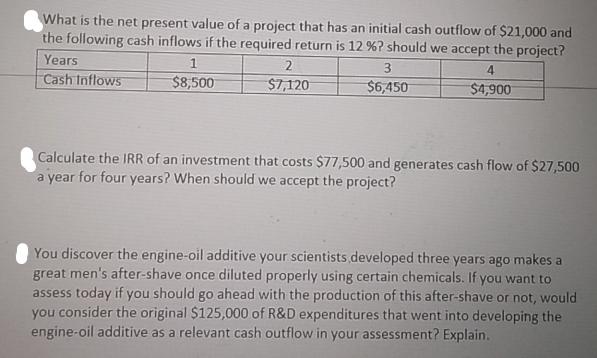

What is the net present value of a project that has an initial cash outflow of $21,000 and the following cash inflows if the

What is the net present value of a project that has an initial cash outflow of $21,000 and the following cash inflows if the required return is 12 %? should we accept the project? Years Cash Inflows 1 $8,500 2 $7,120 3 $6,450 4 $4,900 Calculate the IRR of an investment that costs $77,500 and generates cash flow of $27,500 a year for four years? When should we accept the project? You discover the engine-oil additive your scientists developed three years ago makes a great men's after-shave once diluted properly using certain chemicals. If you want to assess today if you should go ahead with the production of this after-shave or not, would you consider the original $125,000 of R&D expenditures that went into developing the engine-oil additive as a relevant cash outflow in your assessment? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Net Present Value for the first project NPV 21000 850010121 712010122 645010123 490010124 NPV 21000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started