Answered step by step

Verified Expert Solution

Question

1 Approved Answer

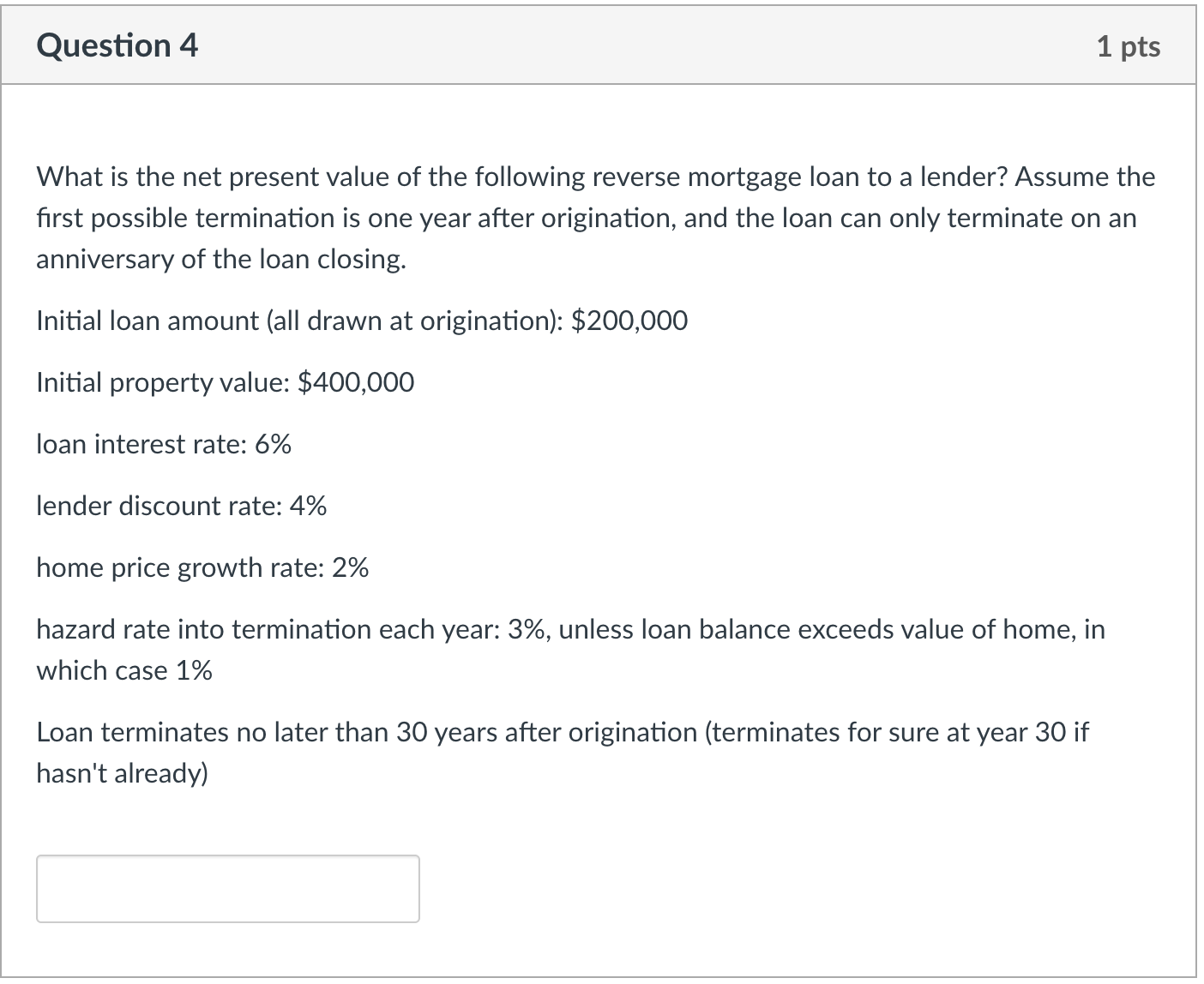

What is the net present value of the following reverse mortgage loan to a lender? Assume the first possible termination is one year after origination,

What is the net present value of the following reverse mortgage loan to a lender? Assume the first possible termination is one year after origination, and the loan can only terminate on an anniversary of the loan closing. Question

What is the net present value of the following reverse mortgage loan to a lender? Assume the

first possible termination is one year after origination, and the loan can only terminate on an

anniversary of the loan closing.

Initial loan amount all drawn at origination: $

Initial property value: $

loan interest rate:

lender discount rate:

home price growth rate:

hazard rate into termination each year: unless loan balance exceeds value of home, in

which case

Loan terminates no later than years after origination terminates for sure at year if

hasn't already Question

What is the net present value of the following reverse mortgage loan to a lender? Assume the

first possible termination is one year after origination, and the loan can only terminate on an

anniversary of the loan closing.

Initial loan amount all drawn at origination: $

Initial property value: $

loan interest rate:

lender discount rate:

home price growth rate:

hazard rate into termination each year: unless loan balance exceeds value of home, in

which case

Loan terminates no later than years after origination terminates for sure at year if

hasn't already

Initial loan amount all drawn at origination: $

Initial property value: $

loan interest rate:

lender discount rate:

home price growth rate:

hazard rate into termination each year: unless loan balance exceeds value of home, in which case

A Loan terminates no later than years after origination terminates for sure at year if hasn't already

BLoan terminates no later than years after origination terminates for sure at year if hasn't already

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started