Answered step by step

Verified Expert Solution

Question

1 Approved Answer

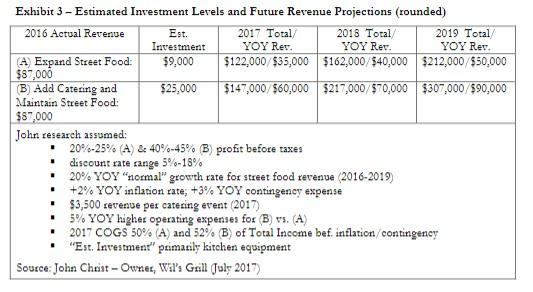

What is the NPV of project A and project B? (you can use your own cash flow and discount rate (5-18%)). Exhibit 3 - Estimated

What is the NPV of project A and project B? (you can use your own cash flow and discount rate (5-18%)).

Exhibit 3 - Estimated Investment Levels and Future Revenue Projections (rounded) 2016 Actual Revenue Est. 2017 Total 2018 Total 2019 Total Investment YOY Rev. YOY Rev. YOY Rev. (A) Expand Street Food: $9,000 $122,000/$35,000 $162,000/540,000 $212,000/$50,000 $87,000 (B) Add Catering and $25,000 $147,000/$60,000 $217,000/$70,000 $307,000 $90,000 Maintain Street Food: $87,000 John research assumed: 20%-25% (A) &: 40%-45% B) profit before taxes discount rate range 5%-18% 20% YOY"normal" growth rate for street food revenue (2016-2019) +2% YOY inflation rate; +3% YOY contingency expense $3,500 revenue per catering event (2017) 5% YOY higher operating expenses for B) vs. (A) . 2017 COGS 50% (A) and 52% (B) of Total Income bef inflation contingency "Est. Investment" primarily kitchen equipment Source: John Christ - Owner, Wa's Guill (July 2017)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started