Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the NPV of the project for Trestor? Part A and B please Trestor, Inc. has the opportunity to engage in a 5-year marketing

What is the NPV of the project for Trestor?

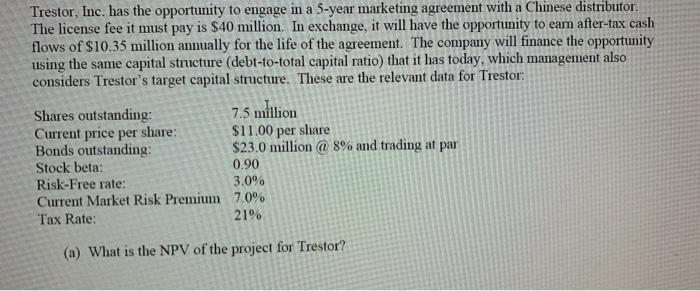

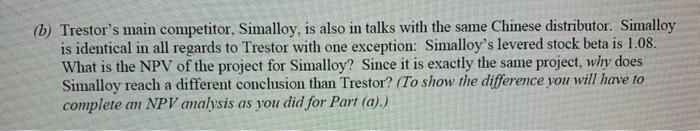

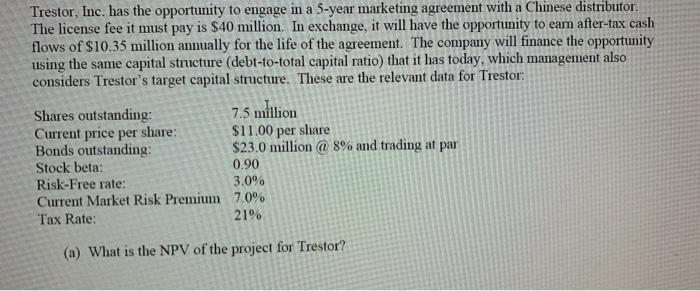

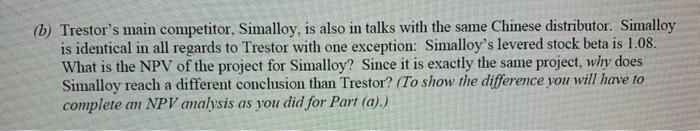

Trestor, Inc. has the opportunity to engage in a 5-year marketing agreement with a Chinese distributor The license fee it must pay is $40 million. In exchange, it will have the opportunity to earn after-tax cash flows of $10.35 million annually for the life of the agreement. The company will finance the opportunity using the same capital structure (debt-to-total capital ratio) that it has today, which management also considers Trestor's target capital structure. These are the relevant data for Trestor: Shares outstanding: 7.5 million Current price per share: $11.00 per share Bonds outstanding: $23.0 million @ 8% and trading at par Stock beta: 0.90 Risk-Free rate: 3.0% Current Market Risk Premium 7.0% Tax Rate: 21% (a) What is the NPV of the project for Trestor? (b) Trestor's main competitor. Simalloy, is also in talks with the same Chinese distributor. Simalloy is identical in all regards to Trestor with one exception: Simalloy's levered stock beta is 1.08. What is the NPV of the project for Simalloy? Since it is exactly the same project, why does Simalloy reach a different conclusion than Trestor? (To show the difference you will have to complete an NPV analysis as you did for Part (a).) Part A and B please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started