Answered step by step

Verified Expert Solution

Question

1 Approved Answer

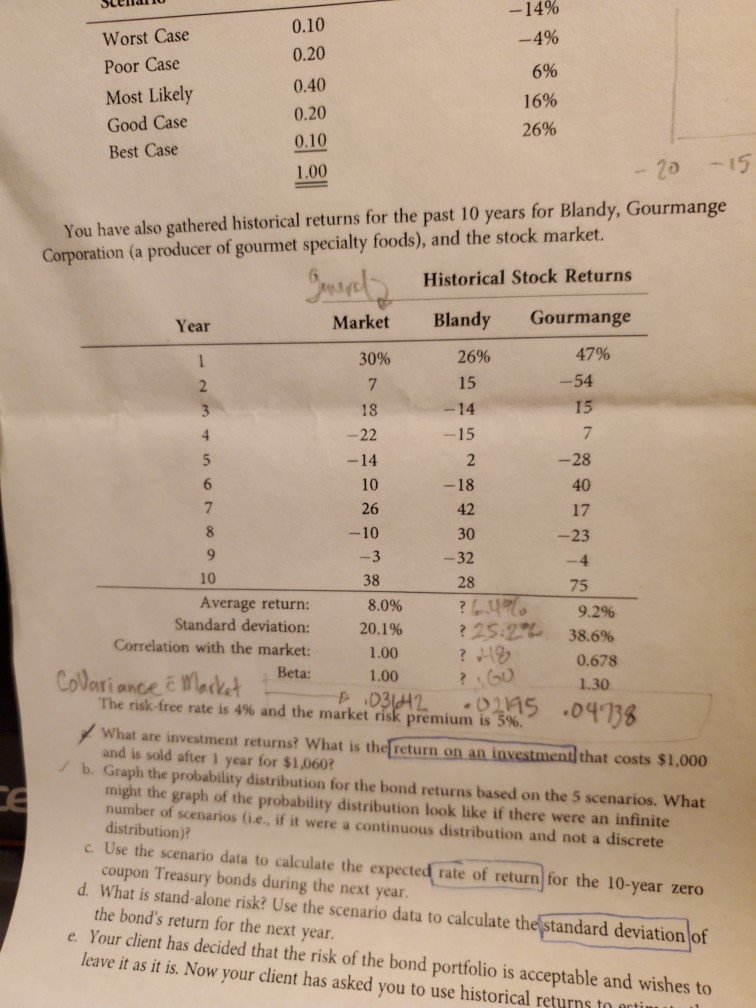

What is the portfolio's Beta and the required rate of return investing 1.4 million in Blandy and .6 million in Gourmange -14 % 0.10 -4%

What is the portfolio's Beta and the required rate of return

investing 1.4 million in Blandy and .6 million in Gourmange

-14 % 0.10 -4% Worst Case 0.20 Poor Case 6% 0.40 Most Likely 16% 0.20 Good Case 26% 0.10 Best Case -15 1.00 You have also gathered historical returns for the past 10 years for Blandy, Gourmange Corporation (a producer of gourmet specialty foods), and the stock market Sprecely Historical Stock Returns Gourmange Blandy Market Year 47% 26% 30% -54 15 7 2 15 -14 18 3 7 - 22 15 4 -14 -28 5 2 6 10 -18 40 7 26 42 17 - 10 30 -23 -3 32 -4 10 38 28 75 Average return: Standard deviation: Correlation with the market: ?ulo ? 25 2 ? 19 8.0% 9.2% 20.1% 38.6% 1.00 0.678 CoVariance E arket Beta: 1.00 1.30 03lH2 The risk-free rate is 4% and the market risk premium is 5%. .04738 What are investment returns? What is thereturn on an investment that costs $1,000 and is sold after 1 year for $1,060? b. Graph the probability distribution for the bond returns based on the 5 scenarios. What might the graph of the probability distribution look like if there were an infinite number of scenarios (i.e., if it were a continuous distribution and not a discrete distribution)? c.Use the scenario data to calculate the expected rate coupon Treasury bonds during the next year. d. What is stand-alone risk? Use the scenario data to calculate the standard deviation of the bond's return for the next year. e. Your client has decided that the risk of the bond portfolio is acceptable and wishes to leave it as it is. Now your client has asked you to use historical returns to octint e return for the 10-year zero TR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started