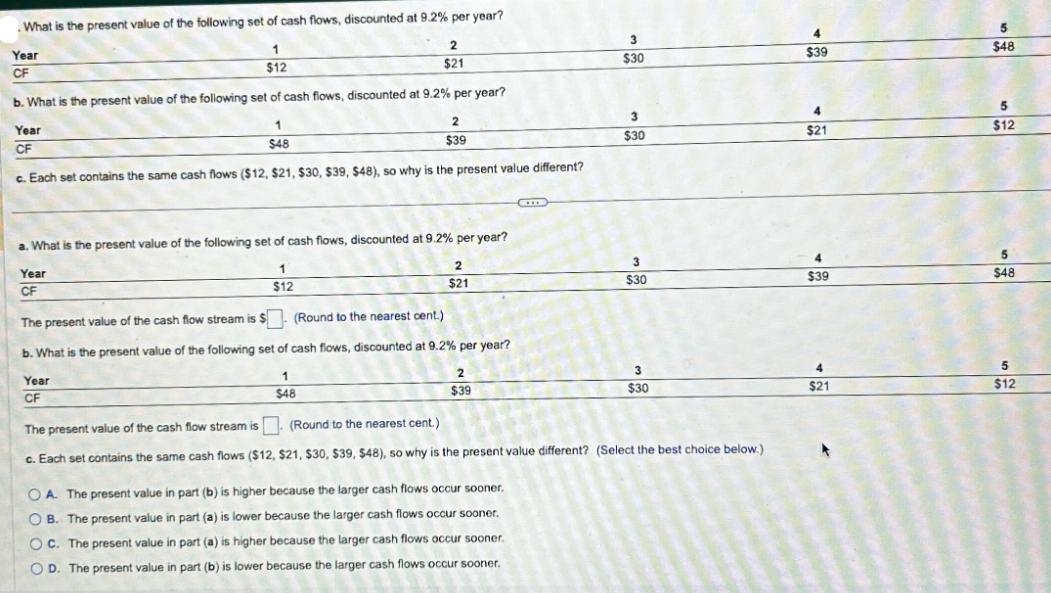

What is the present value of the following set of cash flows, discounted at 9.2% per year? Year CF 1 $12 b. What is

What is the present value of the following set of cash flows, discounted at 9.2% per year? Year CF 1 $12 b. What is the present value of the following set of cash flows, discounted at 9.2% per year? Year 1 $48 2 $39 CF c. Each set contains the same cash flows ($12, $21, $30, $39, $48), so why is the present value different? 2 $21 a. What is the present value of the following set of cash flows, discounted at 9.2% per year? 1 $12 2 $21 Year CF The present value of the cash flow stream is $. (Round to the nearest cent.) b. What is the present value of the following set of cash flows, discounted at 9.2% per year? Year CF 1 $48 2 $39 CIB OA. The present value in part (b) is higher because the larger cash flows occur sooner. OB. The present value in part (a) is lower because the larger cash flows occur sooner. OC. The present value in part (a) is higher because the larger cash flows occur sooner. OD. The present value in part (b) is lower because the larger cash flows occur sooner. 3 $30 3 $30 3 $30 3 $30 (Round to the nearest cent.) The present value of the cash flow stream is c. Each set contains the same cash flows ($12, $21, $30, $39, $48), so why is the present value different? (Select the best choice below.) $39 $21 4 $39 4 $21 + 5 $48 5 $12 5 $48 5 $12

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the present value of the cash flows in the first set discounted at 92 per year we can ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started