Question

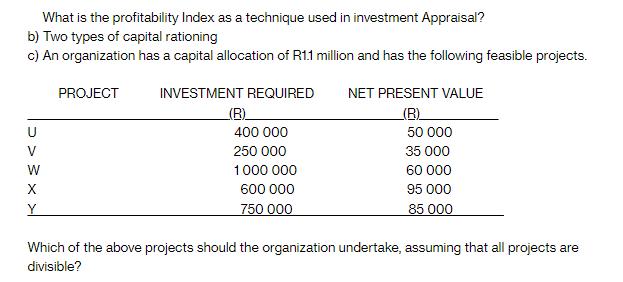

What is the profitability Index as a technique used in investment Appraisal? b) Two types of capital rationing c) An organization has a capital

What is the profitability Index as a technique used in investment Appraisal? b) Two types of capital rationing c) An organization has a capital allocation of R1.1 million and has the following feasible projects. INVESTMENT REQUIRED W X Y PROJECT __(R)__ 400 000 250 000 1 000 000 600 000 750 000 NET PRESENT VALUE (B) 50 000 35.000 60 000 95 000 85 000 Which of the above projects should the organization undertake, assuming that all projects are divisible?

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a The profitability index also known as the profit investment ratio PIR or the benefitcost ratio BCR is a technique used in investment appraisal to ev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App