Answered step by step

Verified Expert Solution

Question

1 Approved Answer

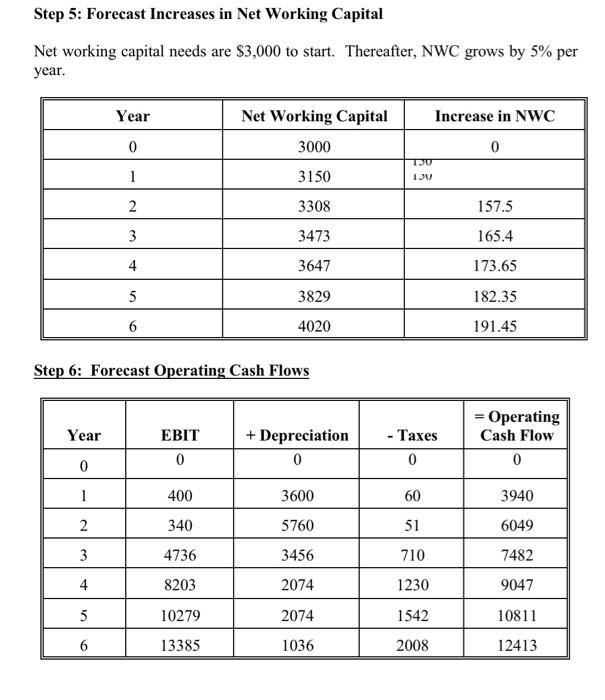

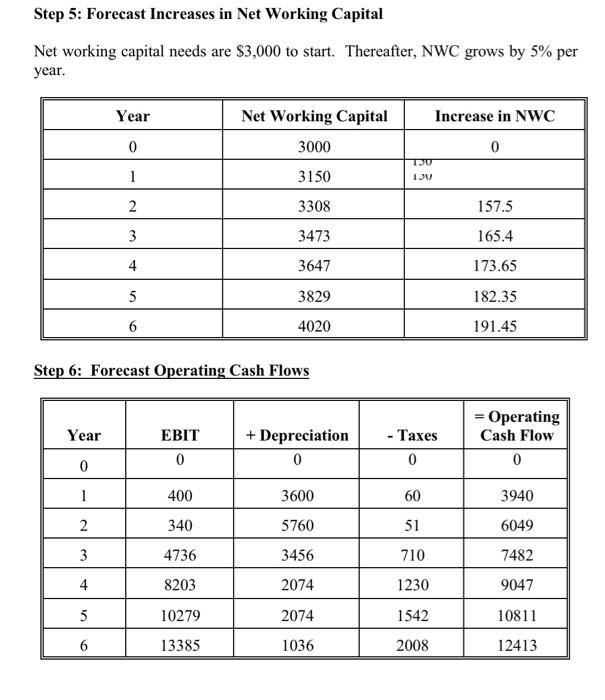

what is the projected terminal value? Step 5: Forecast Increases in Net Working Capital Net working capital needs are $3,000 to start. Thereafter, NWC grows

what is the projected terminal value?

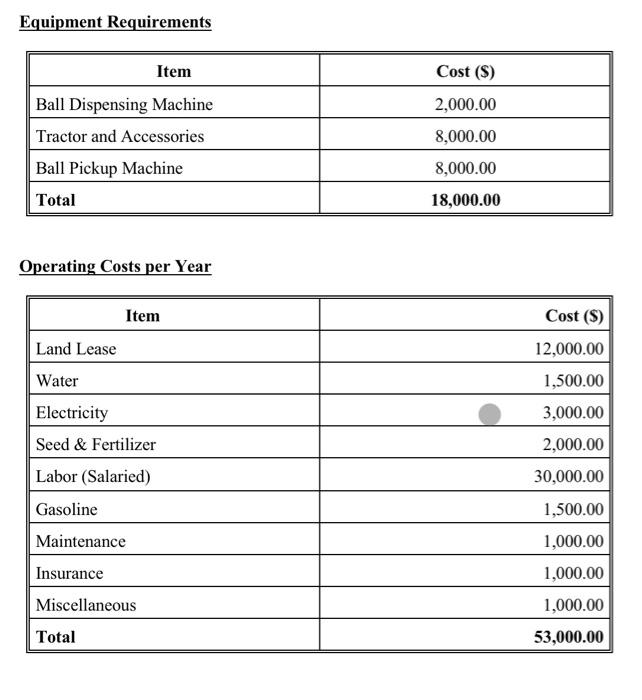

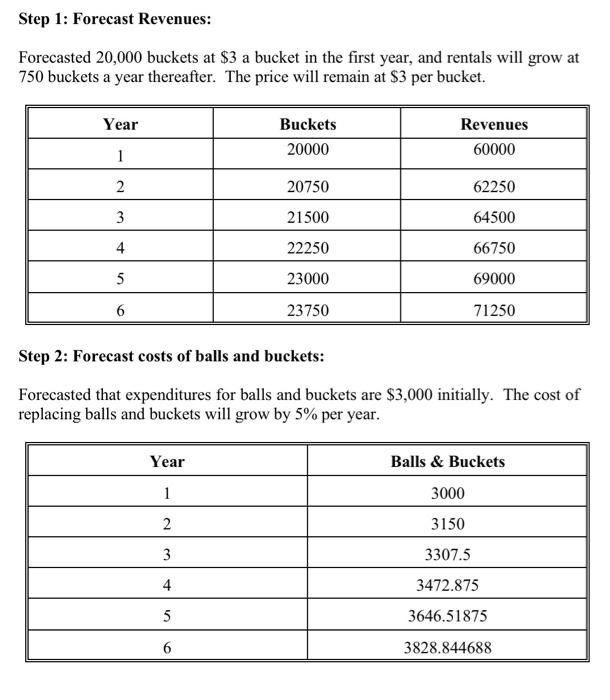

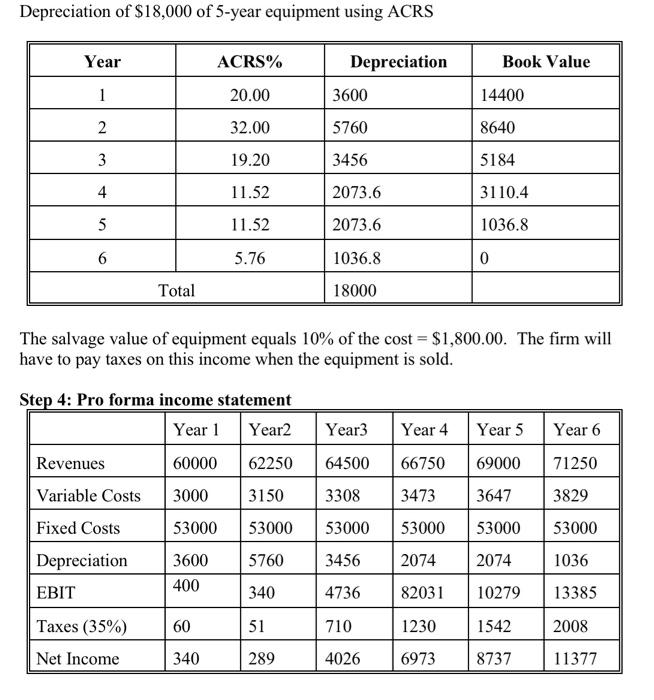

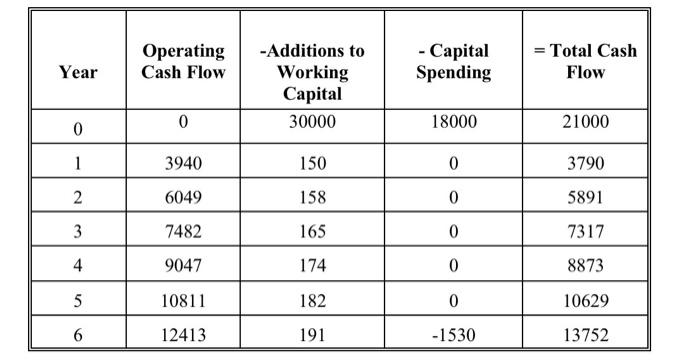

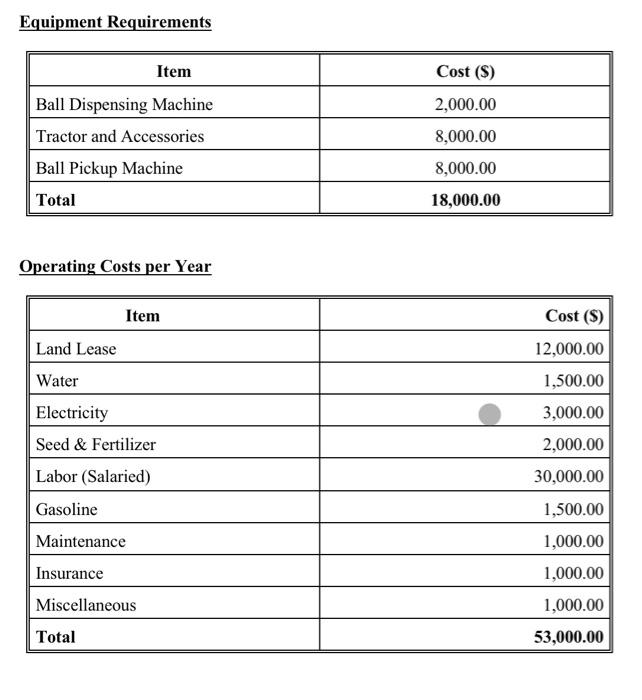

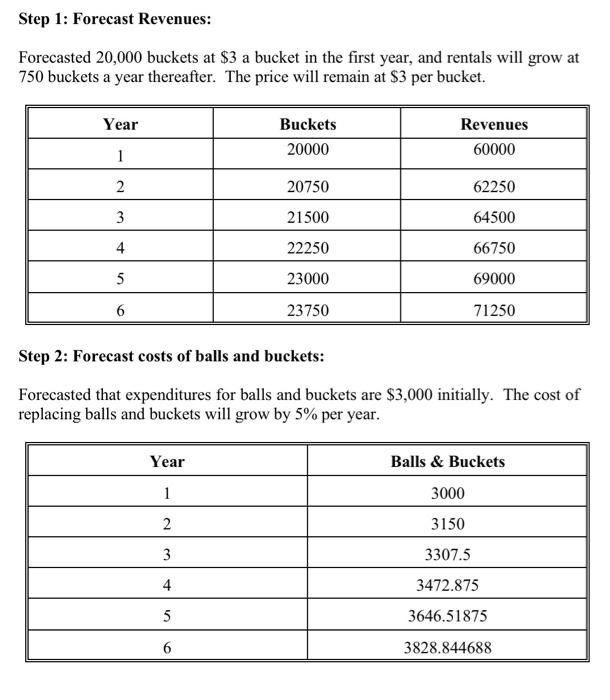

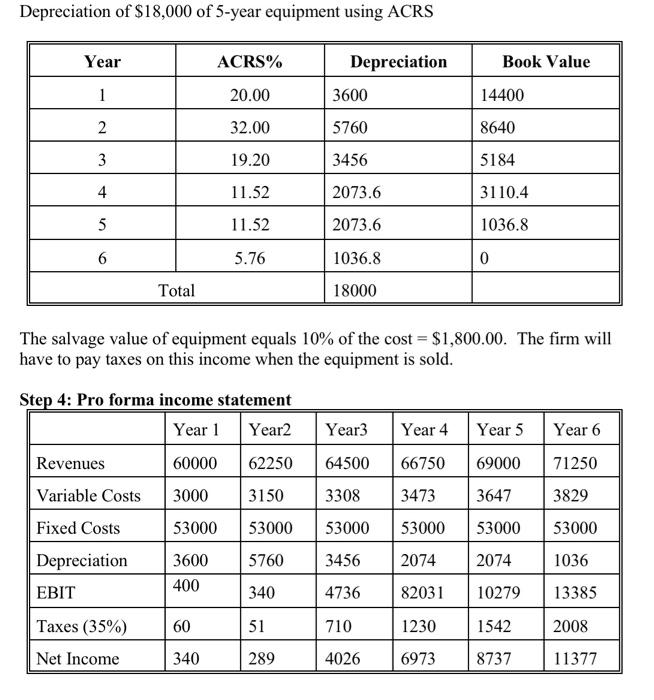

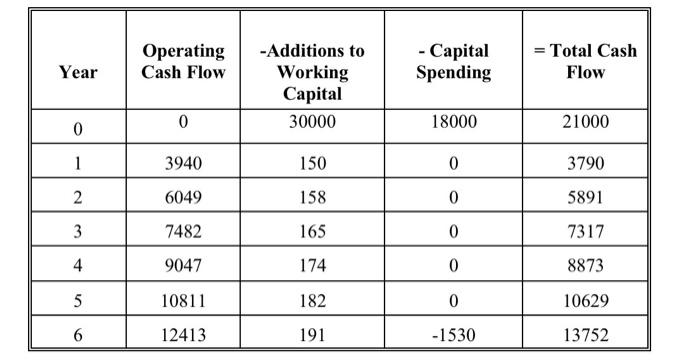

Step 5: Forecast Increases in Net Working Capital Net working capital needs are $3,000 to start. Thereafter, NWC grows by 5% per year. Step 6: Forecast Operating Cash Flows \begin{tabular}{||c|c|c|c|c||} \hline \hline Year & OperatingCashFlow & -AdditionstoWorkingCapital & -CapitalSpending & =TotalCashFlow \\ \hline 0 & 0 & 30000 & 18000 & 21000 \\ \hline 1 & 3940 & 150 & 0 & 3790 \\ \hline 2 & 6049 & 158 & 0 & 5891 \\ \hline 3 & 7482 & 165 & 0 & 7317 \\ \hline 4 & 9047 & 174 & 0 & 8873 \\ \hline 5 & 10811 & 182 & 0 & 10629 \\ \hline 6 & 12413 & 191 & -1530 & 13752 \\ \hline \hline \end{tabular} Equipment Requirements \begin{tabular}{||l|c|} \hline \multicolumn{1}{|c|}{ Item } & Cost (\$) \\ \hline Ball Dispensing Machine & 2,000.00 \\ \hline Tractor and Accessories & 8,000.00 \\ \hline Ball Pickup Machine & 8,000.00 \\ \hline Total & 18,000.00 \\ \hline \end{tabular} Operating Costs per Year \begin{tabular}{|l|r|} \hline \multicolumn{1}{|r|}{ Item } & Cost ($) \\ \hline Land Lease & 12,000.00 \\ \hline Water & 1,500.00 \\ \hline Electricity & 3,000.00 \\ \hline Seed \& Fertilizer & 2,000.00 \\ \hline Labor (Salaried) & 30,000.00 \\ \hline Gasoline & 1,500.00 \\ \hline Maintenance & 1,000.00 \\ \hline Insurance & 1,000.00 \\ \hline Miscellaneous & 1,000.00 \\ \hline Total & 53,000.00 \\ \hline \hline \end{tabular} Depreciation of $18,000 of 5 -year equipment using ACRS The salvage value of equipment equals 10% of the cost =$1,800.00. The firm will have to pay taxes on this income when the equipment is sold. Step 4: Pro forma income statement Step 1: Forecast Revenues: Forecasted 20,000 buckets at $3 a bucket in the first year, and rentals will grow at 750 buckets a year thereafter. The price will remain at $3 per bucket. Step 2: Forecast costs of balls and buckets: Forecasted that expenditures for balls and buckets are $3,000 initially. The cost of replacing balls and buckets will grow by 5% per year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started