Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the purpose of bid-ask spreads in the interbank spot market? Why are bid-ask spreads in the forward market larger than in the spot

What is the purpose of bid-ask spreads in the interbank spot market? Why are bid-ask spreads in the forward market larger than in the spot market?

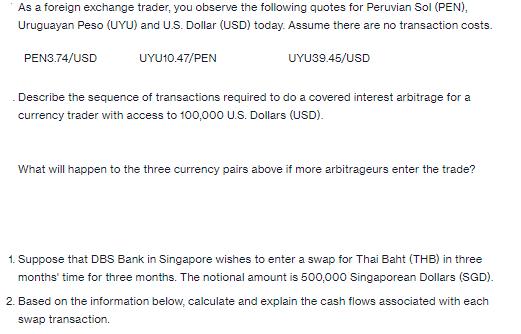

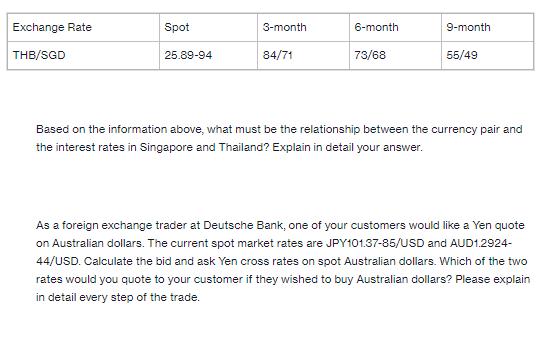

As a foreign exchange trader, you observe the following quotes for Peruvian Sol (PEN), Uruguayan Peso (UYU) and U.S. Dollar (USD) today. Assume there are no transaction costs. PEN3.74/USD UYU10.47/PEN UYU39.45/USD Describe the sequence of transactions required to do a covered interest arbitrage for a currency trader with access to 100,000 U.S. Dollars (USD). What will happen to the three currency pairs above if more arbitrageurs enter the trade? 1. Suppose that DBS Bank in Singapore wishes to enter a swap for Thai Baht (THB) in three months' time for three months. The notional amount is 500,000 Singaporean Dollars (SGD). 2. Based on the information below, calculate and explain the cash flows associated with each swap transaction. As a foreign exchange trader, you observe the following quotes for Peruvian Sol (PEN), Uruguayan Peso (UYU) and U.S. Dollar (USD) today. Assume there are no transaction costs. PEN3.74/USD UYU10.47/PEN UYU39.45/USD Describe the sequence of transactions required to do a covered interest arbitrage for a currency trader with access to 100,000 U.S. Dollars (USD). What will happen to the three currency pairs above if more arbitrageurs enter the trade? 1. Suppose that DBS Bank in Singapore wishes to enter a swap for Thai Baht (THB) in three months' time for three months. The notional amount is 500,000 Singaporean Dollars (SGD). 2. Based on the information below, calculate and explain the cash flows associated with each swap transaction.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answers To do a covered interest arbitrage the currency trader would take advantage of the interest rate differentials between two currencies while eliminating exchange rate risk Heres a stepbystep se...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started