Answered step by step

Verified Expert Solution

Question

1 Approved Answer

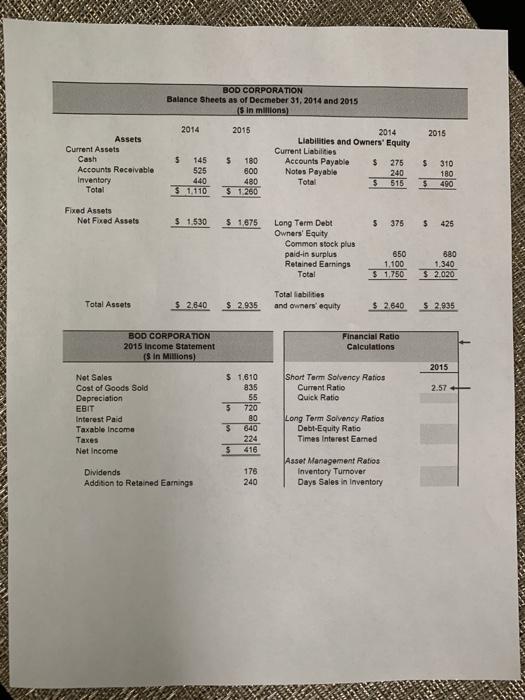

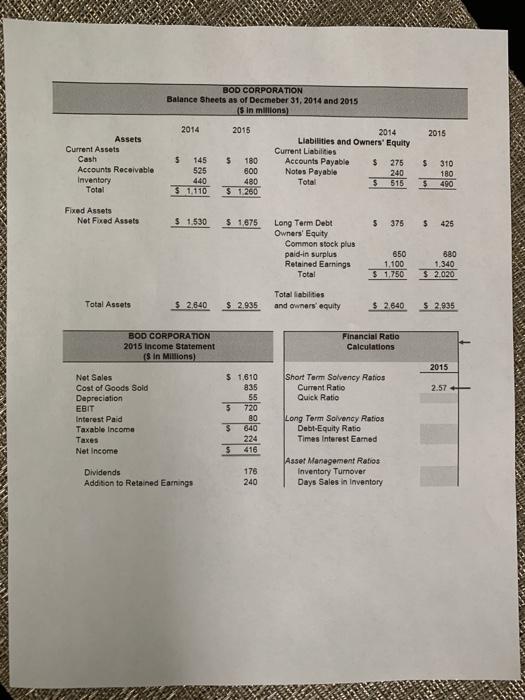

what is the quick ratio? debt-equity ratio? times interest earned? inventory turnover? and days sales in inventory? BOD CORPORATION Balance Sheets as of Decmeber 31,

what is the quick ratio? debt-equity ratio? times interest earned? inventory turnover? and days sales in inventory?

BOD CORPORATION Balance Sheets as of Decmeber 31, 2014 and 2015 (5 in millions) 2014 2015 2015 Assets Current Assets Cash Accounts Receivable Inventory Total 5 145 525 440 3 1.110 $ 2014 Liabilities and Owners' Equity Current Liabilities Accounts Payable $ 275 Notes Payable 240 Total $ 515 $ 180 600 480 $ 1.200 310 180 $ 490 Fixed Assets Net Foxed Assets $ 1.530 $ 1.875 5 375 $ 425 Long Term Debt Owners' Equity Common stock plus paid-in surplus Retained Earnings Total 650 1,100 $1,750 680 1,340 $ 2020 Total Assets $ 2840 $ 2935 Total abilities and owners' equity $ 2.640 $ 2.935 BOD CORPORATION 2015 income Statement ($ in Millions) Financial Ratio Calculations 2015 Short Term Solvency Ratios Current Ratio Quick Ratio 2.57 - Not Sales Cost of Goods Sold Depreciation EBIT Interest Paid Taxable income Taxes Net Income $ 1.610 835 55 5 720 80 $ 640 224 $ 416 Long Term Solvency Ratios Debt-Equity Ratio Times Interest Earned Dividends Addition to Retained Eamings 178 240 Asset Management Ratios Inventory Turnover Days Sales in Inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started