Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the range of standalone valuation of Puma if you use DCF and multiple analysis? Use information provided in Appendix 5-7. Do you believe

What is the range of standalone valuation of Puma if you use DCF and multiple analysis? Use information provided in Appendix 5-7. Do you believe that PPR was right to offer 330 Euros per Puma share?

You can zoom in the pictures on your computer so you can get a clearer picture as this is the biggest quality I could upload.

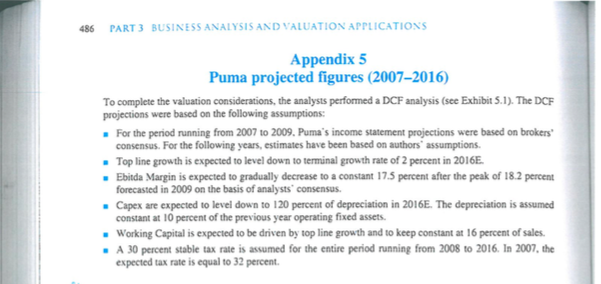

486 PART 3 BUSINESSANALYSISANDVALUATION APPLICATIONS Appendix 5 Puma projected figures (2007-20160 To complete the valuation considerations. the analysts performed a DCF analysis (see Exhibit 5.1) The DCF projections were based on the following assumptions: For the period running from 2007 to 2009. Puma's income statement projections were based on brokers' consensus. For the following years, estimates have been based on authors' assumptions. a Top line growth is expected to level down to terminal growth rate of2percent in 2016E. Ebitda Margin is expected to gradually decrease to a constant 175 percent after the peak of 182 percent forecasted in 2009 on the basis of analysts' consensus. Capex are expected to level down to 120 percent of depreciation in 2016E The depreciation is assumed constant at 10 percent of the previous year operating fixed assets. Working Capital is expected to be driven by top line growth and to keep constant at 16 percent of sales. A 30 percent stable tax rate is assumed for the entire period running from 2008 to 2016. In 2007, the expected tax rate is equal to 32 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started