What is the ratio for Net Income or Loss as a % of Net Sales for Hasbro, must provide excel formula.

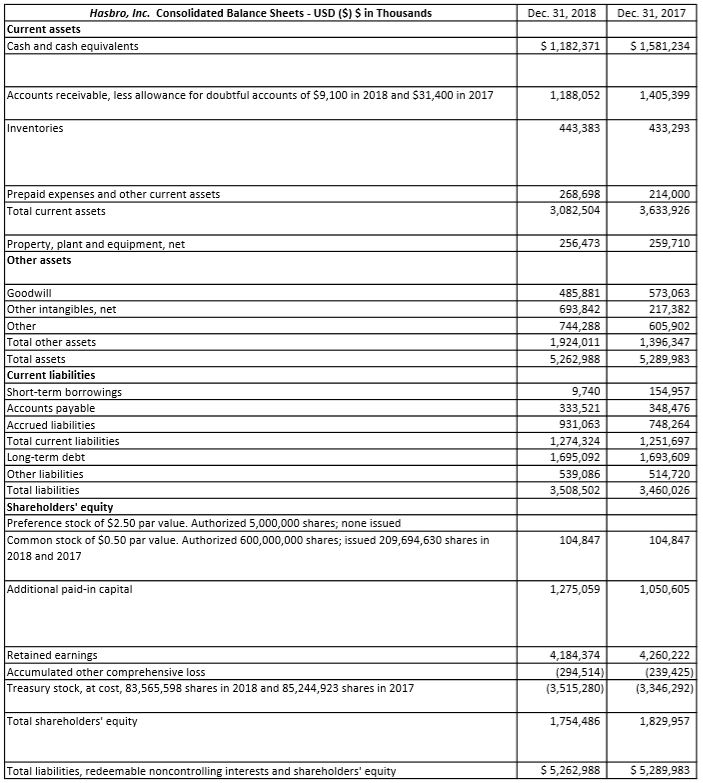

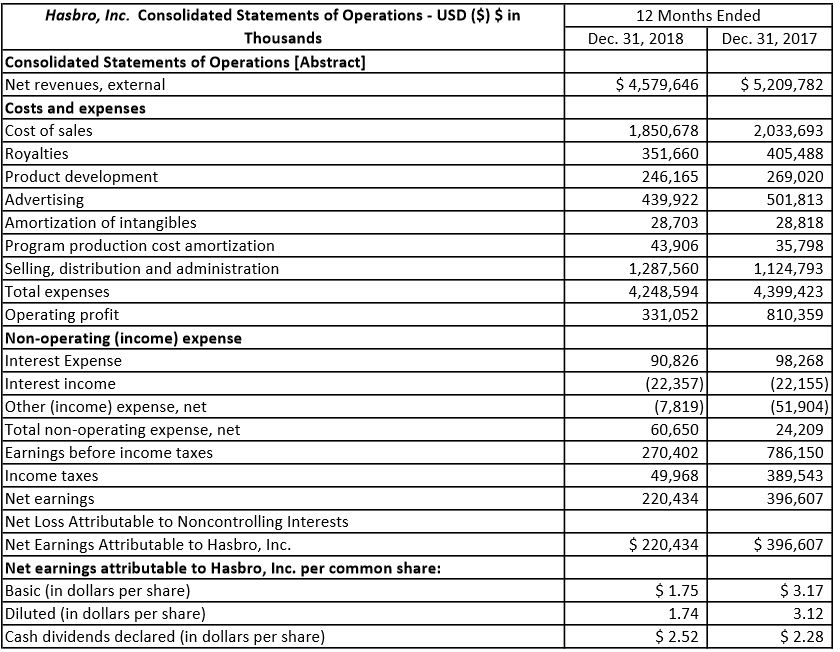

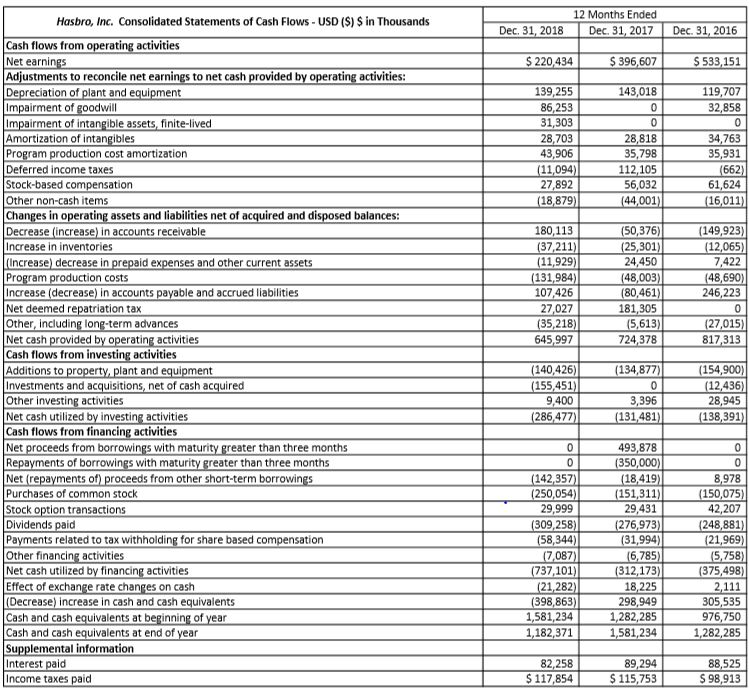

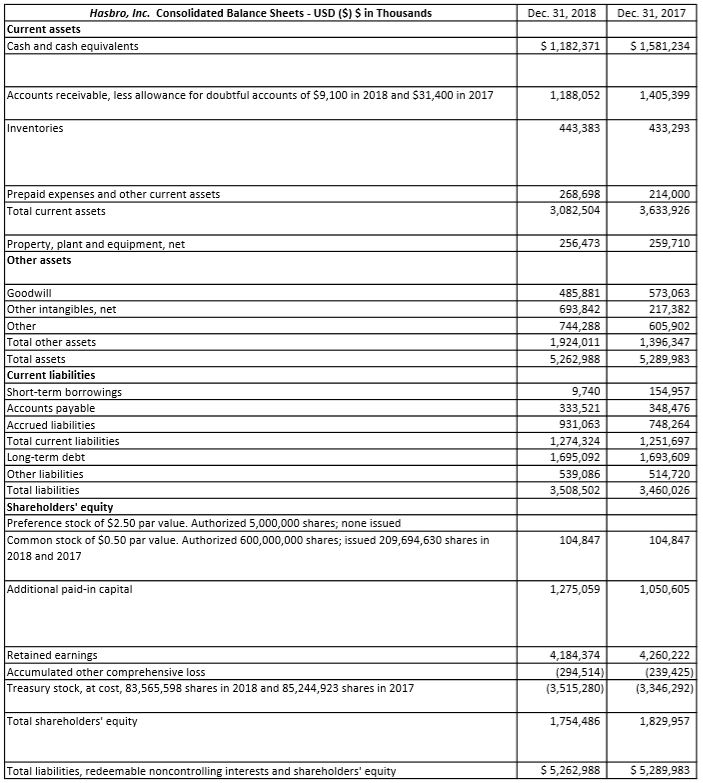

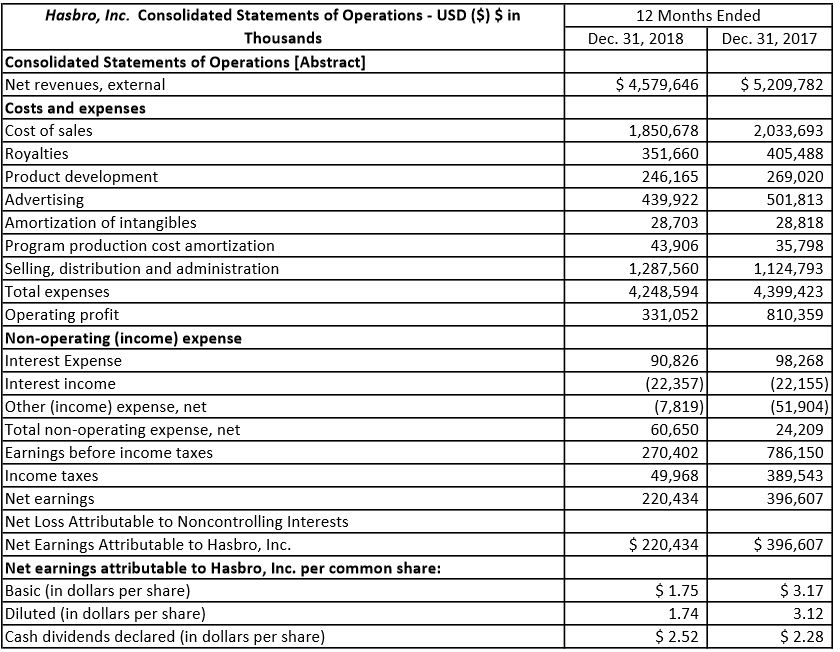

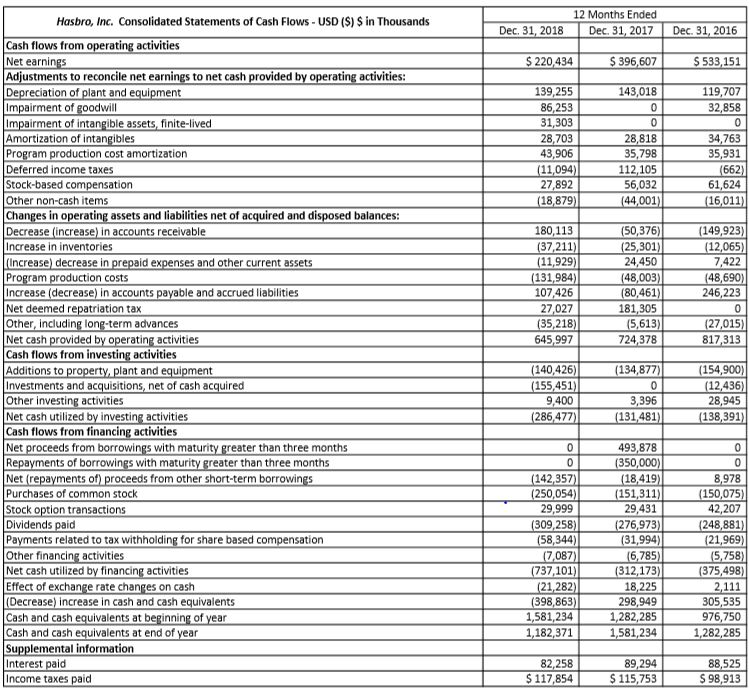

Hasbro, Inc. Consolidated Balance Sheets - USD (S) $ in Thousands Dec. 31, 2018 Dec. 31, 2017 Current assets Cash and cash equivalents $1,182,371 S1,581,234 Accounts receivable, less allowance for doubtful accounts of $9,100 in 2018 and $31,400 in 2017 1,405,399 1,188,052 443,383 Inventories 433,293 214,000 3,633,926 Prepaid expenses and other current assets 268,698 3,082,504 Total current assets Property, plant and equipment, net 256,473 259,710 Other assets Goodwill 485,881 573,063 Other intangibles, net Other 693,842 217,382 744,288 605,902 Total other assets 1,924,011 1,396,347 Total assets 5,289,983 5,262,988 Current liabilities Short-term borrowings 9,740 154,957 Accounts payable 333,521 348,476 748,264 Accrued liabilities Total current liabilities Long-term debt Other liabilities Total liabilities Shareholders' equity 931,063 1,274,324 1,251,697 1,695,092 1,693,609 539,086 514,720 3,508,502 3,460,026 Preference stock of $2.50 par value. Authorized 5,000,000 shares; none issued Common stock of $0.50 par value. Authorized 600,000,000 shares; issued 209,694,630 shares in 2018 and 2017 104,847 104,847 Additional paid-in capital 1,275,059 1,050,605 Retained earnings 4,260,222 4,184,374 Accumulated other comprehensive loss Treasury stock, at cost, 83,565,598 shares in 2018 and 85,244,923 shares in 2017 (294,514) (239,425) (3,515,280) (3,346,292) Total shareholders' equity 1,754,486 1,829,957 $ 5,262,988 $ 5,289,983 Total liabilities, redeemable noncontrolling interests and shareholders' equity Hasbro, Inc. Consolidated Statements of Operations - USD ($) $ in 12 Months Ended Thousands Dec. 31, 2018 Dec. 31, 2017 Consolidated Statements of Operations [Abstract] Net revenues, external Costs and expenses Cost of sales $ 4,579,646 $ 5,209,782 2,033,693 1,850,678 Royalties Product development Advertising Amortization of intangibles Program production cost amortization Selling, distribution and administration Total expenses Operating profit Non-operating (income) expense Interest Expense Interest income Other (income) expense, net Total non-operating expense, net Earnings before income taxes Income taxes Net earnings Net Loss Attributable to Noncontrolling Interests Net Earnings Attributable to Hasbro, Inc. Net earnings attributable to Hasbro, Inc. per common share: Basic (in dollars per share) Diluted (in dollars per share) Cash dividends declared (in dollars per share) 351,660 405,488 246,165 269,020 439,922 501,813 28,703 28,818 43,906 35,798 1,124,793 1,287,560 4,248,594 4,399,423 810,359 331,052 90,826 98,268 (22,357) (22,155) (7,819) (51,904) 60,650 24,209 270,402 786,150 49,968 389,543 220,434 396,607 $ 220,434 $ 396,607 $ 3.17 $ 1.75 1.74 3.12 $ 2.52 $ 2.28 12 Months Ended Hasbro, Inc. Consolidated Statements of Cash Flows - USD ($) $ in Thousands Dec. 31, 2017 Dec. 31, 2018 Dec. 31, 2016 Cash flows from operating activities Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation of plant and equipment Impairment of goodwill Impairment of intangible assets, finite-lived Amortization of intangibles Program production cost amortization Deferred income taxes Stock-based compensation Other non-cash items Changes in operating assets and liabilities net of acquired and disposed balances: Decrease (increase) in accounts receivable Increase in inventories (Increase) decrease in prepaid expenses and other current assets Program production costs Increase (decrease) in accounts payable and accrued liabilities Net deemed repatriation tax Other, including long-term advances Net cash provided by operating activities Cash flows from investing activities Additions to property, plant and equipment Investments and acquisitions, net of cash acquired Other investing activities Net cash utilized by investing activities Cash flows from financing activities Net proceeds from borrowings with maturity greater than three months Repayments of borrowings with maturity greater than three months Net (repayments of) proceeds from other short-term borrowings Purchases of common stock Stock option transactions Dividends paid Payments related to tax withholding for share based compensation Other financing activities Net cash utilized by financing activities Effect of exchange rate changes on cash (Decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental information $ 220,434 $ 396,607 $ 533,151 143,018 139,255 119,707 86,253 32,858 31,303 28,703 43,906 28,818 35,798 112,105 56,032 34,763 35,931 (662) 61,624 (11,094) 27,892 (18,879) (16,011) (44,001) (149,923) (12,065) 7,422 (50,376) (25,301) 24,450 (48,003) (80,461) 181,305 (5,613) 724,378 180,113 (37,211) (11,929) (131,984) 107,426 (48,690) 246,223 27,027 (35,218) (27,015) 645,997 817,313 (154,900) (140,426) (134,877) (155,451) (12,436) 28,945 9,400 (286,477) 3,396 (131,481) (138,391) 493,878 (350,000) (18,419) (151,311) 29,431 (142,357) (250,054) 29,999 (309,258) (58,344) (7,087) (737,101) (21,282) (398,863) 1,581,234 1,182,371 8,978 (150,075) 42,207 (248,881) (21,969) (276,973) (31,994) (6,785) (312,173) 18,225 298,949 1,282,285 1,581,234 (5,758) (375,498) 2,111 305,535 976,750 1,282,285 82,258 $ 117,854 Interest paid 89,294 $ 115,753 88,525 $ 98,913 Income taxes paid