Answered step by step

Verified Expert Solution

Question

1 Approved Answer

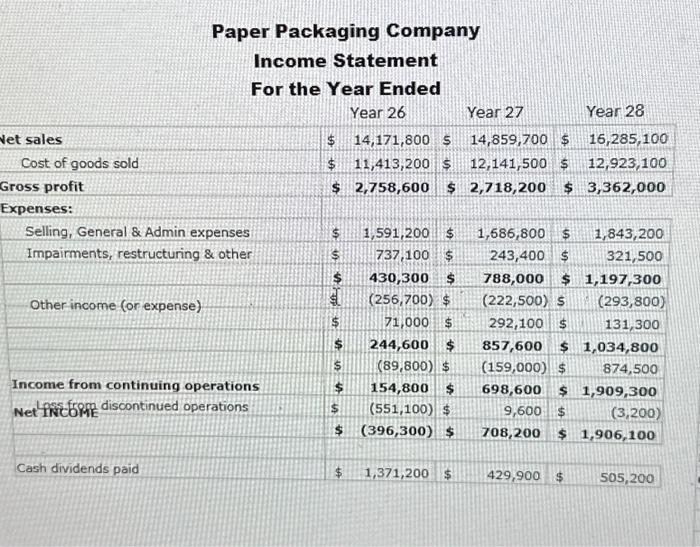

What is the Receivables Turnover Ratio for the following data, and how would I solve for it (in detail, please)? Paper Packaging Company Income Statement

What is the Receivables Turnover Ratio for the following data, and how would I solve for it (in detail, please)?

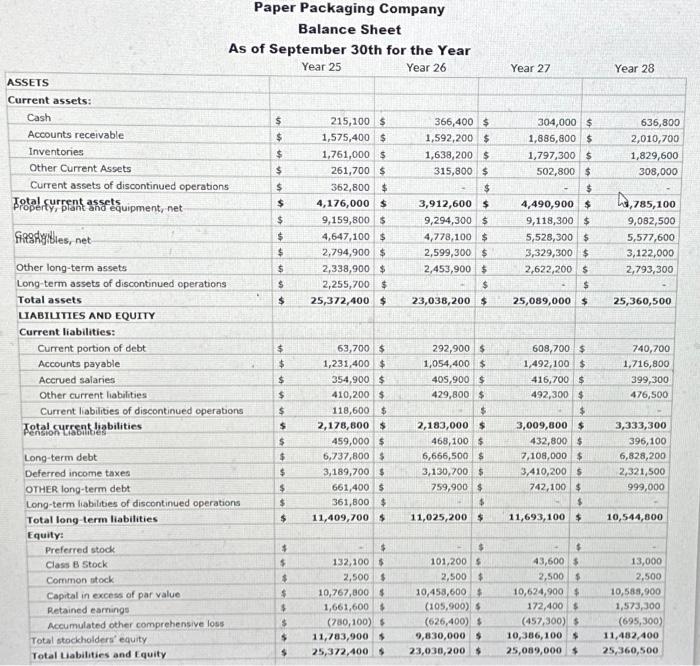

Paper Packaging Company Income Statement For the Year Ended Year 26 Year 27 Year 28 \$ 14,171,800$14,859,700 \$ 16,285,100 Cost of goods sold $11,413,200$12,141,500$12,923,100 Gross profit $2,758,600$2,718,200$3,362,000 Expenses: Selling, General \& Admin expenses $1,591,200$1,686,800$1,843,200 Impairments, restructuring \& other $737,100$243,400$321,500 $430,300$788,000$1,197,300 Other income (or expense) \$ (256,700)$(222,500)$(293,800) $71,000$292,100$131,300 $244,600$857,600$1,034,800 $(89,800)$(159,000)$874,500 Income from continuing operations $154,800$698,600$1,909,300 Net Iffictorme discontinued operations $(551,100)$ (3,200) $(396,300)$708,200$1,906,100 Cash dividends paid $1,371,200$429,900 \$ 505,200 Paper Packaging Company Balance Sheet As of September 30th for the Year Year 25 Year 26 Year 27 Year 28 ASSEIS Current assets: Cash Accounts receivable Inventories Other Current Assets Current assets of discontinued operations Total current assets properfy, pFent assets and equment, net Girankibles, net Other long-term assets Long-term assets of discontinued operations Total assets IABIUIIES AND EQUITY Current liabilities: Current portion of debt Accounts payable Accrued salaries Other current liabilities Current liabilities of discontinued operations fotal current ligabilities Long-term debt Deferred income taxes OTHER long-term debt Long-term liabilites of discontinued operations Total long-term liabilities \$ 215,100$ 366,400$ 1,575,400$ 1,592,200$ 1,761,000 \$ 1,638,200$ 261,700 315,800$ 362,800 $ $ 4,176,000 $ 9,159,800 \$ 3,912,600 \$ 4,647,100 \$ $ $ 2,794,900$ $ 2,338,900 $ 2,255,700 9,294,300$ $25,372,400 4,778,100$5,528,300$ $636,800 304,000 2,599,300$ 3,329,300$ 2,010,700 1,829,600 502,800$ 308,000 Equity: Preferred stock. Class B Stock Common stock Capital in excess of par value $ 2,453,900 \$ 2,622,200$ $ $ 23,038,200$ 25,089,000$ 25,360,500 Retained earnings Accumulated other comprehensive loss $1,231,400$ 608,700 $ 354,900$ 1,492,100 \$ 740,700 $ 410,200 416,700 \$ 1,716,800 $ 492,300$ 399,300 $ 118,600 $ 476,500 \$ 2,178,600 \$ 2,183,000 $459,000 \$ 468,100 \$ 6,737,800 s 6,666,500 \$ 3,189,700 3,130,700$ 661,400$ 759,900 \$ 361,800$ s 11,409,700 s 11,025,200 \$ 11,693,100$ 10,544,800 $ 5 $2,500$ 101,200 $ 2,500 5 43,600 \begin{tabular}{|rr} \hline & \\ 5 & 13,000 \\ $ & 2,500 \end{tabular} $10,767,000 10,453,600 2,500 (105,900) 10,624,900 10,588,900 \$ 1,661,600 (626,400) 172,400 1,573,300 \$ (730,100) \& (457,300) \& (695,300) Total stockholders' equity 11,783,900 9,830,000 \& 10,386,100 11,482,400 Total Labilities and Equity 25,372,400 is 23,030,200 \$ 25,089,000 \$ 25,360,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started