Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is the required rate of return using the Dividend Discount Model for Ford Motor Company Stock compny in these years Stock price of Ford

what is the required rate of return using the Dividend Discount Model for Ford Motor Company Stock compny in these years

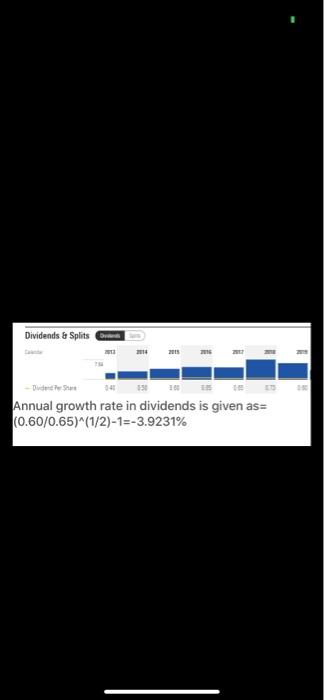

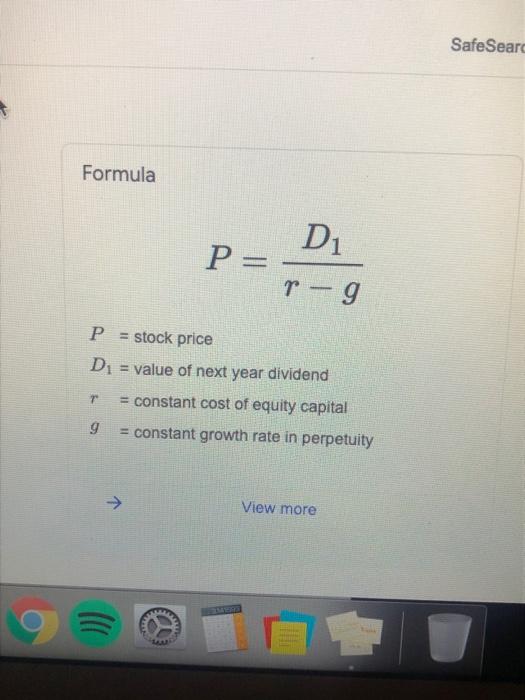

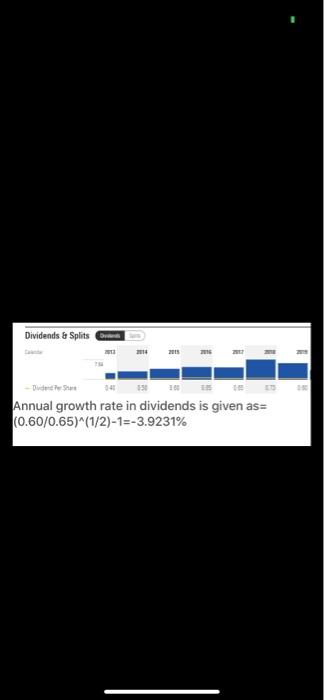

Stock price of Ford Motor Company on July 1st 2017 = $11.19 Stock price of Ford Motor Company on September 30th 2020 = $ 6.66 Company has provided quarterly dividend of $ 0.15 per share between the period. So total dividend income per share = 7 * $ 0.15 = $ 1.05 Total retun over the period - Stock price on September 20 2020 - on July 1ST 2017 + dividend paymnet = $ 6.66 - $ 11.19 + $ 1.05 = $ -3.48 Holding period return = Total return / Purchase price = - $ 3.48 / $ 11.19 =- 31.10% So, investor has made loss of 31.10% over the period by holding the stock of Fordm Motor Company. Histroical price data is taken from Yahoo Finance. Dividends & Splits 04 Annual growth rate in dividends is given as= (0.60/0.65)^(1/2)-1=-3.9231% SafeSearc Formula D1 P= r-9 P = stock price Do = value of next year dividend = constant cost of equity capital 9 = constant growth rate perpetuity 7 View more

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started