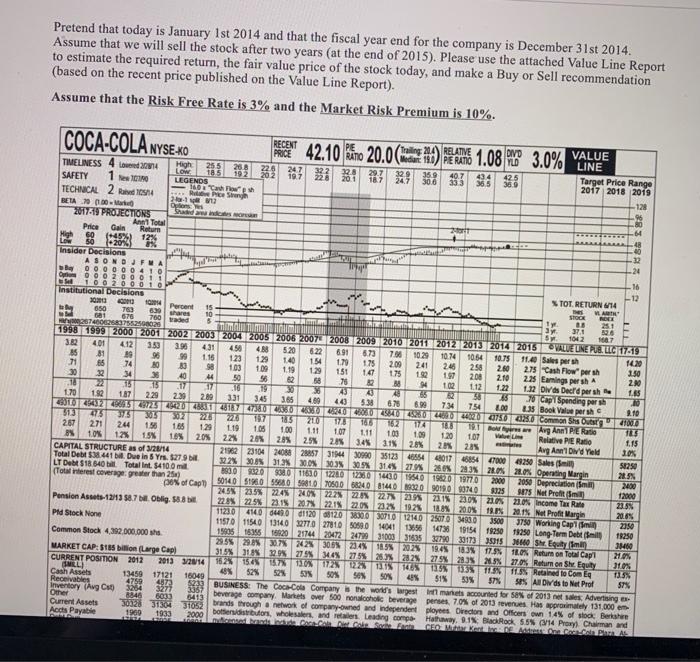

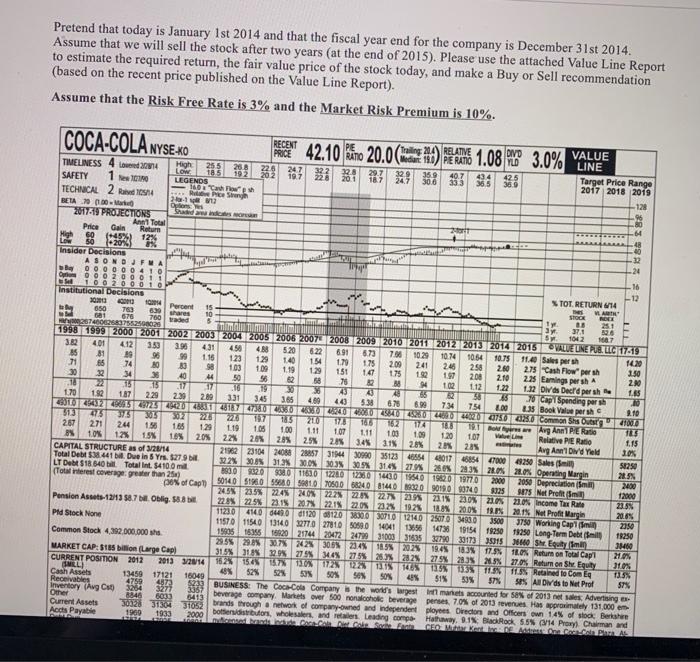

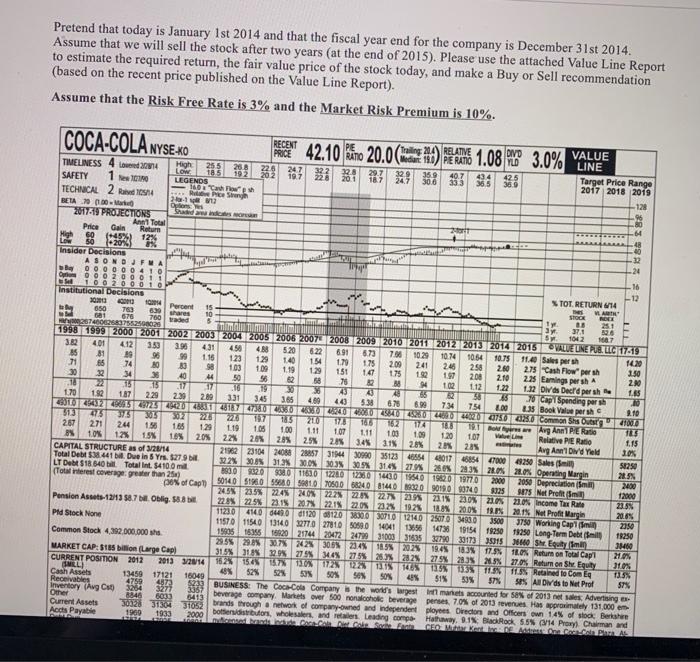

What is the required return for KO?

What is the selling price in two years?

What is the fair value of KO?

Pretend that today is January 1st 2014 and that the fiscal year end for the company is December 31st 2014 Assume that we will sell the stock after two years at the end of 2015). Please use the attached Value Line Report to estimate the required return, the fair value price of the stock today, and make a Buy or Sell recommendation (based on the recent price published on the Value Line Report). Assume that the Risk Free Rate is 3% and the Market Risk Premium is 10%. COCA-COLA NYSEKO (Trading 240) PELATNE het hy 247 28 29 30 383 1.08 Pro 3.0% I B& vool 00 Percent 192 750 aded 382 RECENT PE VALUE YLD TIMELINESS 4 4 LINE 425 SAFETY 1 2010 Target Price Range LEGENDS 333 TECHNICAL 2014 The 2017 2018 2019 e Price Strong BETA 70 000 2. -128 Qos 2017-19 PROJECTIONS Ann Total Price Gain Return High 12% Low Insider Decisions " ASO OFM -24 be o o o GO 16 108 Institutional Decisions -12 300 TOT. RETURN 614 tu WA 650 15 769 NEE 681 670 88 251 0,2574575525625 Em sy 371 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 WALUE UNE PUB LIGJ 17-19 5 1042 1607 401 412 3.39 3.99 431 454 488 520 622 691 6.73 85 81 7.80 10.29 1074 1054 99 1.15 10.75 11. Salespers 123 129 140 154 1420 71 175 66 1.79 209 241 74 80 246 258 98 103 275 Cash Flowpersh 100 2.80 1.19 129 151 147 175 199 3.50 30 22 1.97 34 38 200 44 2.10 40 2.35 Earnings persh 50 56 62 58 70 22 B 4 2.90 5.10 22 15 102 1.12 13 17 17 122 1.12 Dis Decrd per she .10 30 1.85 43 40 65 170 192 62 30 23 187 2.29 2.39 289 3.31 345 3.65 Cap Spending pers 489 10 449 EZTETET SOCOSOCOCO BOTERODUCTS 0 CommonShs Outer 5.38 6.78 8.99 734 7.54 200 2. Book Vale persh 2.10 11 473 35 303 302 20 737 105 210 1 166 41001 162 114 2.67 271 244 156 1.68 129 De Ang Ann P E Ratio 1.19 108 1.00 1.11 107 1.11 TE 100 1.09 120 10% 1.07 Valve 8% 125 1.5% 16% 20% 22% 20% Relative PE Ratio 26% 28 3.45 315 28 f.15 2 285 CAPITAL STRUCTURE as of 26/14 Avg Ann' Did Yield 2162 23104 2003 28857 3194 30990 35123 884 30% Total Debt $8.441. Due in 5 Yrs. $279 4801746854 47000 3250 Sales (Si LT Debt $18.640 bill TotalInt. $4100 mil 322%30153100 30.3% 20.5% 31.4 278 2.0 2035 21% 22% Operating Margia 58250 (Toti interest coverage greater than 25 3830 9320 93071610 12200 1200 1400 TO 1980 19770 21.5% 50140 518005080598107050080408144093209019000740 2000 of Capt 2050 Depreciation 2400 3725 175 Net Profit 24.5 23.5% 224 222 223 227 29 21 2305 2 2% come Tax Rule 12000 Pension Assets-12/13 58.7. Oblig. 33 228 229 23112072215 220 225 1926 23.8% 18.8% 200% 1 2018 Net Profit Margie Pld Stock None 11230 4140 64430 01120 1120 1300 10710 2140 2570 300 3500 11570 1154013140 32770 2701050580 1041 1.56 14738 1954 1925 19250 Long Term Debt 3750 Working Cap (min 2350 Common Stock 4,392.000.000 15805 1835 1882021744 2047224799310033935 18250 37190 33173 350150 Sh Equity 2355 290 307 22 3053 2345 185 2025 360 MARKET CAP: $165 billion (Large Carl 19:45 18 18 Le Return on Total Capi 3141512329324052 253 225 27 29.33 2.9 2.3 Return on SWEquity 10% CURRENT POSITION 2012 2013 2014 2 15.7% 10% 112 113 11465 10% SML) DIN 13 Retained to comig Cash Assets 13459 17121 48% 52% 53 18049 50% 13.3% Sex 90 40% 51% 53% Receivables 57% Se All Dirds to Net Prof 57% 4759 4873 Inventory (Avg Co 3254 3367 Other 8846 6033 6413 beverage company Markets over 500 moralcoholic beverage perses. 70% of 2013 revenues Has approximately 131,000 Current Assets 30328 31304 37062 brands through a network of company-owned and independent ployees Direction and offers own 14% of stock Berkshee Accts Payable 1960 1933 2000 bottlendistributors Wholesalers and in Leading company. 9.11 Block 554 Pryl Chaman and See More 25 20.6% Pretend that today is January 1st 2014 and that the fiscal year end for the company is December 31st 2014 Assume that we will sell the stock after two years at the end of 2015). Please use the attached Value Line Report to estimate the required return, the fair value price of the stock today, and make a Buy or Sell recommendation (based on the recent price published on the Value Line Report). Assume that the Risk Free Rate is 3% and the Market Risk Premium is 10%. COCA-COLA NYSEKO (Trading 240) PELATNE het hy 247 28 29 30 383 1.08 Pro 3.0% I B& vool 00 Percent 192 750 aded 382 RECENT PE VALUE YLD TIMELINESS 4 4 LINE 425 SAFETY 1 2010 Target Price Range LEGENDS 333 TECHNICAL 2014 The 2017 2018 2019 e Price Strong BETA 70 000 2. -128 Qos 2017-19 PROJECTIONS Ann Total Price Gain Return High 12% Low Insider Decisions " ASO OFM -24 be o o o GO 16 108 Institutional Decisions -12 300 TOT. RETURN 614 tu WA 650 15 769 NEE 681 670 88 251 0,2574575525625 Em sy 371 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 WALUE UNE PUB LIGJ 17-19 5 1042 1607 401 412 3.39 3.99 431 454 488 520 622 691 6.73 85 81 7.80 10.29 1074 1054 99 1.15 10.75 11. Salespers 123 129 140 154 1420 71 175 66 1.79 209 241 74 80 246 258 98 103 275 Cash Flowpersh 100 2.80 1.19 129 151 147 175 199 3.50 30 22 1.97 34 38 200 44 2.10 40 2.35 Earnings persh 50 56 62 58 70 22 B 4 2.90 5.10 22 15 102 1.12 13 17 17 122 1.12 Dis Decrd per she .10 30 1.85 43 40 65 170 192 62 30 23 187 2.29 2.39 289 3.31 345 3.65 Cap Spending pers 489 10 449 EZTETET SOCOSOCOCO BOTERODUCTS 0 CommonShs Outer 5.38 6.78 8.99 734 7.54 200 2. Book Vale persh 2.10 11 473 35 303 302 20 737 105 210 1 166 41001 162 114 2.67 271 244 156 1.68 129 De Ang Ann P E Ratio 1.19 108 1.00 1.11 107 1.11 TE 100 1.09 120 10% 1.07 Valve 8% 125 1.5% 16% 20% 22% 20% Relative PE Ratio 26% 28 3.45 315 28 f.15 2 285 CAPITAL STRUCTURE as of 26/14 Avg Ann' Did Yield 2162 23104 2003 28857 3194 30990 35123 884 30% Total Debt $8.441. Due in 5 Yrs. $279 4801746854 47000 3250 Sales (Si LT Debt $18.640 bill TotalInt. $4100 mil 322%30153100 30.3% 20.5% 31.4 278 2.0 2035 21% 22% Operating Margia 58250 (Toti interest coverage greater than 25 3830 9320 93071610 12200 1200 1400 TO 1980 19770 21.5% 50140 518005080598107050080408144093209019000740 2000 of Capt 2050 Depreciation 2400 3725 175 Net Profit 24.5 23.5% 224 222 223 227 29 21 2305 2 2% come Tax Rule 12000 Pension Assets-12/13 58.7. Oblig. 33 228 229 23112072215 220 225 1926 23.8% 18.8% 200% 1 2018 Net Profit Margie Pld Stock None 11230 4140 64430 01120 1120 1300 10710 2140 2570 300 3500 11570 1154013140 32770 2701050580 1041 1.56 14738 1954 1925 19250 Long Term Debt 3750 Working Cap (min 2350 Common Stock 4,392.000.000 15805 1835 1882021744 2047224799310033935 18250 37190 33173 350150 Sh Equity 2355 290 307 22 3053 2345 185 2025 360 MARKET CAP: $165 billion (Large Carl 19:45 18 18 Le Return on Total Capi 3141512329324052 253 225 27 29.33 2.9 2.3 Return on SWEquity 10% CURRENT POSITION 2012 2013 2014 2 15.7% 10% 112 113 11465 10% SML) DIN 13 Retained to comig Cash Assets 13459 17121 48% 52% 53 18049 50% 13.3% Sex 90 40% 51% 53% Receivables 57% Se All Dirds to Net Prof 57% 4759 4873 Inventory (Avg Co 3254 3367 Other 8846 6033 6413 beverage company Markets over 500 moralcoholic beverage perses. 70% of 2013 revenues Has approximately 131,000 Current Assets 30328 31304 37062 brands through a network of company-owned and independent ployees Direction and offers own 14% of stock Berkshee Accts Payable 1960 1933 2000 bottlendistributors Wholesalers and in Leading company. 9.11 Block 554 Pryl Chaman and See More 25 20.6%