Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the right formula for this question? Use the AVERAGEIF function to pull the 'Capacity Utilization' data on the 'Data - Automobiles' into the

What is the right formula for this question?

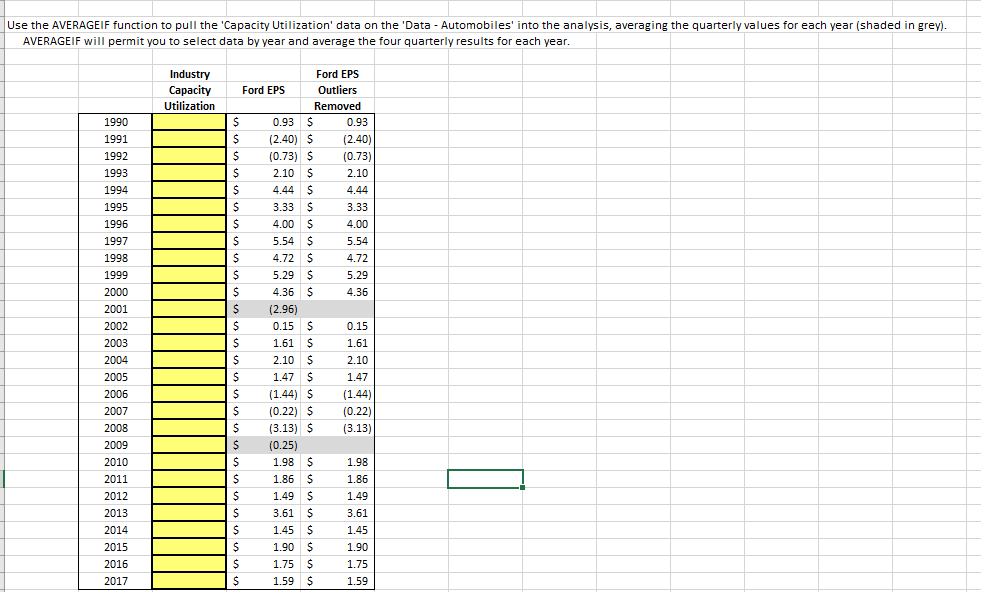

Use the AVERAGEIF function to pull the 'Capacity Utilization' data on the 'Data - Automobiles' into the analysis, averaging the quarterly values for each year (shaded in grey). AVERAGEIF will permit you to select data by year and average the four quarterly results for each year. Industry Capacity Utilization 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Ford EPS Ford EPS Outliers Removed $ 0.93 $ 0.93 $ (2.40) $ (2.40) $ (0.73) $ (0.73) $ 2.10 $ 2.10 $ 4.44 $ 4.44 $ 3.33 $ 3.33 $ 4.00 $ 4.00 $ 5.54 $ 5.54 $ 4.72 $ 4.72 $ 5.29 $ 5.29 $ 4.36 $ 4.36 $ (2.96) $ 0.15 S 0.15 $ 1.61 $ 1.61 $ 2.10 S 2.10 $ $ 1.47 $ 1.47 $ (1.44) $ (1.44) $ (0.22) $ (0.22) $ (3.13) $ (3.13) $ (0.25) $ 1.98 $ 1.98 $ 1.86 $ 1.86 $ 1.49 $ 1.49 $ 3.61 $ 3.61 $ 1.45 $ 1.45 $ 1.90 $ 1.90 $ 1.75 $ 1.75 $ 1.59 $ 1.59 O 2013 2014 2015 2016 2017 Use the AVERAGEIF function to pull the 'Capacity Utilization' data on the 'Data - Automobiles' into the analysis, averaging the quarterly values for each year (shaded in grey). AVERAGEIF will permit you to select data by year and average the four quarterly results for each year. Industry Capacity Utilization 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Ford EPS Ford EPS Outliers Removed $ 0.93 $ 0.93 $ (2.40) $ (2.40) $ (0.73) $ (0.73) $ 2.10 $ 2.10 $ 4.44 $ 4.44 $ 3.33 $ 3.33 $ 4.00 $ 4.00 $ 5.54 $ 5.54 $ 4.72 $ 4.72 $ 5.29 $ 5.29 $ 4.36 $ 4.36 $ (2.96) $ 0.15 S 0.15 $ 1.61 $ 1.61 $ 2.10 S 2.10 $ $ 1.47 $ 1.47 $ (1.44) $ (1.44) $ (0.22) $ (0.22) $ (3.13) $ (3.13) $ (0.25) $ 1.98 $ 1.98 $ 1.86 $ 1.86 $ 1.49 $ 1.49 $ 3.61 $ 3.61 $ 1.45 $ 1.45 $ 1.90 $ 1.90 $ 1.75 $ 1.75 $ 1.59 $ 1.59 O 2013 2014 2015 2016 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started