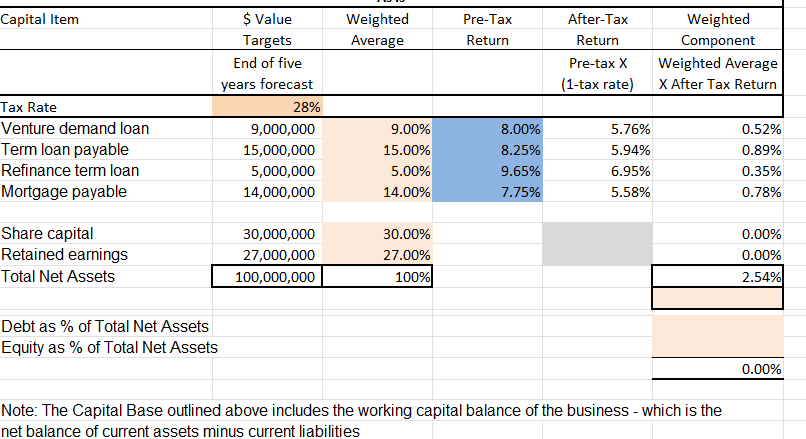

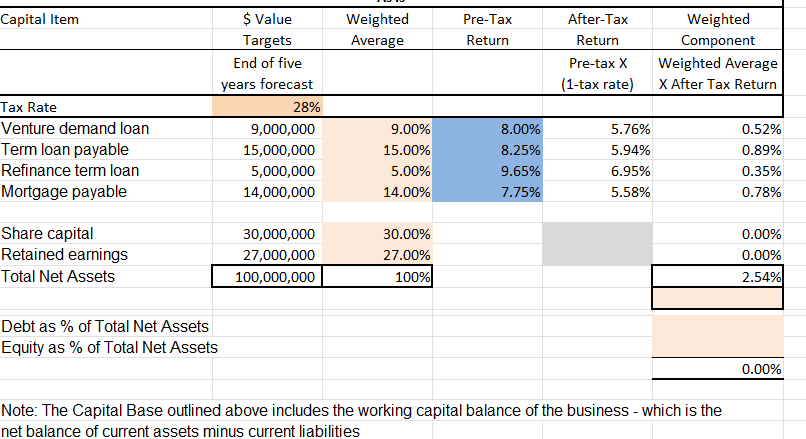

What is the share capital and retained earnings value after tax return?

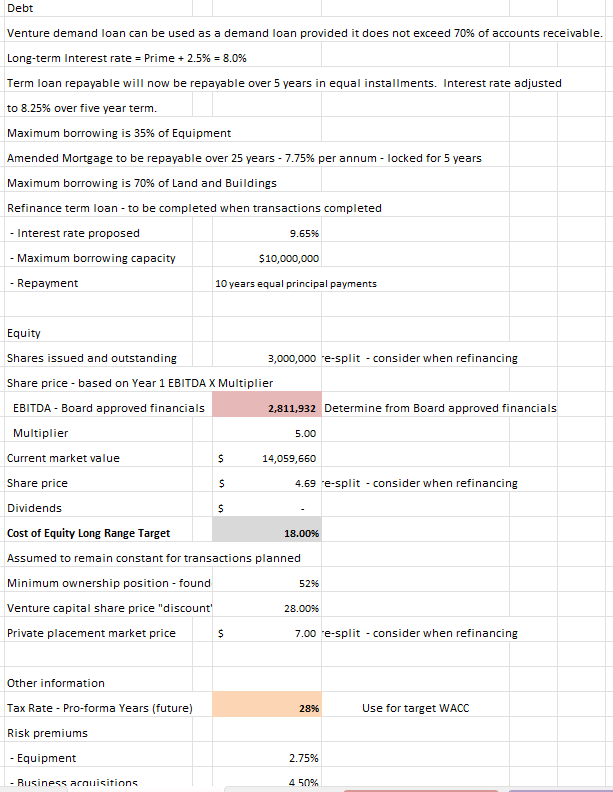

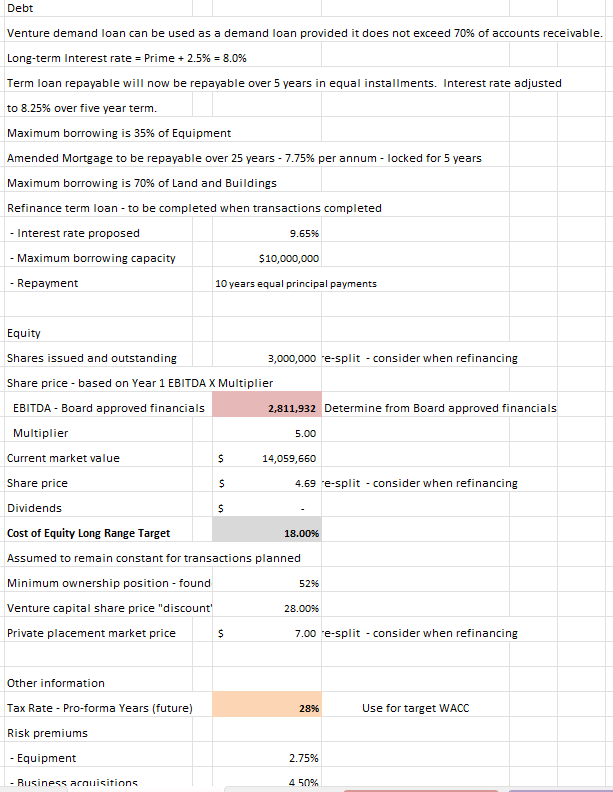

Debt Venture demand loan can be used as a demand loan provided it does not exceed 70% of accounts receivable. Long-term Interest rate = Prime +2.5%=8.0% Term loan repayable will now be repayable over 5 years in equal installments. Interest rate adjusted to 8.25% over five year term. Maximum borrowing is 35% of Equipment Amended Mortgage to be repayable over 25 years - 7.75% per annum - locked for 5 years Maximum borrowing is 70% of Land and Buildings Refinance term loan - to be completed when transactions completed - Interest rate proposed 9.65% - Maximum borrowing capacity $10,000,000 - Repayment 10 years equal principal payments Equity Shares issued and outstanding 3,000,000 ee-split - consider when refinancing Share price - based on Year 1 EBITDA X Multiplier EBITDA - Board approved financials 2,811,932 Determine from Board approved financials Multiplier Current market value $14,059,660 Share price 5 4.69 -e-split - consider when refinancing Dividends 5 Cost of Equity Long Range Target 18.00% Assumed to remain constant for transactions planned Minimum ownership position - found 52% Venture capital share price "discount' 28.00% Private placement market price $7.00-e-split - consider when refinancing Other information Tax Rate - Pro-forma Years (future) 28% Use for target WACC Risk premiums - Equipment 2.75% - Rusinpes arruigitions 450% el valamle Ui cumem assels Im mus cumem mavimes Debt Venture demand loan can be used as a demand loan provided it does not exceed 70% of accounts receivable. Long-term Interest rate = Prime +2.5%=8.0% Term loan repayable will now be repayable over 5 years in equal installments. Interest rate adjusted to 8.25% over five year term. Maximum borrowing is 35% of Equipment Amended Mortgage to be repayable over 25 years - 7.75% per annum - locked for 5 years Maximum borrowing is 70% of Land and Buildings Refinance term loan - to be completed when transactions completed - Interest rate proposed 9.65% - Maximum borrowing capacity $10,000,000 - Repayment 10 years equal principal payments Equity Shares issued and outstanding 3,000,000 ee-split - consider when refinancing Share price - based on Year 1 EBITDA X Multiplier EBITDA - Board approved financials 2,811,932 Determine from Board approved financials Multiplier Current market value $14,059,660 Share price 5 4.69 -e-split - consider when refinancing Dividends 5 Cost of Equity Long Range Target 18.00% Assumed to remain constant for transactions planned Minimum ownership position - found 52% Venture capital share price "discount' 28.00% Private placement market price $7.00-e-split - consider when refinancing Other information Tax Rate - Pro-forma Years (future) 28% Use for target WACC Risk premiums - Equipment 2.75% - Rusinpes arruigitions 450% el valamle Ui cumem assels Im mus cumem mavimes