Answered step by step

Verified Expert Solution

Question

1 Approved Answer

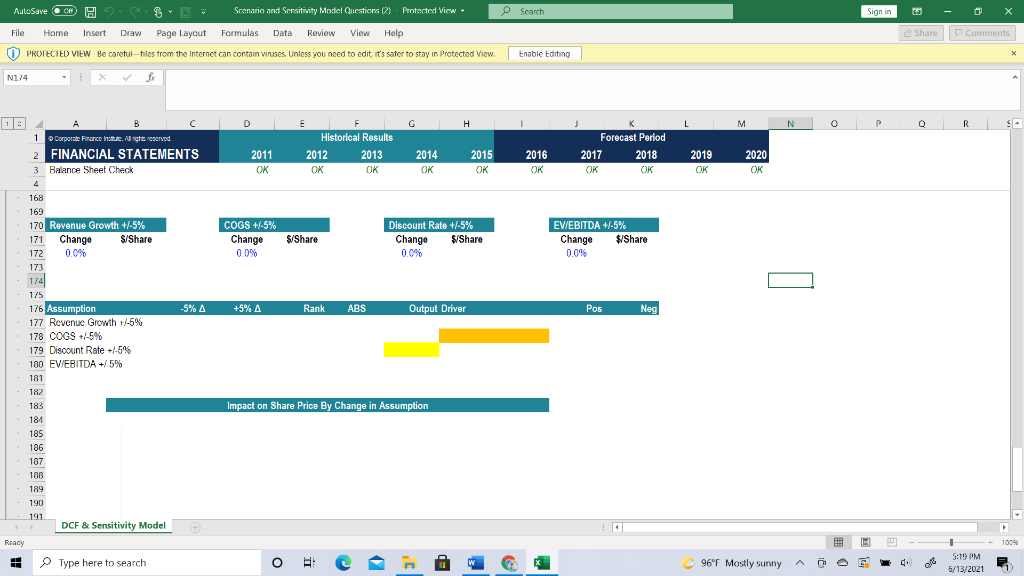

What is the share price when COGS increases by 5%? 26.87 29.29 30.47 22.71 AutoSave C H2 Scenario and Sensitivity Model Questions (2) - Protected

What is the share price when COGS increases by 5%?

26.87

29.29

30.47

22.71

AutoSave C H2 Scenario and Sensitivity Model Questions (2) - Protected View Search Sign in ca File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments PROTECTED VIEW Be carefulfiles from the Internet can contain viruses. Unless you need to edit it's safer to stay in Protected View. Enable Editing N174 fo D E H L N 0 R 9- 1 Corporate Finance Alght reserved Historical Results Forecast Period 2 FINANCIAL STATEMENTS 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 3 Balance Sheet Check OK OK OK OK OK OK OK OK OK OK 4 168 COGS +/-5% Discount Rate +/-5% 169 170 Revenue Growth +/-5% 171 Change S/Share 172 0.0% $/Share $/Share Change 0.0% Change 0.0% EV/EBITDA +/-5% Change $/Share 0.0% 173 174 1/5 -5% A +5% A Rank ABS Output Driver Pos Neg 176 Assumption 177 Revenue Growth +/-5% 178 COGS +/-5% 179 Discount Rate +/-5% 180 EVEBITDA +/-5% 181 182 183 Impact on Share Price By Change in Assumption 184 185 186 187 188 189 190 191 DCF & Sensitivity Model Reacy - + 100% 5:19 PM 1 Type here to search o 96F Mostly sunny C LS 6/13/2021 AutoSave C H2 Scenario and Sensitivity Model Questions (2) - Protected View Search Sign in ca File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments PROTECTED VIEW Be carefulfiles from the Internet can contain viruses. Unless you need to edit it's safer to stay in Protected View. Enable Editing N174 fo D E H L N 0 R 9- 1 Corporate Finance Alght reserved Historical Results Forecast Period 2 FINANCIAL STATEMENTS 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 3 Balance Sheet Check OK OK OK OK OK OK OK OK OK OK 4 168 COGS +/-5% Discount Rate +/-5% 169 170 Revenue Growth +/-5% 171 Change S/Share 172 0.0% $/Share $/Share Change 0.0% Change 0.0% EV/EBITDA +/-5% Change $/Share 0.0% 173 174 1/5 -5% A +5% A Rank ABS Output Driver Pos Neg 176 Assumption 177 Revenue Growth +/-5% 178 COGS +/-5% 179 Discount Rate +/-5% 180 EVEBITDA +/-5% 181 182 183 Impact on Share Price By Change in Assumption 184 185 186 187 188 189 190 191 DCF & Sensitivity Model Reacy - + 100% 5:19 PM 1 Type here to search o 96F Mostly sunny C LS 6/13/2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started