Answered step by step

Verified Expert Solution

Question

1 Approved Answer

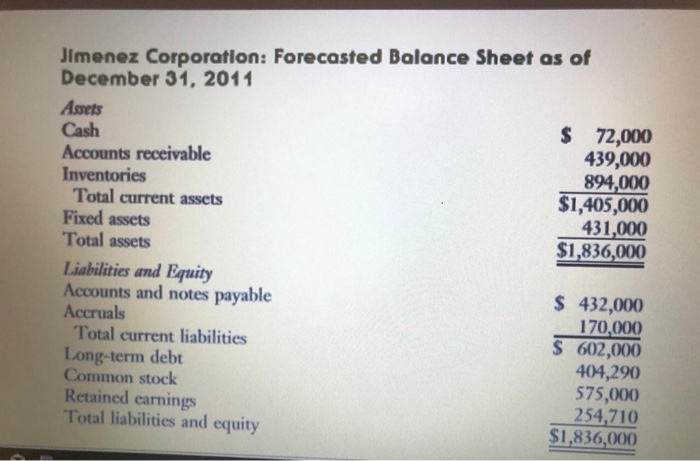

what is the solution jimenez corporation: forecasted balance sheet as of december 31, 2011 Jimenez Corporation: Forecasted Balance Sheet as of December 31, 2011 Asets

what is the solution

jimenez corporation: forecasted balance sheet as of december 31, 2011

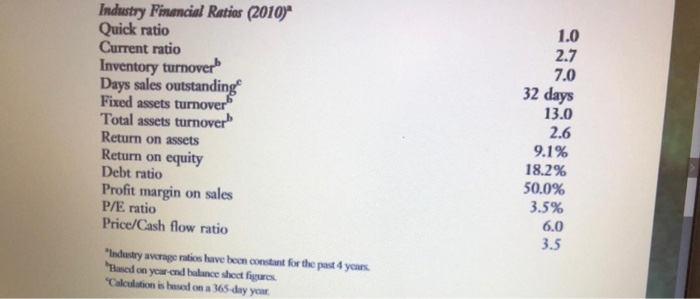

Jimenez Corporation: Forecasted Balance Sheet as of December 31, 2011 Asets Cash $ 72,000 Accounts receivable 439,000 Inventories 894,000 Total current assets $1,405,000 Fixed assets 431,000 Total assets $1,836,000 Liabilities and Equity Accounts and notes payable $ 432,000 Accruals 170,000 Total current liabilities $ 602,000 Long-term debt 404,290 Common stock Retained earnings 575,000 Total liabilities and equity 254,710 $1,836,000 2.7 7.0 32 days Industry Financial Ratios (2010) Quick ratio Current ratio Inventory turnover Days sales outstanding Fixed assets turnover Total assets turnover Return on assets Return on equity Debt ratio Profit margin on sales P/E ratio Price/Cash flow ratio 13.0 2.6 9.1% 18.2% 50.0% 3.5% 6.0 3.5 "Industry average ratios have been constant for the past years. "Based on year and balance sheet figuros "Calculation is based on a 365-day your Jimenez Corporation: Forecasted Balance Sheet as of December 31, 2011 Asets Cash $ 72,000 Accounts receivable 439,000 Inventories 894,000 Total current assets $1,405,000 Fixed assets 431,000 Total assets $1,836,000 Liabilities and Equity Accounts and notes payable $ 432,000 Accruals 170,000 Total current liabilities $ 602,000 Long-term debt 404,290 Common stock Retained earnings 575,000 Total liabilities and equity 254,710 $1,836,000 2.7 7.0 32 days Industry Financial Ratios (2010) Quick ratio Current ratio Inventory turnover Days sales outstanding Fixed assets turnover Total assets turnover Return on assets Return on equity Debt ratio Profit margin on sales P/E ratio Price/Cash flow ratio 13.0 2.6 9.1% 18.2% 50.0% 3.5% 6.0 3.5 "Industry average ratios have been constant for the past years. "Based on year and balance sheet figuros "Calculation is based on a 365-day your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started