Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the solution to these questions Question 33 Not yet answered At the beginning of the year partners Ahmed and Saeed have capital balances

What is the solution to these questions

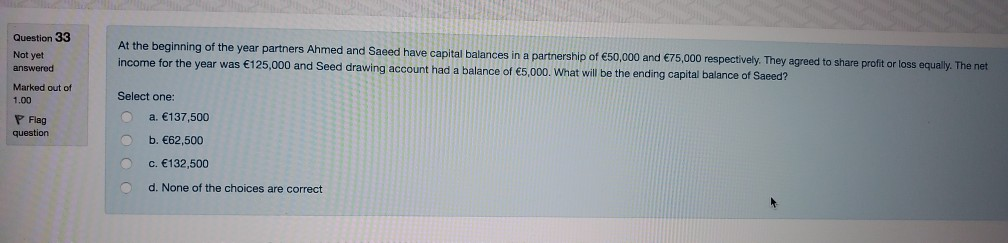

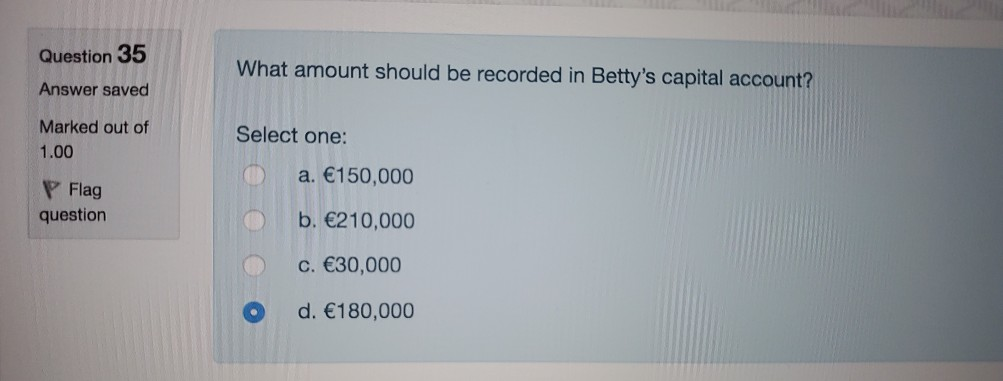

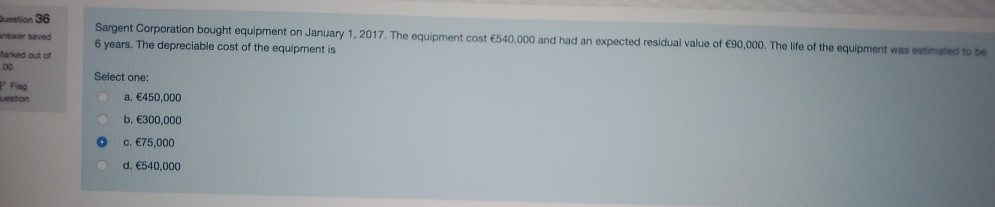

Question 33 Not yet answered At the beginning of the year partners Ahmed and Saeed have capital balances in a partnership of 50,000 and 75,000 respectively. They agreed to share profit or loss equally. The net income for the year was 125,000 and Seed drawing account had a balance of 5,000. What will be the ending capital balance of Saeed? Marked out of 1.00 P Flag question Select one: a. 137,500 b. 62,500 c. 132,500 d. None of the choices are correct Question 35 Answer saved What amount should be recorded in Betty's capital account? Marked out of 1.00 Select one: a. 150,000 Flag question b. 210,000 c. 30,000 d. 180,000 estion 36 Sargent Corporation bought equipment on January 1, 2017. The equipment cost 540,000 and had an expected residual value of 90,000. The life of the equipment was ested to 6 years. The depreciable cost of the equipment is and out of 00 Pag Select one: a. 450,000 b. 300,000 c. 75,000 d. 540,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started