Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the tax issue presented by the continuity of interest requirement? Facts: Target Corporation has been a publicly-traded company for the last five years.

What is the tax issue presented by the continuity of interest requirement?

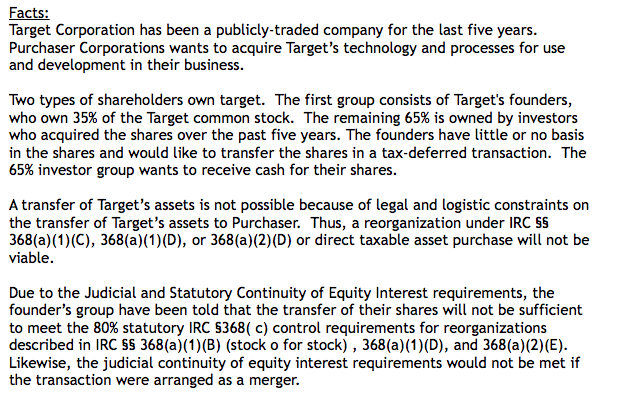

Facts: Target Corporation has been a publicly-traded company for the last five years. Purchaser Corporations wants to acquire Target's technology and processes for use and development in their business. Two types of shareholders own target. The first group consists of Target's founders, who own 35% of the Target common stock. The remaining 65% is owned by investors who acquired the shares over the past five years. The founders have little or no basis in the shares and would like to transfer the shares in a tax-deferred transaction. The 65% investor group wants to receive cash for their shares. A transfer of Target's assets is not possible because of legal and logistic constraints on the transfer of Target's assets to Purchaser. Thus, a reorganization under IRC SS 368(a)(1)(C), 368(a)(1)(D), or 368(a)(2)(D) or direct taxable asset purchase will not be viable. Due to the Judicial and Statutory Continuity of Equity Interest requirements, the founder's group have been told that the transfer of their shares will not be sufficient to meet the 80% statutory IRC $368( c) control requirements for reorganizations described in IRC SS 368(a)(1)(B) (stock o for stock), 368(a)(1)(D), and 368(a)(2)(E). Likewise, the judicial continuity of equity interest requirements would not be met if the transaction were arranged as a merger. Facts: Target Corporation has been a publicly-traded company for the last five years. Purchaser Corporations wants to acquire Target's technology and processes for use and development in their business. Two types of shareholders own target. The first group consists of Target's founders, who own 35% of the Target common stock. The remaining 65% is owned by investors who acquired the shares over the past five years. The founders have little or no basis in the shares and would like to transfer the shares in a tax-deferred transaction. The 65% investor group wants to receive cash for their shares. A transfer of Target's assets is not possible because of legal and logistic constraints on the transfer of Target's assets to Purchaser. Thus, a reorganization under IRC SS 368(a)(1)(C), 368(a)(1)(D), or 368(a)(2)(D) or direct taxable asset purchase will not be viable. Due to the Judicial and Statutory Continuity of Equity Interest requirements, the founder's group have been told that the transfer of their shares will not be sufficient to meet the 80% statutory IRC $368( c) control requirements for reorganizations described in IRC SS 368(a)(1)(B) (stock o for stock), 368(a)(1)(D), and 368(a)(2)(E). Likewise, the judicial continuity of equity interest requirements would not be met if the transaction were arranged as a mergerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started