what is the taxable income?

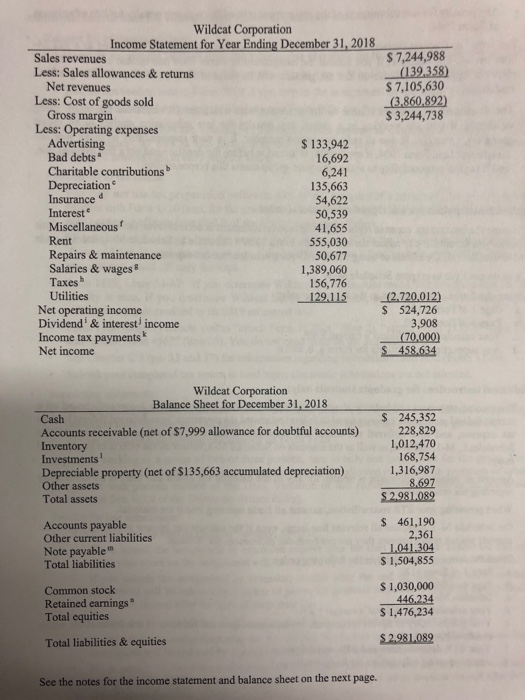

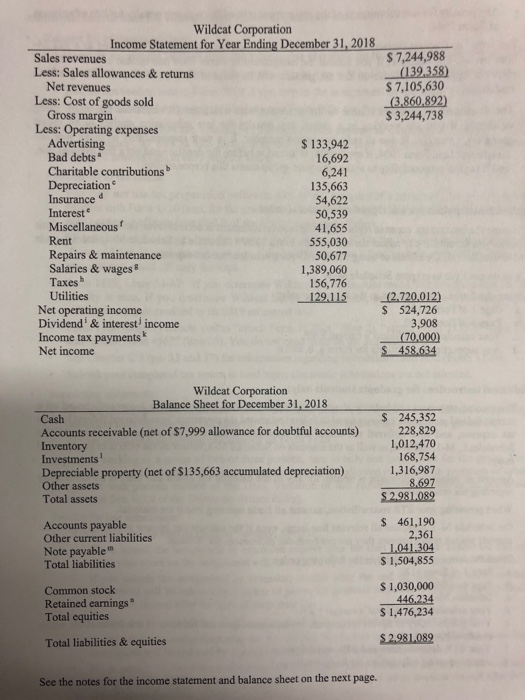

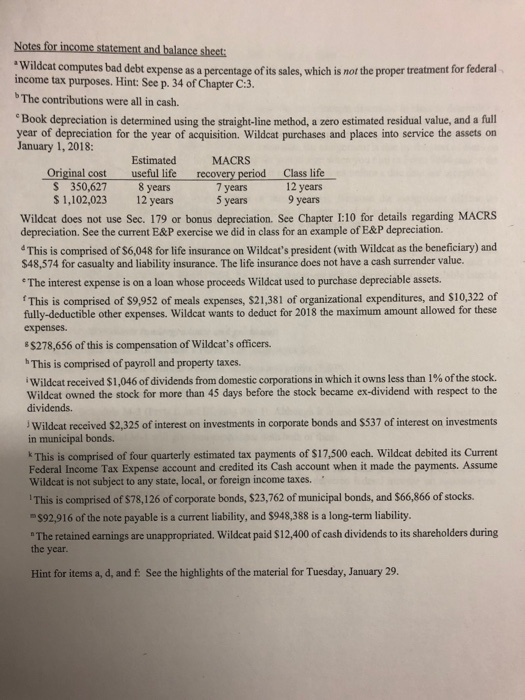

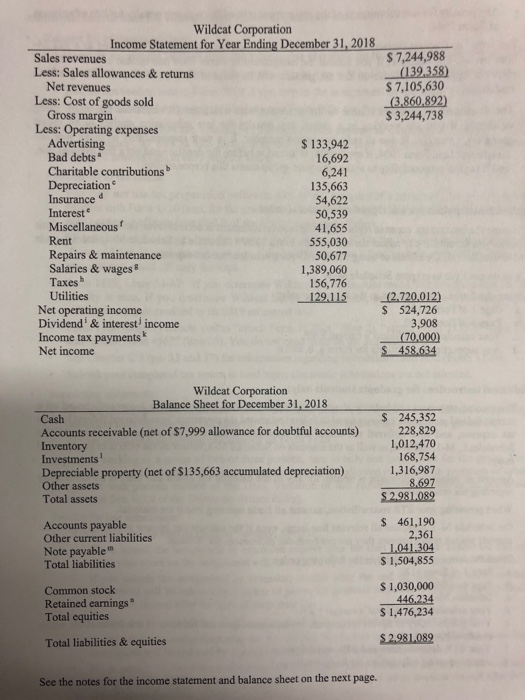

Wildcat Corporation Income Statement for Year Ending December 31,2018 S 7,244,988 (139,35 S 7,105,630 Sales revenues Less: Sales allowances & returns Less: Cost of goods sold Less: Operating expenses Net revenues Gross margin $ 3,244,738 Advertising Bad debts Charitable contributions b Depreciation Insurance Interest Miscellaneous Rent Repairs & maintenance Salaries & wages Taxes Utilities $133,942 16,692 6,241 135,663 54,622 50,539 41,655 555,030 50,677 1,389,060 156,776 d 129.115 (2.720.012) S 524,726 3,908 Net operating income Dividend& interest income Income tax payments Net income Wildcat Corporation Balance Sheet for December 31, 2018 Cash Accounts receivable (net of $7,999 allowance for doubtful accounts) Inventory Investments Depreciable property (net of $135,663 accumulated depreciation) Other assets Total assets S 245,352 228,829 1,012,470 168,754 1,316,987 S2.981089 Accounts payable Other current liabilities Note payable Total liabilities 461,190 2,361 -041.304 S 1,504,855 Common stock Retained earnings Total equities S 1,030,000 S 1,476,234 S2,981,089 Total liabilities & equities See the notes for the income statement and balance sheet on the next page. Wildcat computes bad debt expense as a percentage of its sales, which is not the proper treatment for federal income tax purposes. Hint: See p. 34 of Chapter C:3. The contributions were all in cash. eBook depreciation is determined using the straight-line method, a zero estimated residual value, and a full year of depreciation for the year of acquisition. Wildcat purchases and places into service the assets on January 1, 2018 Original cost S 350,627 $ 1,102,023 Estimated useful life 8 years 12 years MACRS recovery period 7 years 5 years Class life 12 years 9 years Wildcat does not use Sec. 179 or bonus depreciation. See Chapter I:10 for details regarding MACRS depreciation. See the current E&P exercise we did in class for an example of E&P depreciation. dThis is comprised of $6,048 for life insurance on Wildcat's president (with Wildcat as the beneficiary) and S48,574 for casualty and liability insurance. The life insurance does not have a cash surrender value. The interest expense is on a loan whose proceeds Wildcat used to purchase depreciable assets. 'This is comprised of $9,952 of meals expenses, $21,381 of organizational expenditures, and S10,322 of fully-deductible other expenses. Wildcat wants to deduct for 2018 the maximum amount allowed for these expenses. $278,656 of this is compensation of Wildcat's officers. h This is comprised of payroll and property taxes. "Wildcat received $1,046 of dividends from domestic corporations in which it owns less than 1% of the stock. Wildeat owned the stock for more than 45 days before the stock became ex-dividend with respect to the dividends. Wildeat received $2,325 of interest on investments in corporate bonds and $537 of interest on investments in municipal bonds. k This is comprised of four quarterly estimated tax payments of $17,500 each. Wildcat debited its Current Federal Income Tax Expense account and credited its Cash account when it made the payments. Assume Wildeat is not subject to any state, local, or foreign income taxes. This is comprised of $78,126 of corporate bonds, $23,762 of municipal bonds, and $66,866 of stocks. $92,916 of the note payable is a current liability, and $948,388 is a long-term liability The retained earnings are unappropriated. Wildcat paid $12,400 of cash dividends to its shareholders during the year. Hint for items a, d, and f See the highlights of the material for Tuesday, January 29. Wildcat Corporation Income Statement for Year Ending December 31,2018 S 7,244,988 (139,35 S 7,105,630 Sales revenues Less: Sales allowances & returns Less: Cost of goods sold Less: Operating expenses Net revenues Gross margin $ 3,244,738 Advertising Bad debts Charitable contributions b Depreciation Insurance Interest Miscellaneous Rent Repairs & maintenance Salaries & wages Taxes Utilities $133,942 16,692 6,241 135,663 54,622 50,539 41,655 555,030 50,677 1,389,060 156,776 d 129.115 (2.720.012) S 524,726 3,908 Net operating income Dividend& interest income Income tax payments Net income Wildcat Corporation Balance Sheet for December 31, 2018 Cash Accounts receivable (net of $7,999 allowance for doubtful accounts) Inventory Investments Depreciable property (net of $135,663 accumulated depreciation) Other assets Total assets S 245,352 228,829 1,012,470 168,754 1,316,987 S2.981089 Accounts payable Other current liabilities Note payable Total liabilities 461,190 2,361 -041.304 S 1,504,855 Common stock Retained earnings Total equities S 1,030,000 S 1,476,234 S2,981,089 Total liabilities & equities See the notes for the income statement and balance sheet on the next page. Wildcat computes bad debt expense as a percentage of its sales, which is not the proper treatment for federal income tax purposes. Hint: See p. 34 of Chapter C:3. The contributions were all in cash. eBook depreciation is determined using the straight-line method, a zero estimated residual value, and a full year of depreciation for the year of acquisition. Wildcat purchases and places into service the assets on January 1, 2018 Original cost S 350,627 $ 1,102,023 Estimated useful life 8 years 12 years MACRS recovery period 7 years 5 years Class life 12 years 9 years Wildcat does not use Sec. 179 or bonus depreciation. See Chapter I:10 for details regarding MACRS depreciation. See the current E&P exercise we did in class for an example of E&P depreciation. dThis is comprised of $6,048 for life insurance on Wildcat's president (with Wildcat as the beneficiary) and S48,574 for casualty and liability insurance. The life insurance does not have a cash surrender value. The interest expense is on a loan whose proceeds Wildcat used to purchase depreciable assets. 'This is comprised of $9,952 of meals expenses, $21,381 of organizational expenditures, and S10,322 of fully-deductible other expenses. Wildcat wants to deduct for 2018 the maximum amount allowed for these expenses. $278,656 of this is compensation of Wildcat's officers. h This is comprised of payroll and property taxes. "Wildcat received $1,046 of dividends from domestic corporations in which it owns less than 1% of the stock. Wildeat owned the stock for more than 45 days before the stock became ex-dividend with respect to the dividends. Wildeat received $2,325 of interest on investments in corporate bonds and $537 of interest on investments in municipal bonds. k This is comprised of four quarterly estimated tax payments of $17,500 each. Wildcat debited its Current Federal Income Tax Expense account and credited its Cash account when it made the payments. Assume Wildeat is not subject to any state, local, or foreign income taxes. This is comprised of $78,126 of corporate bonds, $23,762 of municipal bonds, and $66,866 of stocks. $92,916 of the note payable is a current liability, and $948,388 is a long-term liability The retained earnings are unappropriated. Wildcat paid $12,400 of cash dividends to its shareholders during the year. Hint for items a, d, and f See the highlights of the material for Tuesday, January 29