Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paramount Limited purchased 80% of the issued ordinary share capital of Star Limited four years ago, when the retained earnings of Star Limited were

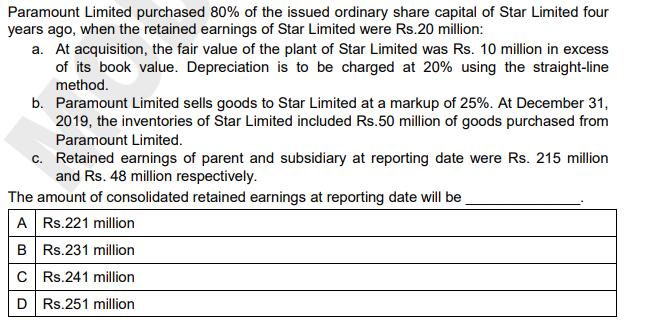

Paramount Limited purchased 80% of the issued ordinary share capital of Star Limited four years ago, when the retained earnings of Star Limited were Rs.20 million: a. At acquisition, the fair value of the plant of Star Limited was Rs. 10 million in excess of its book value. Depreciation is to be charged at 20% using the straight-line method. b. Paramount Limited sells goods to Star Limited at a markup of 25%. At December 31, 2019, the inventories of Star Limited included Rs.50 million of goods purchased from Paramount Limited. c. Retained earnings of parent and subsidiary at reporting date were Rs. 215 million and Rs. 48 million respectively. The amount of consolidated retained earnings at reporting date will be A Rs.221 million B Rs.231 million C Rs.241 million D Rs.251 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The answer is C Rs241 million Paramount Limited owns 80 of Star Limited The plant of Star Limited wa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started