Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the total cash receipts during the month of May? What is the total payment for the cost of goods manufactured for the month

What is the total cash receipts during the month of May?

What is the total cash receipts during the month of May?

What is the total payment for the cost of goods manufactured for the month of June?

What is the total cash disbursements during the month of July

What is the forecasted cash balance at the end of May?

In order to maintain the minimum cash balance of $50,000, how much (in cumulative amount) would have to be borrowed at the end of August?

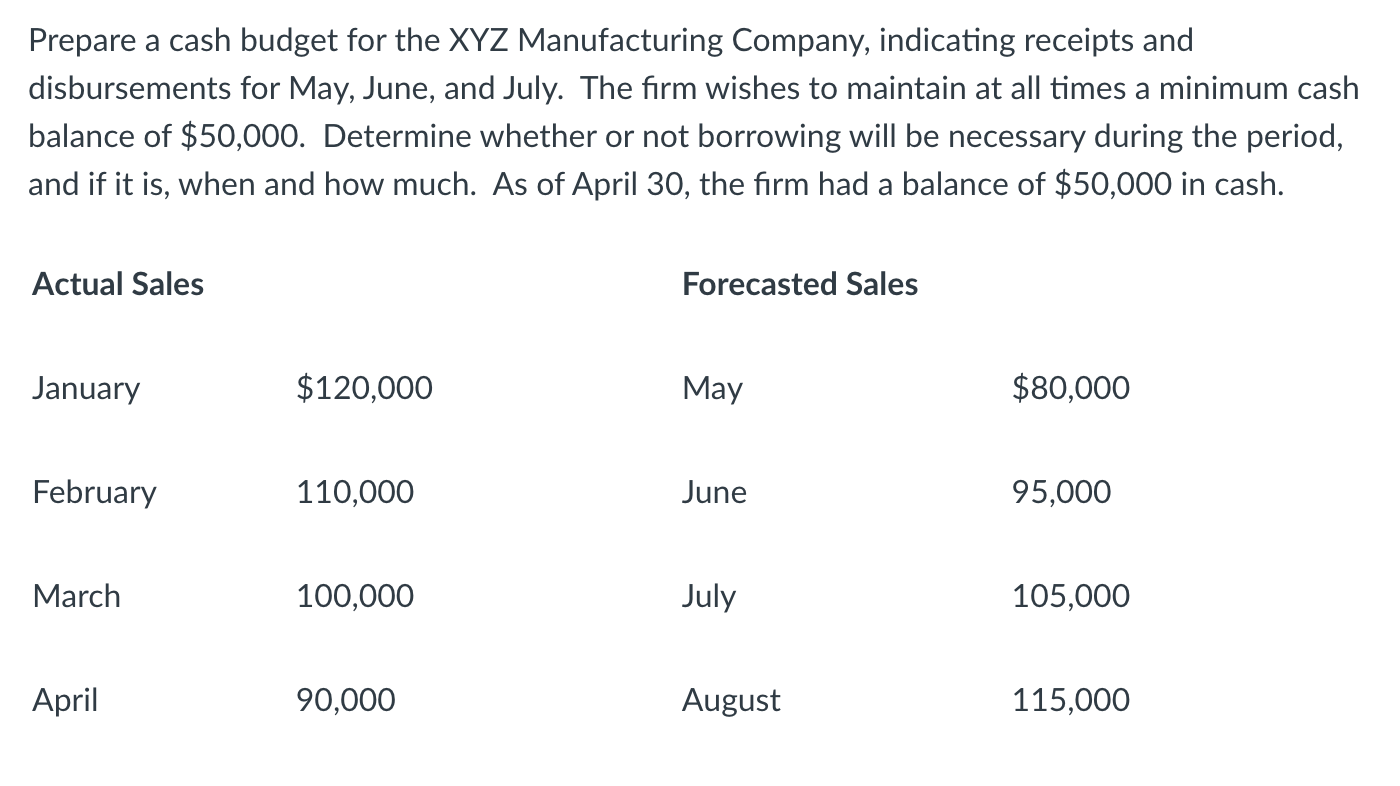

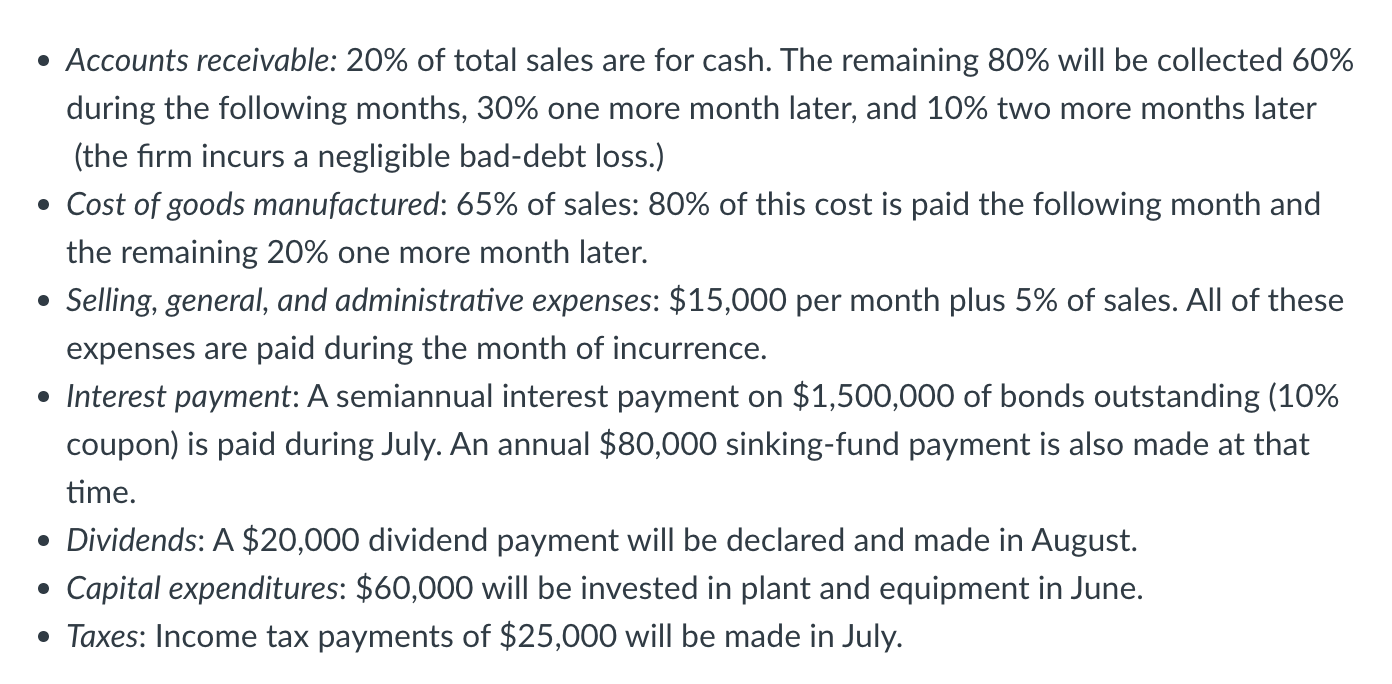

Prepare a cash budget for the XYZ Manufacturing Company, indicating receipts and disbursements for May, June, and July. The firm wishes to maintain at all times a minimum cash balance of $50,000. Determine whether or not borrowing will be necessary during the period, and if it is, when and how much. As of April 30, the firm had a balance of $50,000 in cash. Actual Sales Forecasted Sales January $120,000 May $80,000 February 110,000 June 95,000 March 100,000 July 105,000 April 90,000 August 115,000 Accounts receivable: 20% of total sales are for cash. The remaining 80% will be collected 60% during the following months, 30% one more month later, and 10% two more months later (the firm incurs a negligible bad-debt loss.) Cost of goods manufactured: 65% of sales: 80% of this cost is paid the following month and the remaining 20% one more month later. Selling, general, and administrative expenses: $15,000 per month plus 5% of sales. All of these expenses are paid during the month of incurrence. Interest payment: A semiannual interest payment on $1,500,000 of bonds outstanding (10% coupon) is paid during July. An annual $80,000 sinking-fund payment is also made at that time. Dividends: A $20,000 dividend payment will be declared and made in August. Capital expenditures: $60,000 will be invested in plant and equipment in June. Taxes: Income tax payments of $25,000 will be made in July. Prepare a cash budget for the XYZ Manufacturing Company, indicating receipts and disbursements for May, June, and July. The firm wishes to maintain at all times a minimum cash balance of $50,000. Determine whether or not borrowing will be necessary during the period, and if it is, when and how much. As of April 30, the firm had a balance of $50,000 in cash. Actual Sales Forecasted Sales January $120,000 May $80,000 February 110,000 June 95,000 March 100,000 July 105,000 April 90,000 August 115,000 Accounts receivable: 20% of total sales are for cash. The remaining 80% will be collected 60% during the following months, 30% one more month later, and 10% two more months later (the firm incurs a negligible bad-debt loss.) Cost of goods manufactured: 65% of sales: 80% of this cost is paid the following month and the remaining 20% one more month later. Selling, general, and administrative expenses: $15,000 per month plus 5% of sales. All of these expenses are paid during the month of incurrence. Interest payment: A semiannual interest payment on $1,500,000 of bonds outstanding (10% coupon) is paid during July. An annual $80,000 sinking-fund payment is also made at that time. Dividends: A $20,000 dividend payment will be declared and made in August. Capital expenditures: $60,000 will be invested in plant and equipment in June. Taxes: Income tax payments of $25,000 will be made in JulyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started