Answered step by step

Verified Expert Solution

Question

1 Approved Answer

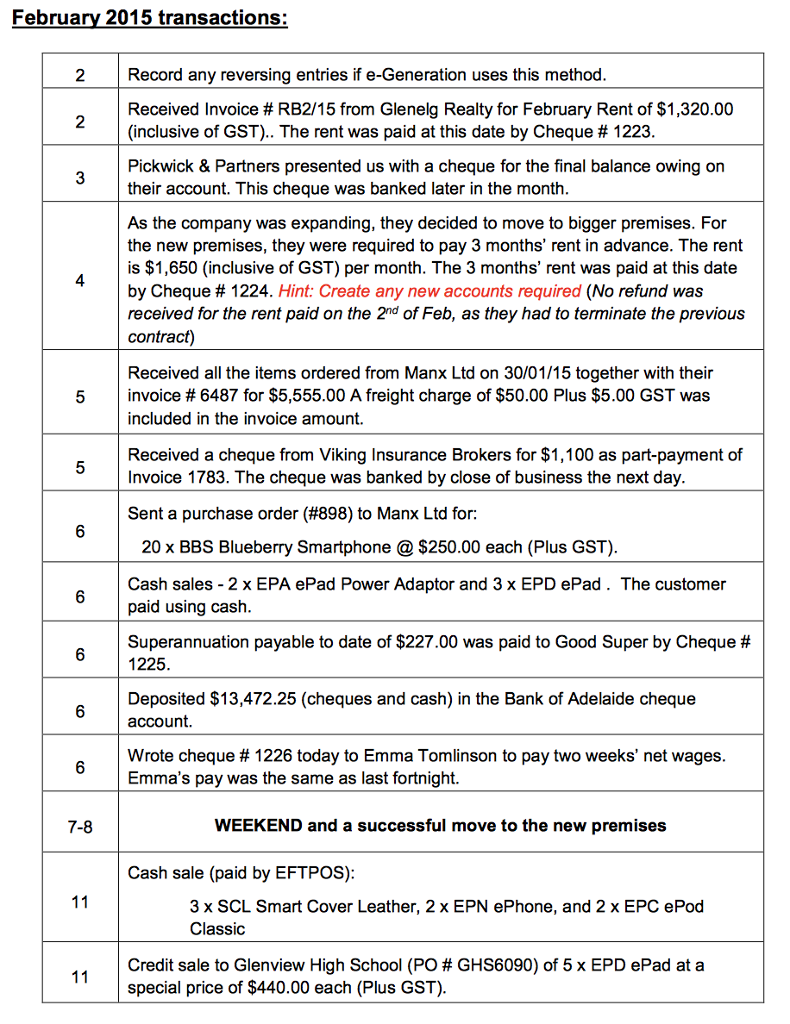

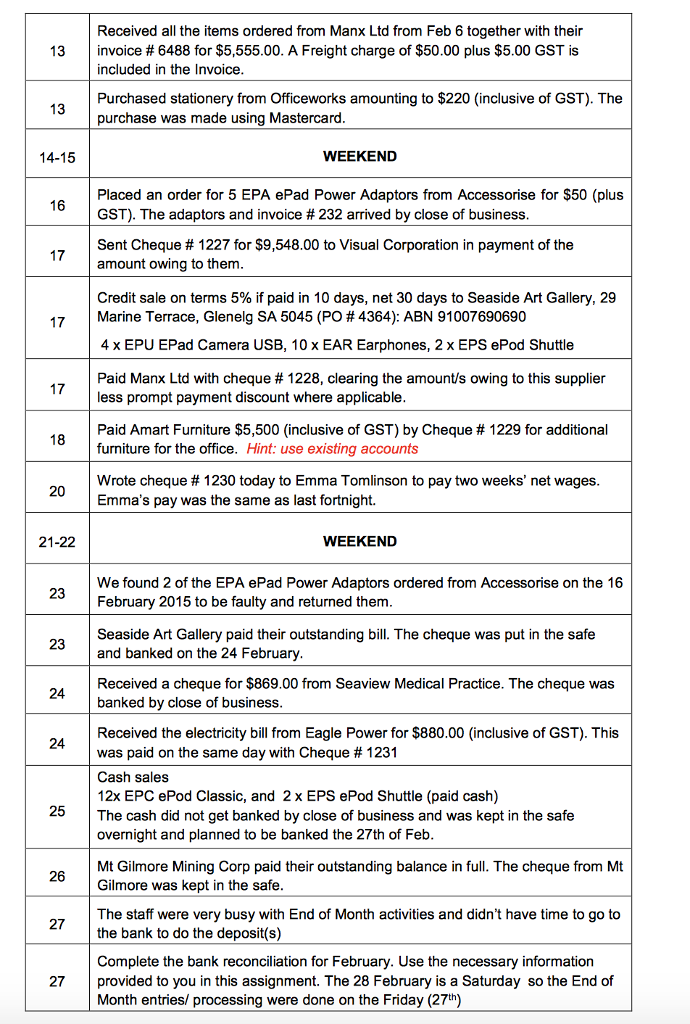

what is the trial balance for this February transaction February 2015 transactions Record any reversing entries if e-Generation uses this method Received invoice RB2/15 from

what is the trial balance for this February transaction

February 2015 transactions Record any reversing entries if e-Generation uses this method Received invoice RB2/15 from Glenelg Realty for February Rent of $1,320.00 (inclusive of GST).. The rent was paid at this date by Cheque 1223 Pickwick & Partners presented us with a cheque for the final balance owing on their account. This cheque was banked later in the month. As the company was expanding, they decided to move to bigger premises. For the new premises, they were required to pay 3 months' rent in advance. The rent is $1,650 (inclusive of GST) per month. The 3 months' rent was paid at this date by Cheque 1224. Hint: Create any new accounts required (No refund was received for the rent paid on the 2nd of Feb, as they had to terminate the previous contract) Received all the items ordered from Manx Ltd on 30/01/15 together with their 5 invoice 6487 for $5,555.00 A freight charge of $50.00 Plus $5.00 GST was included in the invoice amount. Received a cheque from Viking Insurance Brokers for $1,100 as part-payment of Invoice 1783. The cheque was banked by close of business the next day Sent a purchase order (#898) to Manx Ltd for 20 x BBS Blueberry Smartphone $250.00 each (Plus GST). Cash sales 2x EPA ePad Power Adaptor and 3x EPD ePad The customer paid using cash. Superannuation payable to date of $227.00 was paid to Good Super by Cheque 1225 Deposited $13,472.25 (cheques and cash) in the Bank of Adelaide cheque account Wrote cheque 1226 today to Emma Tomlinson to pay two weeks' net wages. Emma's pay was the same as last fortnight. WEEKEND and a successful move to the new premises 7-8 Cash sale (paid by EFTPOS) 11 3 x SCL Smart Cover Leather, 2 x EPN ePhone, and 2 x EPC ePod Classic Credit sale to Glenview High School (PO GHS6090) of 5 x EPD ePad at a 11 special price of $440.00 each (Plus GST) February 2015 transactions Record any reversing entries if e-Generation uses this method Received invoice RB2/15 from Glenelg Realty for February Rent of $1,320.00 (inclusive of GST).. The rent was paid at this date by Cheque 1223 Pickwick & Partners presented us with a cheque for the final balance owing on their account. This cheque was banked later in the month. As the company was expanding, they decided to move to bigger premises. For the new premises, they were required to pay 3 months' rent in advance. The rent is $1,650 (inclusive of GST) per month. The 3 months' rent was paid at this date by Cheque 1224. Hint: Create any new accounts required (No refund was received for the rent paid on the 2nd of Feb, as they had to terminate the previous contract) Received all the items ordered from Manx Ltd on 30/01/15 together with their 5 invoice 6487 for $5,555.00 A freight charge of $50.00 Plus $5.00 GST was included in the invoice amount. Received a cheque from Viking Insurance Brokers for $1,100 as part-payment of Invoice 1783. The cheque was banked by close of business the next day Sent a purchase order (#898) to Manx Ltd for 20 x BBS Blueberry Smartphone $250.00 each (Plus GST). Cash sales 2x EPA ePad Power Adaptor and 3x EPD ePad The customer paid using cash. Superannuation payable to date of $227.00 was paid to Good Super by Cheque 1225 Deposited $13,472.25 (cheques and cash) in the Bank of Adelaide cheque account Wrote cheque 1226 today to Emma Tomlinson to pay two weeks' net wages. Emma's pay was the same as last fortnight. WEEKEND and a successful move to the new premises 7-8 Cash sale (paid by EFTPOS) 11 3 x SCL Smart Cover Leather, 2 x EPN ePhone, and 2 x EPC ePod Classic Credit sale to Glenview High School (PO GHS6090) of 5 x EPD ePad at a 11 special price of $440.00 each (Plus GST)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started