Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is the unclear part? Check my w c. What is the effective 2-year Interest rate on the effective 3-year-ahead forward loan? (Round your answer

what is the unclear part?

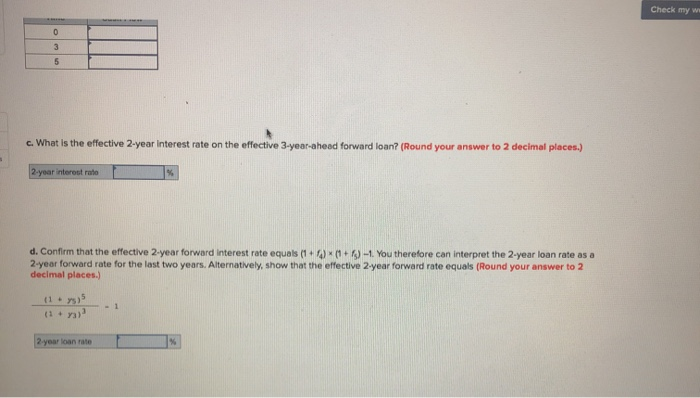

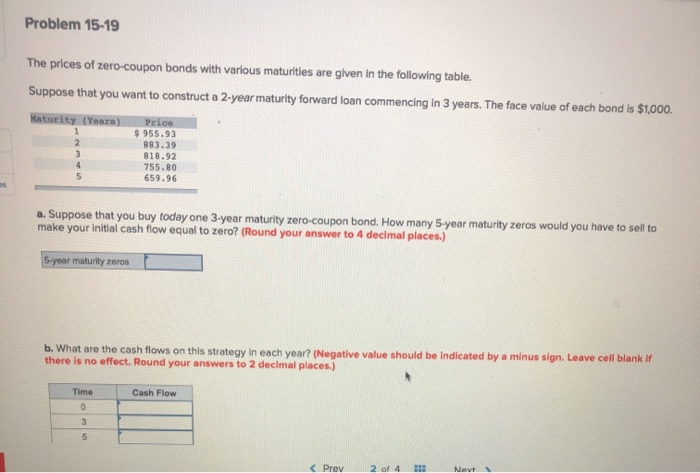

Check my w c. What is the effective 2-year Interest rate on the effective 3-year-ahead forward loan? (Round your answer to 2 decimal places.) 2-year interest rate d. Confirm that the effective 2-year forward interest rate equals (1+4)*(1 + (s)-1. You therefore can interpret the 2-year loan rate as a 2-year forward rate for the last two years. Alternatively, show that the effective 2 year forward rate equals (Round your answer to 2 decimal places.) (1 ) 2 your loan rate Problem 15-19 The prices of zero-coupon bonds with various maturities are given in the following table. Suppose that you want to construct a 2-year maturity forward loan commencing in 3 years. The face value of each bond is $1,000. Maturity Years) Price $ 955.93 883.39 818.92 755.80 659.96 a. Suppose that you buy today one 3-year maturity zero-coupon bond. How many 5-year maturity zeros would you have to sell to make your initial cash flow equal to zero? (Round your answer to 4 decimal places.) 5-year maturity zeros b. What are the cash flows on this strategy in each year? (Negative value should be indicated by a minus sign. Leave cell blank if there is no effect. Round your answers to 2 decimal places.) Time Cash Flow Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started