Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is the value of the derivative asset as of December 31, 2022? On January 1, 2020, ABC Co. borrowed P5,000,000 from a bank at

what is the value of the derivative asset as of December 31, 2022?

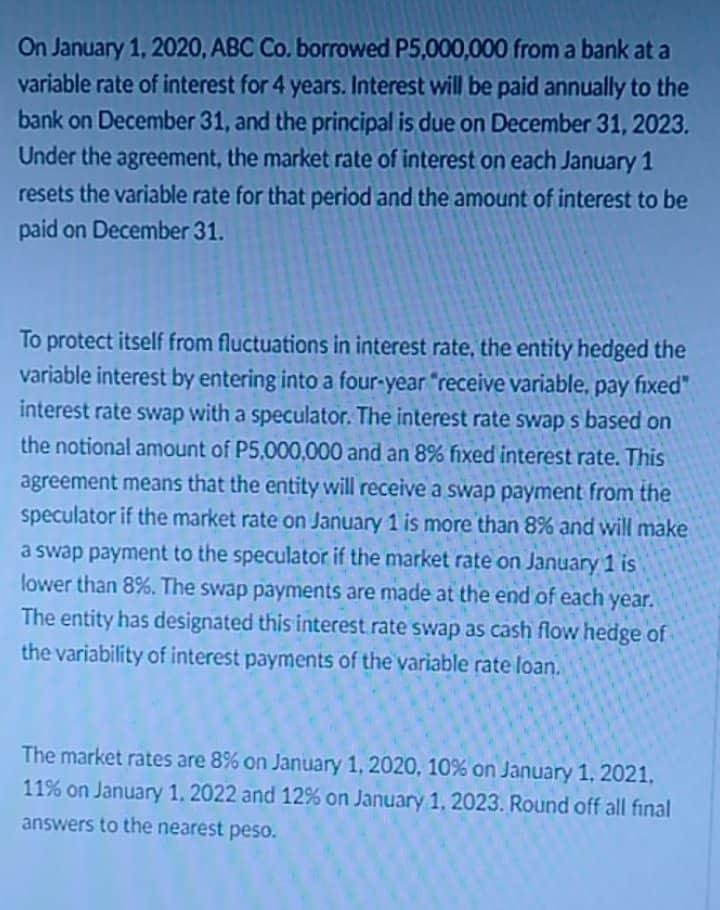

On January 1, 2020, ABC Co. borrowed P5,000,000 from a bank at a variable rate of interest for 4 years. Interest will be paid annually to the bank on December 31, and the principal is due on December 31, 2023. Under the agreement, the market rate of interest on each January 1 resets the variable rate for that period and the amount of interest to be paid on December 31. To protect itself from fluctuations in interest rate, the entity hedged the variable interest by entering into a four-year "receive variable, pay fixed" interest rate swap with a speculator. The interest rate swap s based on the notional amount of P5,000,000 and an 8% fixed interest rate. This agreement means that the entity will receive a swap payment from the speculator if the market rate on January 1 is more than 8% and will make a swap payment to the speculator if the market rate on January 1 is lower than 8%. The swap payments are made at the end of each year. The entity has designated this interest rate swap as cash flow hedge of the variability of interest payments of the variable rate loan. The market rates are 8% on January 1, 2020, 10% on January 1, 2021, 11% on January 1, 2022 and 12% on January 1, 2023. Round off all final answers to the nearest peso. On January 1, 2020, ABC Co. borrowed P5,000,000 from a bank at a variable rate of interest for 4 years. Interest will be paid annually to the bank on December 31, and the principal is due on December 31, 2023. Under the agreement, the market rate of interest on each January 1 resets the variable rate for that period and the amount of interest to be paid on December 31. To protect itself from fluctuations in interest rate, the entity hedged the variable interest by entering into a four-year "receive variable, pay fixed" interest rate swap with a speculator. The interest rate swap s based on the notional amount of P5,000,000 and an 8% fixed interest rate. This agreement means that the entity will receive a swap payment from the speculator if the market rate on January 1 is more than 8% and will make a swap payment to the speculator if the market rate on January 1 is lower than 8%. The swap payments are made at the end of each year. The entity has designated this interest rate swap as cash flow hedge of the variability of interest payments of the variable rate loan. The market rates are 8% on January 1, 2020, 10% on January 1, 2021, 11% on January 1, 2022 and 12% on January 1, 2023. Round off all final answers to the nearest pesoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started