Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is the vook value of the machine they own at the end of year 1? Vector Corporation purchased a machine on January 1, 2019,

what is the vook value of the machine they own at the end of year 1?

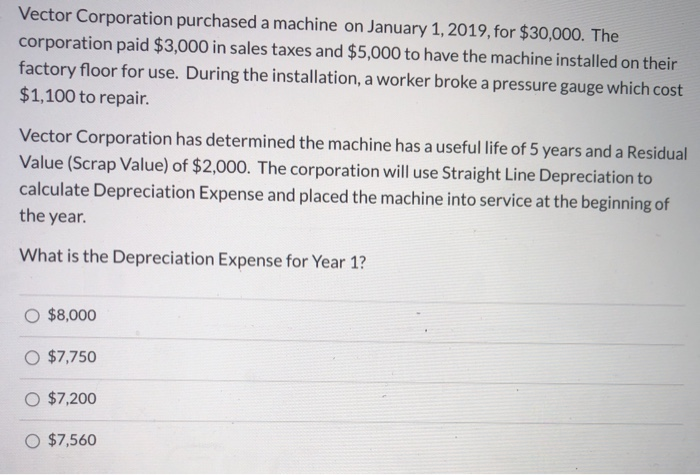

Vector Corporation purchased a machine on January 1, 2019, for $30,000. The corporation paid $3,000 in sales taxes and $5,000 to have the machine installed on their factory floor for use. During the installation, a worker broke a pressure gauge which cost $1,100 to repair Vector Corporation has determined the machine has a useful life of 5 years and a Residual Value (Scrap Value) of $2,000. The corporation will use Straight Line Depreciation to calculate Depreciation Expense and placed the machine into service at the beginning of the year. What is the Depreciation Expense for Year 1? $8,000 $7,750 O $7,200 $7,560 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started