Question

: What is the WACC for Marriotts contract services division? Hint: the asset beta of the whole company is just a weighted average of the

: What is the WACC for Marriotts contract services division? Hint: the asset beta of the whole company is just a weighted average of the asset betas of the divisions.

This is based off of this case study:

Marriott Corporation: The Cost of Capital (Abridged)

In April 1988, Dan Cohrs, vice president of project finance at the Marriott Corporation, was preparing his annual recommendations for the hurdle rates at each of the firms three divisions. Investment projects at Marriott were selected by discounting the appropriate cash flows by the appropriate hurdle rate for each division.

In 1987, Marriotts sales grew by 24% and its return on equity (ROE) stood at 22%. Sales and earnings per share had doubled over the previous four years, and the operating strategy was aimed at continuing this trend. Marriotts 1987 annual report stated that:

We intend to remain a premier growth company. This means aggressively developing appropriate opportunities within our chosen lines of businesslodging, contract services, and related businesses. In each of these areas, our goal is to be the preferred employer, the preferred provider, and the most profitable company.

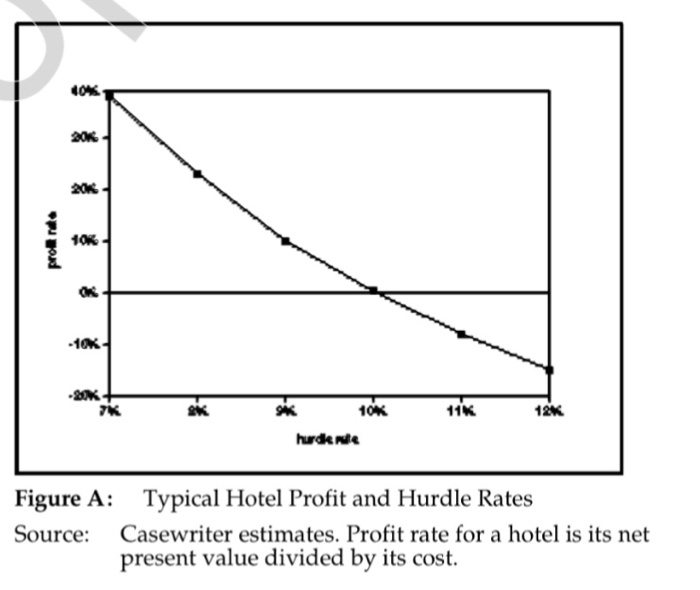

Cohrs recognized that the divisional hurdle rates at Marriott would have a significant impact on the firms financial and operating strategies. As a rule of thumb, increasing the hurdle rate by 1% (for example, from 12% to 12.12%), decreased the present value of project inflows by 1%. Because costs remained roughly fixed, these changes in the value of inflows translated into changes in the net present value of projects. Figure A shows the substantial impact of hurdle rates on the anticipated net present value of projects. If hurdle rates were to increase, Marriotts growth would be reduced as once profitable projects no longer met the hurdle rates. Conversely, if hurdle rates decreased, Marriotts growth would accelerate.

Marriott also considered using the hurdle rates to determine incentive compensation. Annual incentive compensation constituted a significant portion of total compensation, ranging from 30% to 50% of base pay. Criteria for bonus awards depended on specific job responsibilities but often included the earnings level, the ability of managers to meet budgets, and overall corporate performance. There was some interest, however, in basing the incentive compensation, in part, on a comparison of the divisional return on net assets and the market-based divisional hurdle rate. The compensation plan would then reflect hurdle rates, making managers more sensitive to Marriotts financial strategy and capital market conditions.

Company Background

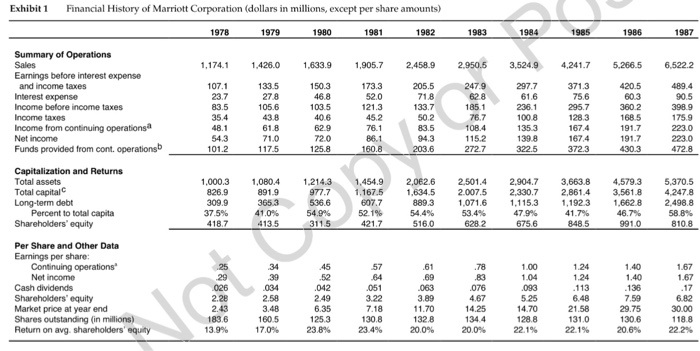

Marriott Corporation began in 1927 with J. Willard Marriotts root beer stand. Over the next 60 years, the business grew into one of the leading lodging and food service companies in the United States. Marriotts 1987 profits were $223 million on sales of $6.5 billion. See Exhibit 1 for a summary of Marriotts financial history.

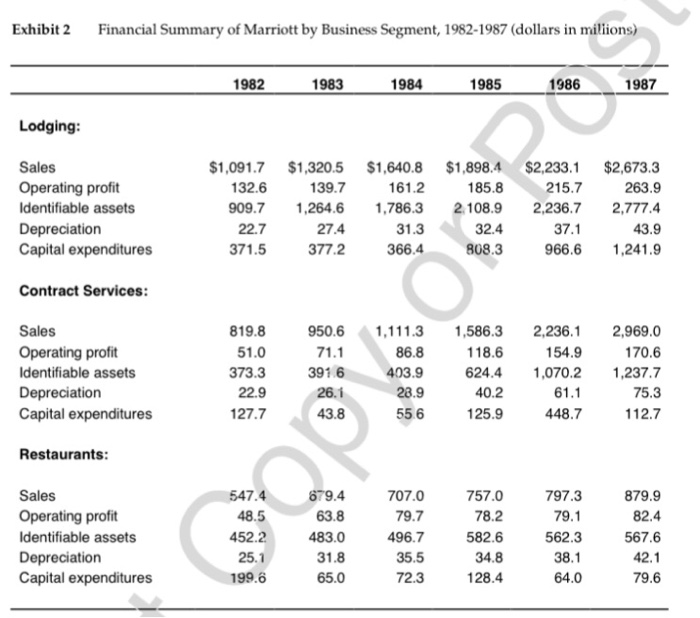

Marriott had three major lines of business: lodging, contract services, and restaurants. Exhibit 2 summarizes its line-of-business data. Lodging operations included 361 hotels, with more than 100,000 rooms in total. Hotels ranged from the full-service, high-quality Marriott hotels and suites to the moderately priced Fairfield Inn. Lodging generated 41% of 1987 sales and 51% of profits.

Contract services provided food and services management to health-care and educational institutions and corporations. It also provided airline catering and airline services through its Marriott In-Flite Services and Host International operations. Contract services generated 46% of 1987 sales and 33% of profits.

Marriotts restaurants included Bobs Big Boy, Roy Rogers, and Hot Shoppes. Restaurants provided 13% of 1987 sales and 16% of profits.

Financial Strategy

The four key elements of Marriotts financial strategy were:

Manage rather than own hotel assets;

Invest in projects that increase shareholder value;

Optimize the use of debt in the capital structure; and

Repurchase undervalued shares.

Manage rather than own hotel assets In 1987, Marriott developed more than $1 billion worth of hotel properties, making it one of the ten largest commercial real estate developers in the United States. With a fully integrated development process, Marriott identified markets, created development plans, designed projects, and evaluated potential profitability.

After development, the company sold the hotel assets to limited partners while retaining operating control as the general partner under a long-term management contract. Management fees typically equalled 3% of revenues plus 20% of the profits before depreciation and debt service. The 3% of revenues usually covered the overhead cost of managing the hotel. Marriotts 20% of profits before depreciation and debt service often required it to stand aside until investors earned a prespecified return. Marriott also guaranteed a portion of the partnerships debt. During 1987, three Marriott hotels and 70 Courtyard hotels were syndicated for $890 million. In total, the company operated about $7 billion worth of syndicated hotels.

Invest in projects that increase shareholder value The company used discounted cash flow techniques to evaluate potential investments. The hurdle rate assigned to a specific project was based on market interest rates, project risk, and estimates of risk premiums. Cash flow forecasts incorporated standard companywide assumptions that instilled some consistency across projects. As one Marriott executive put it:

Our projects are like a lot of similar little boxes. This similarity disciplines the pro forma analysis. There are corporate macro data on inflation, margins, project lives, terminal values, percent of sales required to remodel, and so on. Projects are audited throughout their lives to check and update these standard pro forma template assumptions. Divisional managers still have discretion over unit-specific assumptions, but they must conform to the corporate templates.

Optimize the use of debt in the capital structure Marriott determined the amount of debt in its capital structure by focusing on its ability to service its debt. It used an interest coverage target instead of a target debt-to-equity ratio. In 1987, Marriott had about $2.5 billion of debt, 59% of its total capital.

Repurchase undervalued shares Marriott regularly calculated a warranted equity value for its common shares and was committed to repurchasing its stock whenever its market price fell substantially below that value. The warranted equity value was calculated by discounting the firms equity cash flows by its equity cost of capital. It was checked by comparing Marriotts stock price with that of comparable companies using price/earnings ratios for each business and by valuing each business under alternative ownership structures, such as a leveraged buyout. Marriott had more confidence in its measure of warranted value than in the day-to-day market price of its stock. A gap between warranted value and market price, therefore, usually triggered repurchases instead of a revision in the warranted value by, for example, revising the hurdle rate. Furthermore, the company believed that repurchases of shares below warranted equity value were a better use of its cash flow and debt capacity than acquisitions or owning real estate. In 1987, Marriott repurchased 13.6 million shares of its common stock for $429 million.

The Cost of Capital

Marriott measured the opportunity cost of capital for investments of similar risk using the Weighted Average Cost of Capital (WACC) as:

WACC = (1 - ?)r- (D/V) +r- (E/V) DE

where D and E are the market value of the debt and equity, respectively, r -D is the pretax cost of debt, is the after-tax cost of equity, and V is the value of the firm. (V = D+E), and ? is the corporate tax rate. Marriott used this approach to determine the cost of capital for the corporation as a whole and E

for each division.

To determine the opportunity cost of capital, Marriott required three inputs: debt capacity, debt cost, and equity cost consistent with the amount of debt. The cost of capital varied across the three divisions because all three of the cost-of-capital inputs could differ for each division. The cost of capital for each division was updated annually.

Debt capacity and the cost of debt Marriott applied its coverage-based financing policy to each of its divisions. It also determined for each division the fraction of debt that should be floating rate debt based on the sensitivity of the divisions cash flows to interest rate changes. The interest rate on floating rate debt changed as interest rates changed. If cash flows increased as the interest rate increased, using floating rate debt expanded debt capacity.

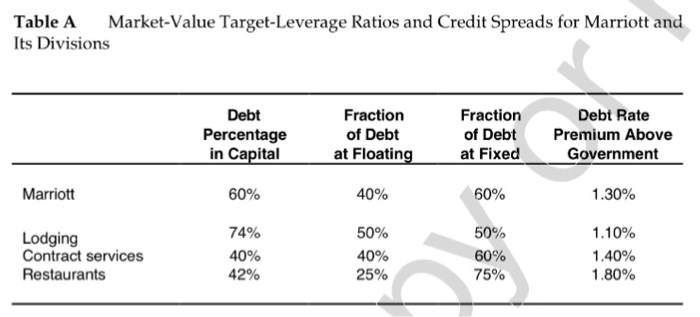

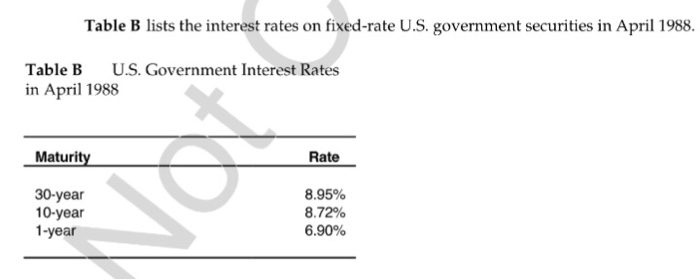

In April 1988, Marriotts unsecured debt was A-rated. As a high-quality corporate risk, Marriott could expect to pay a spread above the current government bond rates. It based the debt cost for each division on an estimate of the divisions debt cost as an independent company. The spread between the debt rate and the government bond rate varied by division because of differences in risk. Table A provides the market value target leverage rates, the fraction of the debt at floating rate, the fraction at fixed rates, and the credit spread for Marriott as a whole and for each division. The credit spread was the debt rate premium above the government rate required to induce investors to lend money to Marriott.

The cost of equity

Because lodging assets, like hotels, had long useful lives, Marriott used the cost of long-term debt for its lodging cost-of-capital calculations. It used shorter-term debt as the cost of debt for its restaurant and contract services divisions because those assets had shorter useful lives.

The cost of equity Marriott recognized that meeting its financial strategy of embarking only on projects that increased shareholder values meant that it had to use its shareholders measure of equity costs. Marriott used the Capital Asset Pricing Model (CAPM) to estimate the cost of equity. The CAPM, originally developed by John Lintner and William Sharpe in the early 1960s, had gained wide acceptance among financial professionals. According to the CAPM, the cost of equity, or, equivalently, the expected return for equity, was determined as:

expected return = r = riskless rate + beta * [risk premium]

where the risk premium is the difference between the expected return on the market portfolio and the riskless rate.

The key insight in the CAPM was that risk should be measured relative to a fully diversified portfolio of risky assets such as common stocks. The simple adage Dont put all your eggs in one basket dictated that investors could minimize their risks by holding assets in fully diversified portfolios. An assets risk was not measured as its individual risk. Instead, the assets contribution to the risk of a fully diversified or market portfolio was what mattered. This risk, usually called systematic risk, was measured by the beta coefficient.

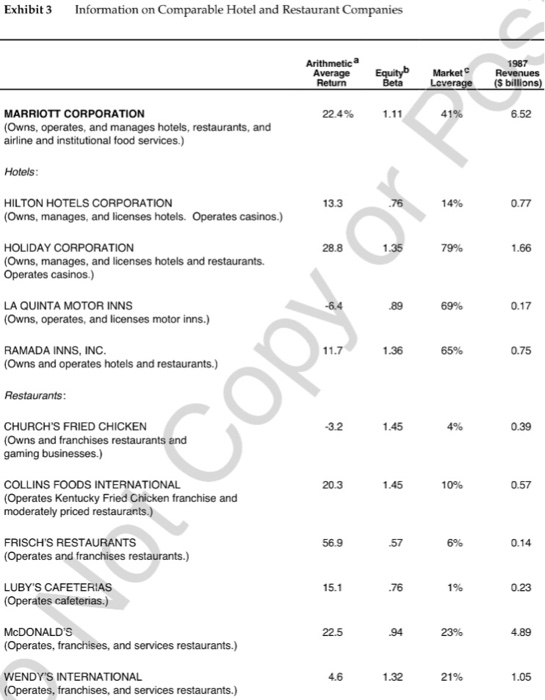

Betas could be calculated from historical data on common stock returns using simple linear regression analysis. Marriotts beta, calculated using five years of monthly stock returns was 1.11.

Two problems limited the use of the historical estimates of beta in calculating the hurdle rates for projects. First, corporations generally had multiple lines of business. A companys beta, therefore, was a weighted average of the betas of its different lines of business. Second, leverage affected beta. Adding debt to a firm increased its equity beta even if the riskiness of the firms assets remained unchanged, because the safest cash flows went to the debt holders. As debt increased, the cash flows remaining for stockholders became more risky. The historical beta of a firm, therefore, had to be interpreted and adjusted before it could be used as a projects beta, unless the project had the same risk and the same leverage as the firm overall.

Exhibit 3 contains the beta, leverage, and other related information for Marriott and potentially comparable companies in the lodging and restaurant businesses.

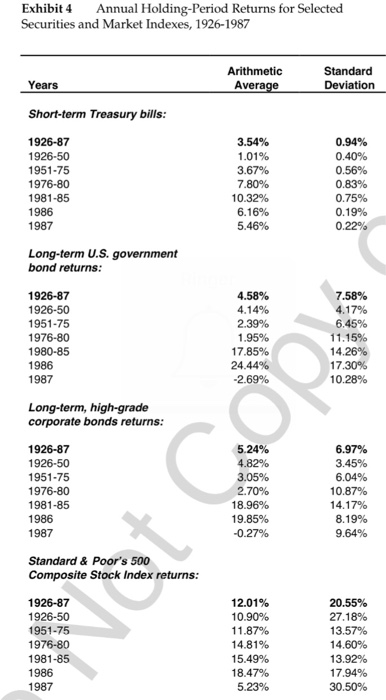

To select the appropriate risk premium to use in the hurdle rate calculations, Cohrs examined a variety of data on the stock and bond markets. Exhibit 4 provides historical information on the holding-period returns on government and corporate bonds and the S&P 500 Composite Index of common stocks. Holding-period returns were the returns realized by the security holder, including any cash payment (e.g., dividends for common stocks, coupons for bonds) received by the holder plus any capital gain or loss on the security. As examples, the 5.23% holding-period return for the S&P 500 Composite Index of common stocks in 1987 was the sum of the dividend yield of 3.20% and the capital gain of 2.03%. The -2.69% holding-period return for the index of long-term U.S. government bonds in 1987 was the sum of the coupon yield of 7.96% and a capital gain of -10.65%.1

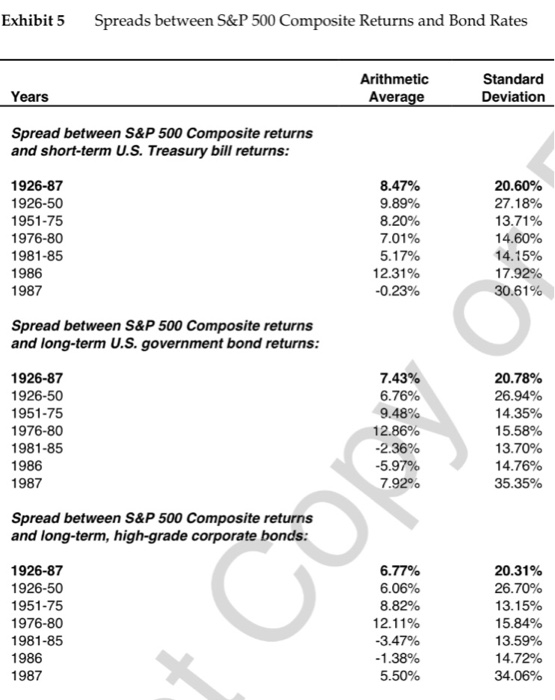

Exhibit 5 provides statistics on the spread between the S&P 500 Composite Returns and the holding-period returns on U.S. government bills, U.S. government bonds, and high-grade, long-term corporate bonds. Cohrs was concerned about the correct time interval to measure these averages, especially given the high returns and volatility of the bond markets shown in Exhibits 4 and 5.

-

-

-

-

What is the Wacc, cost of debt, cost of equity and the equity beta

20K 20S OK 8X 41K 12K 40K 7K Figure A: Typical Hotel Profit and Hurdle Rates Source: Casewriter estimates. Profit rate for a hotel is its net present value divided by its cost. Table A Market-Value Target-Leverage Ratios and Credit Spreads for Marriott and Its Divisions Debt Percentage in Capital Fraction of Debt at Floatin Fraction of Debt at Fixed Debt Rate Premium Above Government 40% Marriott 60% 60% 1.30% 1.10% 1.40% 1.80% 74% 40% 42% 50% 60% 75% Lodging Contract services Restaurants 40% 25% Table B lists the interest rates on fixed-rate U.S. government securities in April 1988. Table B U.S. Government Interest Rates in April 1988 Maturity Rate 30-year 10-year 1-year 8.95% 8.72% 6.90% Exhibit 1 Financial History of Marriott Corporation (dollars in millions, except per share amounts) 1982 1985 1987 50.5 3.524.9 4241.7 52665 6.522.2 174. 1.426.0 1,633.9 1,905.7 2,458.9 2 expense Funds provided from cont. operationsb ,000.3 ,080.4 214.31,454.92,062.6 2.501.42,904.7 3,663.8 4,579.3 5,370.5 977.7 1.167.5 1,634.5 2.007.5 2,330.72,861.4 3,5618 4,247.8 Per Share and Other Data 30.00 Shares outstanding (in millions) 23.8% 23 4% 20.0% 22.1% 22.2% Exhibit 2 Financial Summary of Marriott by Business Segment, 1982-1987 (dollars in miliions) 1982 1983 1984 1985 1986 1987 Lodging Sales Operating profit Identifiable assets Depreciation Capital expenditures 1,091.7$1,320.5 $1,640.8 $1,898.4 $2,233. $2,673.3 263.9 909.71,264.6 1,786.3 2.108.92,236.7 2,777.4 43.9 966.6,241.9 132.6 39.7 161.2 185.8 215.7 31.3 366.4 32.4 808.3 22.7 371.5 27.4 377.2 37.1 Contract Services: 819.8 51.0 373.3 22.9 127.7 Sales Operating profit Identifiable assets Depreciation Capital expenditures 950.61,111.3 1,586.3 2,236. 2,969.0 170.6 54.9 118.6 624.41,070.2 1,237.7 71.1 391.6 26.i 86.8 403.9 28.9 55 6 40.2 125.9 61.1 75.3 112.7 448.7 43.8 Restaurants 547.4 48.5 452.2 25. 199.6 Sales Operating profit Identifiable assets Depreciation Capital expenditures 879.9 82.4 567.6 42.1 79.6 679.4 63.8 483.0 31.8 65.0 707.0 79.7 496.7 35.5 72.3 757.0 78.2 582.6 34.8 128.4 797.3 79.1 562.3 38.1 64.0 Exhibit 3 Information on Comparable Hotel and Restaurant Companies Arithmetic Average Equity Market Revenues S billions 41% MARRIOTT CORPORATION (Owns, operates, and manages hotels, restaurants, and airline and institutional food services.) 22.4% 1.11 6.52 Hotels HILTON HOTELS CORPORATION Owns, manages, and licenses hotels. Operates casinos.) 13.3 76 14% 0.77 HOLIDAY CORPORATION Owns, manages, and licenses hotels and restaurants. Operates casinos.) 28.8 1-35 1.66 0.17 LA QUINTA MOTOR INNS Owns, operates, and licenses motor inns.) 6.4 RAMADA INNS, INC Owns and operates hotels and restaurants.) 65% 0.75 11.7 1.36 CHURCH'S FRIED CHICKEN Owns and franchises restaurants and gaming businesses.) 3.2 0.39 1.45 COLLINS FOODS INTERNATIONAL Operates Kentucky Fried Chicken franchise and 10% 0.57 1.45 FRISCH'S RESTAURANTS Operates and franchises restaurants.) 0.14 56.9 6% 15.1 LUBY'S CAFETERIAS (Operates cafeterias.) 1% 0.23 22.5 94 Operates, franchises, and services restaurants.) WENDY'S INTERNATIONAL Operates, franchises, and services restaurants.) 1.32 21% 1.05 4.6 Exhibit 4 Annual Holding-Period Returns for Selected Securities and Market Indexes, 1926-1987 Arithmetic Standard Deviation Years Avera Short-term Treasury bills 3.54% 1.01% 3.67% 7.80% 10.32% 6.16% 5.46% 0.94% 0.40% 0.56% 0.83% 0.75% 0.19% 0.22% 1926-87 1926-50 1951-75 1976-80 1981-85 1986 1987 bond returns: 4.58% 4.14% 2.39% 1.95% 17.85% 24.44% -2.69% 7.58% 4.17% 6.45% 11.15% 14.26% 17.30% 10.28% 1926-87 1926-50 1951-75 1976-80 1980-85 1986 1987 Long-term, high-grade corporate bonds returns: 5.24% 4.82% 3.05% 2.70% 18.96% 19.85% -0.27% 6.97% 3.45% 6.04% 10.87% 14.17% 8.19% 9.64% 1926-87 1926-50 1951-75 1976-80 981-85 1986 1987 Standard&Poor's 500 Composite Stock Index returns: 12.01% 10.90% 11-87% 14.81% 15.49% 18.47% 5.23% 1926-87 1926-50 1951-75 1976-80 1981-85 1986 1987 20.55% 27.18% 13.57% 14.60% 13.92% 17.94% 30.50% Exhibit 5 Spreads between S&P 500 Composite Returns and Bond Rates Standard Deviation Arithmetic Average Years Spread between S&P 500 Composite returns and short-term U.S. Treasury bill returns: 1926-87 1926-50 1951-75 1976-80 1981-85 1986 1987 8.47% 9.89% 8.20% 7.01% 5.17% 12.31% -0.23% 20.60% 27.1 8% 13.71 % 14.60% 14.15% 17.92% 30.61% Spread between S&P 500 Composite returns and long-term U.S. government bond returns 7.43% 6.76% 9.48% 12.86% 2.36% -5.97% 1926-87 1926-50 1951-75 1976-80 1981-85 1986 1987 20.78% 26.94% 14.35% 15.58% 13.70% 14.76% 35.35% Spread between S&P 500 Composite returns and long-term, high-grade corporate bonds: 6.77% 6.06% 8.82% 12.11% -3.47% -138% 5.50% 1926-87 1926-50 1951-75 1976-80 1981-85 1986 1987 20.31% 2670% 13.15% 15.84% 13.59% 14.72% 34.06% 20K 20S OK 8X 41K 12K 40K 7K Figure A: Typical Hotel Profit and Hurdle Rates Source: Casewriter estimates. Profit rate for a hotel is its net present value divided by its cost. Table A Market-Value Target-Leverage Ratios and Credit Spreads for Marriott and Its Divisions Debt Percentage in Capital Fraction of Debt at Floatin Fraction of Debt at Fixed Debt Rate Premium Above Government 40% Marriott 60% 60% 1.30% 1.10% 1.40% 1.80% 74% 40% 42% 50% 60% 75% Lodging Contract services Restaurants 40% 25% Table B lists the interest rates on fixed-rate U.S. government securities in April 1988. Table B U.S. Government Interest Rates in April 1988 Maturity Rate 30-year 10-year 1-year 8.95% 8.72% 6.90% Exhibit 1 Financial History of Marriott Corporation (dollars in millions, except per share amounts) 1982 1985 1987 50.5 3.524.9 4241.7 52665 6.522.2 174. 1.426.0 1,633.9 1,905.7 2,458.9 2 expense Funds provided from cont. operationsb ,000.3 ,080.4 214.31,454.92,062.6 2.501.42,904.7 3,663.8 4,579.3 5,370.5 977.7 1.167.5 1,634.5 2.007.5 2,330.72,861.4 3,5618 4,247.8 Per Share and Other Data 30.00 Shares outstanding (in millions) 23.8% 23 4% 20.0% 22.1% 22.2% Exhibit 2 Financial Summary of Marriott by Business Segment, 1982-1987 (dollars in miliions) 1982 1983 1984 1985 1986 1987 Lodging Sales Operating profit Identifiable assets Depreciation Capital expenditures 1,091.7$1,320.5 $1,640.8 $1,898.4 $2,233. $2,673.3 263.9 909.71,264.6 1,786.3 2.108.92,236.7 2,777.4 43.9 966.6,241.9 132.6 39.7 161.2 185.8 215.7 31.3 366.4 32.4 808.3 22.7 371.5 27.4 377.2 37.1 Contract Services: 819.8 51.0 373.3 22.9 127.7 Sales Operating profit Identifiable assets Depreciation Capital expenditures 950.61,111.3 1,586.3 2,236. 2,969.0 170.6 54.9 118.6 624.41,070.2 1,237.7 71.1 391.6 26.i 86.8 403.9 28.9 55 6 40.2 125.9 61.1 75.3 112.7 448.7 43.8 Restaurants 547.4 48.5 452.2 25. 199.6 Sales Operating profit Identifiable assets Depreciation Capital expenditures 879.9 82.4 567.6 42.1 79.6 679.4 63.8 483.0 31.8 65.0 707.0 79.7 496.7 35.5 72.3 757.0 78.2 582.6 34.8 128.4 797.3 79.1 562.3 38.1 64.0 Exhibit 3 Information on Comparable Hotel and Restaurant Companies Arithmetic Average Equity Market Revenues S billions 41% MARRIOTT CORPORATION (Owns, operates, and manages hotels, restaurants, and airline and institutional food services.) 22.4% 1.11 6.52 Hotels HILTON HOTELS CORPORATION Owns, manages, and licenses hotels. Operates casinos.) 13.3 76 14% 0.77 HOLIDAY CORPORATION Owns, manages, and licenses hotels and restaurants. Operates casinos.) 28.8 1-35 1.66 0.17 LA QUINTA MOTOR INNS Owns, operates, and licenses motor inns.) 6.4 RAMADA INNS, INC Owns and operates hotels and restaurants.) 65% 0.75 11.7 1.36 CHURCH'S FRIED CHICKEN Owns and franchises restaurants and gaming businesses.) 3.2 0.39 1.45 COLLINS FOODS INTERNATIONAL Operates Kentucky Fried Chicken franchise and 10% 0.57 1.45 FRISCH'S RESTAURANTS Operates and franchises restaurants.) 0.14 56.9 6% 15.1 LUBY'S CAFETERIAS (Operates cafeterias.) 1% 0.23 22.5 94 Operates, franchises, and services restaurants.) WENDY'S INTERNATIONAL Operates, franchises, and services restaurants.) 1.32 21% 1.05 4.6 Exhibit 4 Annual Holding-Period Returns for Selected Securities and Market Indexes, 1926-1987 Arithmetic Standard Deviation Years Avera Short-term Treasury bills 3.54% 1.01% 3.67% 7.80% 10.32% 6.16% 5.46% 0.94% 0.40% 0.56% 0.83% 0.75% 0.19% 0.22% 1926-87 1926-50 1951-75 1976-80 1981-85 1986 1987 bond returns: 4.58% 4.14% 2.39% 1.95% 17.85% 24.44% -2.69% 7.58% 4.17% 6.45% 11.15% 14.26% 17.30% 10.28% 1926-87 1926-50 1951-75 1976-80 1980-85 1986 1987 Long-term, high-grade corporate bonds returns: 5.24% 4.82% 3.05% 2.70% 18.96% 19.85% -0.27% 6.97% 3.45% 6.04% 10.87% 14.17% 8.19% 9.64% 1926-87 1926-50 1951-75 1976-80 981-85 1986 1987 Standard&Poor's 500 Composite Stock Index returns: 12.01% 10.90% 11-87% 14.81% 15.49% 18.47% 5.23% 1926-87 1926-50 1951-75 1976-80 1981-85 1986 1987 20.55% 27.18% 13.57% 14.60% 13.92% 17.94% 30.50% Exhibit 5 Spreads between S&P 500 Composite Returns and Bond Rates Standard Deviation Arithmetic Average Years Spread between S&P 500 Composite returns and short-term U.S. Treasury bill returns: 1926-87 1926-50 1951-75 1976-80 1981-85 1986 1987 8.47% 9.89% 8.20% 7.01% 5.17% 12.31% -0.23% 20.60% 27.1 8% 13.71 % 14.60% 14.15% 17.92% 30.61% Spread between S&P 500 Composite returns and long-term U.S. government bond returns 7.43% 6.76% 9.48% 12.86% 2.36% -5.97% 1926-87 1926-50 1951-75 1976-80 1981-85 1986 1987 20.78% 26.94% 14.35% 15.58% 13.70% 14.76% 35.35% Spread between S&P 500 Composite returns and long-term, high-grade corporate bonds: 6.77% 6.06% 8.82% 12.11% -3.47% -138% 5.50% 1926-87 1926-50 1951-75 1976-80 1981-85 1986 1987 20.31% 2670% 13.15% 15.84% 13.59% 14.72% 34.06%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started